Peter Thiel on Investing In Yourself (Exclusive to Steemit)

(Photo credit: Dan Taylor - CC BY 2.0)

(Photo credit: Dan Taylor - CC BY 2.0)

Hi Steemians! I found out about Steemit literally yesterday, via my friend Neil Strauss. I am an established author (three books published by major publishers) but I've been disillusioned with the current economics of both print and Web publishing, for a long time, and have been looking for an alternative that rewards authors for the content they produce.

After 24 hours of immersing myself in the Steemit world, I'm blown away but what's happening here, and I think this just may be the answer I've been looking for. I decided to give it a test-drive here, and contribute to the community, by publishing original quality content (unpublished anywhere else.)

In 2013, in the process of writing my most recent book, The Last Safe Investment: Spending Now to Increase Your True Wealth Forever (co-authored with Bryan Franklin), I interviewed Peter Thiel, co-founder of PayPal and first outside investor in Facebook, on the topic of investing in yourself.

This audio and text has never been available before. I just put up the audio as a podcast episode on my Soundcloud, and I have pasted the text below, exclusively to Steemit. (For reasons of space, and a shift in focus, the interview did not end up going into the book.)

Here are some topics we covered:

- The value of investing in relationships for the long-haul

- Investing in your health and longevity as a way to increase your lifetime earnings

- Why longer life expectancies should change the way you think about investing

- The shockingly low rate of personal savings and investment in the US

- My favorite part of the interview: whether we can reasonably expect the US markets to keep going up at their long-term average 7% per year after inflation, or whether that was a unique period of US expansion which won’t be repeated again.

- The over-financialization of personal investing

- How subjective types of value that are hard to measure, like relationships, health, and well-being, are priced inefficiently because they’re hard to value, and therefore may be an area for exceptional investments.

Note 1: This interview took place in 2013, long before Steem existed, and we did not discuss cryptocurrency at all. Nonetheless, I think many parts of his answers are highly relevant to Steem. For your interest, I have italicized the sections of the interview below that I think are relevant to Steem. All italicizations in the interview text are my own. In some cases I have inserted editorial notes with the label [Ellsberg note:] in brackets. My italicizations of text I deem relevant below, and my editorial notes, simply indicate my own subjective judgment of relevance to Steem, and in no way imply that Thiel was endorsing cryptocurrency or Steem.

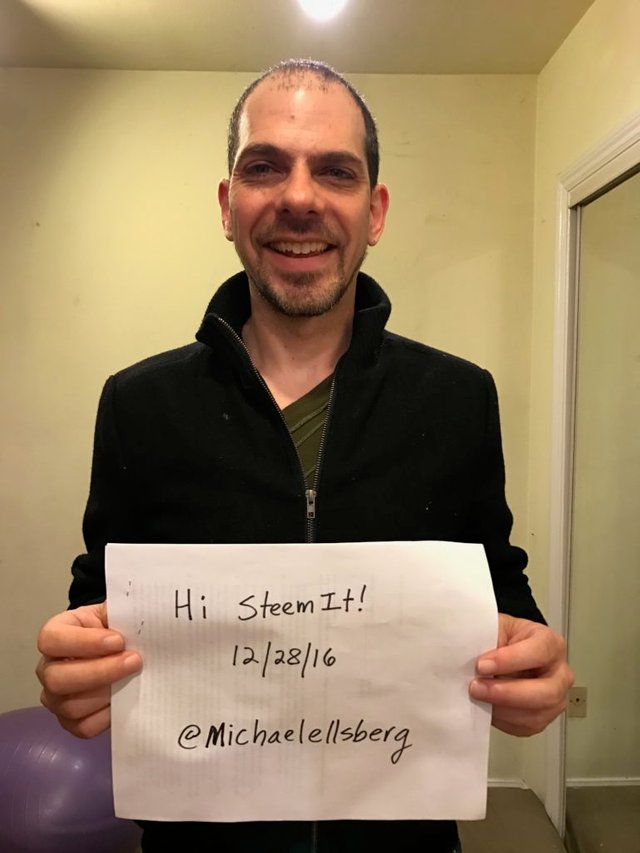

Note 2: I understand that the Steemit community requires verification, especially for content posted by publicly-known figures (both me and Thiel.) While I plan to write a longer Introduce Yourself post soon, I have provided extensive verification of my identity, and the authenticity of this Thiel interview, at the bottom.

Note 3: The interview text has been edited slightly for clarity and readability. In cases where I've added words for clarity, I put those words in brackets.

Now, with all that said... thank you! I can't wait to be a part of this community, and post tons of great original content here! :)

Yours,

Michael Ellsberg

###

Ellsberg: The basic thesis of my book is that, for the average investor, there aren't really any bargains anymore that they can find investing in [traditional assets or traditional human capital investments.] Higher education has, as we know, over-inflated prices. It's not clear that investing in the home market is a great steal right now. Even as much as the stock market has dropped, it's still relatively high P/E ratios by historical standards. My argument is, average people should take a more entrepreneurial approach to investing, in the sense of investing in their human capital. Not with a masters or PhD, but in their network, their earning power and skills, and even their health, and quality of life. Do you have any reaction overall to that thesis?

Thiel: I generally agree with the thesis. The conventional wisdom is that “life is short.” The truth is that it’s actually quite long. And so, we typically lack imagination for our future lives. We think ahead six months, maybe two to three years. Maybe to the next line item on the résumé. But, we don't really think of it as something where you’re investing for your career on a twenty-to-fifty year horizon.

When people pick careers, they often base them on how much money they will make in year one. This is not a terrible criterion, but you should be looking at how much you’ll make in the lifetime of the career. And also: is it fulfilling? Is it meaningful? We can only measure the first years; we don't think enough about the long term.

I certainly think the health issue [as a form of self-investment] is a very important one in the US, since many people end up with serious health problems in their late forties, fifties, and sixties, and that can cut off years or decades from their earning potential. Maybe it’s not realistic to keep working past sixty-five in every case, but there’s probably something to be said for being able to work at least in some part-time capacity up to your mid-seventies. One of the things that does make an enormous difference at the margins is investing in your health, and thinking of your health as a very long-term asset.

I also think the relationships you build with people are an important asset. When we started PayPal back in ‘98, we didn't know how the company was going to do, but we had a goal that we’d still be working together many, many years into the future. Three of the four of us who co-founded PayPal—Luke Nosek, Ken Howery and myself—are still working together [eighteen] years later on the venture capital side. There’s a lot of value in these long-term working relationships. We know each other's strengths, we know each other's weaknesses. There's a long history of conversations that we've had over many years. That’s a lot of capital built up.

Networking is a misleading word, because it has this connotation of a speed-dating thing, where you’re talking to lots of different people for five minutes at a time. But what does have a lot of value is sustained relationships with people that are built over a longer period of time. A lot of people have not done that.

When I look in my friends who went into a number of professional tracks—law, banking, consulting—they often thought of their careers in these two- to three-year increments. Then they move on to another, better job. There was no long-term plan, but instead there was a portfolio of options they were building up over time.

But when those people ended up in the wrong place at the wrong time career-wise, the recovery was actually quite tricky. Things really got derailed [because these people didn’t know whom to call.] People who did the best were ones who had invested in very long term relationships, which was a contrarian strategy in a place like New York, where it’s super transactional. Almost no one else is doing them; it’s certainly a radical, contrarian strategy.

Ellsberg: I’ve noticed that almost any success that I've had professionally or personally has come through these long-term relationships. It seems like almost like a truism to me, yet it’s relatively rare that people think that way. Why is it a contrarian strategy?

Thiel: A lot of people have been trained in our academic system, which is individualistic and competitive. It says that you need to beat other people and you need to do a certain set of [academic] tasks better than others. I think most of the business world is not like that. Most of it involves not individuals but teams of people, and a lot of the value gets created by working well with other people over time. But it’s certainly natural to see it as structured in a super competitive way, where you’re competing with other people and it’s all very zero-sum. Year-to-year, it looks like it’s super competitive, but on a longer time horizon, even in these very competitive contexts, the best strategy is one that ends up being more collaborative.

The reason that people don't understand this is that, again, it goes to this short-term vs. long-term issue, where the relevant factors don’t necessarily show up on a one-year horizon. In a world where everyone can think ahead no more than six months or a year, you would say that it's a waste of time to do these things. But if you think of it as this twenty-year strategy, building long-term relationships is a really critical component. It becomes very important, whom you work with, that they’re non-zero sum people, they’re positive-sum people. It’s a big mistake to ignore that, because in the long run, these effects really matter a lot.

Ellsberg: Speaking of the long-term, you have been publicly associated with the concept of life extension. It seems pretty clear that the trend is that the people who are younger now are going to be living a lot longer than the people who are older now. How do you see that trend impacting the investment decisions of younger people?

Thiel: Even on current trends, life expectancy is going up by 2.5 years per decade. Which means every day you survive, your life expectancy goes up by 6 hours. We’d like to get to a place where it goes up 24 hours every day you survive. I think people have underestimated the potential for life extension for quite awhile. Even within that, there's always this question about whether people will live longer and healthy lives, or longer and somewhat unhealthy lives. While most people are not involved in pushing the science of life extension directly, I think a lot of choices that we make as individuals are very important to trying to tilt things towards living healthy lives within this broader context of ever-longer lives. Like nutrition, exercise, trying to maintain reasonable stress levels.

Ellsberg: Given this context of longer lives, it seems to me that two things become clear. One is that the model of running yourself ragged on eighty-hour workweeks to save up for retirement no longer makes sense. That maybe made sense when your expectation was that you’d going to croak five to ten years after retirement, as during the period when the retirement age was set. But it doesn't make sense when people can live vibrant lives into their eighties, nineties, and maybe even beyond, with life extension. It seems to me that if you can foresee that coming, you'd think “OK, let me do this slow and steady. Let me do a marathon here rather than a sprint.” Take more risks now, figure out something that’s more aligned with your passions, the life that you want to lead. Does that make sense to you?

Thiel: Yes. It certainly is more of a marathon than a sprint. I think it’s very important to do something that's sustainable, not in a way where you’ll hit a wall and have a mid-life crisis and give up—or have a quarter-life crisis and give up, which I think happens a lot too.

There’s a financial version of this, which is quite extreme as well. If you think that your life is very long and we’re living in a world of roughly 0% real interest rate, there's a question of how much should you be saving. The number that I end up coming to is something on the order of 30 to 40%. Again, this would be things including investing in yourself, or actually saving.

One byproduct of very long lives is that it makes sense to have a high savings rate and investment rate. Think of the opposite case. If you're going to die tomorrow, you don't need to be saving lots of money. Conversely, if you’re expecting to be around for a very long time, it makes sense to have a fairly high savings and investment rate—including a fairly high investment rate in yourself. Your life expectancy very much goes into what you think your savings rate and investment rate should be.

The savings rates in our society are very low, whether you measure savings conventionally—how much money people actually save—or unconventionally, in the sense that you're using it, which is how much are you actually investing in your human capital.

Whether you’re talking about human capital or other capital, savings and investment rates are shockingly low. They’re barely north of 0%. If you include government borrowing, the savings rates are probably negative in the United States. There are probably all sorts of things that pressure people to spend all of their money now and not to invest it. It’s important to find a trajectory where you don’t have to work quite as hard, but also a social mileu where you’re not under so much social pressure to keep up with the Joneses and spend on these status goods which will not matter in three years or five years. People can find themselves in social bubbles where there’s [financially] self-destructive behavior going on, where people are focused on what’s cool, but not what’s best in the long run.

I think insulating yourself partially from all the advertising that drenches our society and encourages people to spend everything now-- people need to find some balance, where you don’t feel you have to work eighty to ninety hours per week, nor do you feel you need to spend all of your money, which are the crazy extremes. You can find something where you’re working forty to fifty hours a week and can still save a fair bit in all of the avenues that you’re saving.

I don’t think of this all as an individual thing. I think of this always as more of a collective thing. There's this Nietzsche quote, “Insanity in individuals is something rare—but in groups, parties, nations and epochs, it is the rule.” Where in a context where everything you're describing makes a lot of sense. The mystery is why people are not doing something like it. Part of my answer is that they find themselves in these sort of social contexts that are objectively insane from the perspective of twenty to fifty years. It’s not that individuals are crazy and can’t figure out, “Okay, this is what the retirement calculator does. How long do I expect to live? Okay, it's more than a year, yes.” Individual people can be quite rational, but then they’re transposed into these social contexts that are almost overpowering. It’s critical to be aware of how powerful these contexts are so that we can partially resist them.

Ellsberg: When I was interviewing you for my last book [The Education of Millionaires, in 2010,] you were saying that the only candidate in your mind for a bubble at that time was higher education, because it involved such intense, almost religious belief. I want to put forward that there’s one other that hasn’t been talked about enough, and that is around the concept of retirement. There is this enormous belief, that it's almost an entitlement to have several decades of inactivity at the end of your life. It used to be that the companies were going to provide that with pensions, and that's all gone by the wayside. Now, people have the same belief, that the markets are going to provide that. But the markets have been flat for essentially [fifteen] years [accounting for inflation.] So it seems to me delusional that large amounts of people are going to have this retirement based on the appreciation of their [financial] assets. Do you have any thoughts on that?

Thiel: There's definitely something crazy going on. I'm not sure describe it as a bubble though. A bubble involves some intense and mistaken optimistic belief. Certainly, people’s expected returns on education qualifies as that. But I don’t think people actually have very intense beliefs about the future [when it comes to saving and investing.] If you ask people in their twenties—and I’m generalizing here—questions like, “Do you expect to get a big pension from the government? Do you expect Social Security to take care of you?” etc., etc., the answer is generally “No.” And then if you ask, “Are you saving a lot?” The answer is also generally, “No.”

If you take those two answers together, well, you're going to be old and very poor in the future for a long time—which would be a pessimistic belief. But people don’t actually believe that, because I don’t think that they actually think about the future at all. I’m projecting the generalized poll here, but I think you sort of humorous dismissal, like “There's no point in saving, we're all screwed anyway.” But it doesn’t motivate any action. It’s just a strange phenomenon.

Maybe baby boomers still have a belief in retirement. If you look at the post-boomer generations, it’s much less so. Even the boomers may be wrong. If you look at what's happening in places like Detroit, what may happen in many other places, it’s not clear even the boomers will be able to even have a middle-class existence in retirement. I think younger people are less optimistic than the boomers were, but are for the most part not really thinking about it at all, because if they were, they’d probably be adopting a radically different strategy.

The extreme philosophy version of this, is that people don’t seem to think they’re the same person in the future. It’s as if, between when you’re twenty-five and seventy-five, that’s a different person, and you don’t owe them anything. It’s not articulated that way, but if I had to impute what people believe, it’s sort of close to that.

I have a slightly more robust conception of personal identity, so I do think, even though you may change and you may develop, it's probably healthy to think of yourself as one person over time.

Ellsberg: Here’s one thing that is very confusing to me. I’ve tried to figure this out, and maybe you can shed some light on this. It has to do with the whole concept of "expected return" that retirement planners use. They tell people, “If you look at the US stock market over 100 years or 200 years, it’s gone up 7% per year, compounded, ahead of inflation. So that’s you're expected value going forward.” What I don’t get is, it seems the entire financial planning industry is making some kind of mistake that my statistics professor said not to make, practically on day one of class: if you have data showing your historical return, you cannot extrapolate, unless you understand the causal mechanisms that produced these results, and are convinced that those are going to remain the same. People just look at the data and say, “It's always going to be 7%,” without any analysis as to why that is, and whether those conditions have changed. It seems to me a kind of an insanity that no one ever really points out. Am I missing something, or is it really simple?

Thiel: I think it is that simple. There is a question of who has the burden of proof. The retirement plan argument is, “This mechanism kind of works. Companies need capital, they invest the capital and they generate returns and it’s just called the economy. That’s what happens when an economy works.” If you’re going to [argue against that and] say that the economy is no longer going to work, then the burden of proof is on you to show otherwise.

[Ellsberg note: the following paragraphs are relevant to the future of the US dollar and the global dollar-reserve based fiat system.] However, I personally find myself somewhat sympathetic to your view. I think the US is quite anomalous. If you look at the 200+ year history of the US, it’s basically this vast wild land in 1776, and it has been transformed into this very different society. There have been no revolutions [since the founding.] Most other countries in the world, you have points where the stock market went to zero. If you had your wealth in the stock market for the long run, your average returns would have been negative. It just has to go to zero once in two hundred years and the returns aren’t 7% [per year], they're negative. So, when you broaden this analysis beyond the United States, it [the 7% argument] doesn't hold up, which is why I think your question is right, and the burden of proof is actually on the people who make the claim.

It is a reasonable question to ask: whether there is something unusual about the last two centuries in the US? It's going to be hard to find a new frontier as big as the one we had in the last 200 years. We might do that. I think that it’s something that we should work to accomplish. But it’s perhaps not as obvious or straightforward to accomplish as in the past. I think one shouldn’t count on it.

Point #2 I would make: there's this joke about the efficient market theory, where you have these two professors from the University of Chicago, which is known for explaining the efficient market theory. They're walking along the street, and one of them sees a $100 bill on the sidewalk. And the other one says, "It can't be there, because there'd be an efficient market in people picking it up.

[Ellsberg note: the following two paragraphs are relevant to Steem, as they talk about how financial systems/currencies only work if people are motivated to create value within them.] Markets only work when people work really hard to get them to work. You can get 7% returns when people are thinking really hard about how to invest the money, what to do with it, and stuff like that, which is historically what people in the US did.

If you were a wealthy person in the US in 1900 or even 1950, you were investing the money yourself. You were thinking, “Do I give this person money? Is this going to work, is this not going to work?” In that sort of a context, people made the kind of decisions where you were able to find new frontiers and grow the whole pie and find those returns. In the last thirty to forty years, our economy has become much more financialized, and we think, “We shouldn't be investing our money, we should let other people do that.”

[Ellsberg note: the following three paragraphs are relevant to discussions of Steem vs. Bitcoin, as they deal with the distinction between investments based on value creation vs. investments based on financialization and speculation.] But you can’t get those kind of returns, as a society, if everyone just gives their money to the various people who are running the large mutual funds and they just buy the index of the S&P 500. And then all of the companies in the S&P 500 are run by sort of sclerotic management that has no really brilliant ideas about what to do with the money, and they return it to shareholders or they invest the money in T-bills and earn 0% on it.

If you actually think of how this worked over time, it’s changed in a very strange way in the last thirty to forty years. So, fifty or sixty years ago, nobody would have said “You should expect 7% in the stock market.” It was like this dangerous, risky thing, and you had to think really hard about how you were going to do it. In that context, people worked hard at it and were able to do it in an economy that deployed capital in a certain way.

Whereas now, it’s been automated and professionalized, and we've hidden how that 7% was perhaps never automatic. We now live in a world where we think it's automatic. Yet it’s precisely at the point where people think it’s automatic that it may not work anymore.

Ellsberg: The people who think it's automatic never answer one question: if you can get "automatic" 7% returns, why wouldn't bonds be bid up, or why wouldn't those returns be bid down? The idea that there's this "risk free" way to earn 7%...

Thiel: There's all sorts of complexity to this. You could say bond returns are low, because the government sets the interest rates at 0% on the front end. But stocks are always somewhat risky, and maybe they're at the riskiest when people are sort of oblivious to the risks. I think this is a byproduct of the financialization that's taken place.

The numbers that I've seen on this show that it's more like 4% after inflation on a 100-year horizon. You always have to add the inflation number back in. And then you if you get paid dividends, you have to take out taxes on the dividends. So the actual numbers have not been 7% after inflation, they've been more like 4%. Even in the context of the 200+ year history of the US, which has been a history of an extraordinary boom, I think there are a lot of ways in which the data has been somewhat cherry picked. And it still has been fairly risky.

We had Madoff scandal, a number of years ago. And if you ask, "How was this possible?" it was because people had been told that they could get 8% a year at no risk. I think if Madoff had offered 20% a year, the whole thing would've blown up much sooner. People would have been more skeptical and would have asked more questions. But, 8% a year is just the right amount where people didn’t ask questions, because we’ve had this endless propaganda that you can get 8% a year with close to no risk. But in the stock market we've had 50% down-corrections a few times in the last number of decades. People have this view of it being much less risky than it really is.

Ellsberg: You mentioned that one of the key questions you ask young people in the Thiel Fellowship program, and also potential entrepreneurs that you might invest in: "What's something you believe that almost no one else believes?" It seems like that question really cuts at the heart at what it means to take a risk that might end up producing really good returns.

Thiel: Yes. The investment version of the question is, "What is a great investment that nobody else thinks is great?" On the venture fund side, I always think we need to ask two questions when we invest in companies. One is," Why is this a good company?"

But secondly, which I think is at least as important: "Why is this not something that everyone already understands?" In which case, the price has already been bid up. It may be an OK investment, but unlikely to be a great one. The great investments are things that are both really good, and that are somehow very nonconventional.

Ellsberg: Yes. And the non-conventional is crucial. If it's something everyone already knows, then the price has been bid up. People know that the American economy has grown over two centuries. That's not a secret anymore. The price has been bid up already.

Thiel: Yes. People know that Coca-Cola is addictive, and is a profitable monopoly. And maybe that will change. But I think everything we know about that is already in the price.

Ellsberg: Last question. This is one of my idiosyncratic ideas, and I want to see if I'm crazy, or if there's something to what I'm talking about: I believe if you step away from looking just at quantifiable returns that can be put in dollars and cents and percentages, and instead look at using your money to create what might be called “quality of life value"-- it seems to me like things like dealing with emotional issues, psychotherapy, getting in great shape, developing a career that you really love instead of one that just makes money-- it seem these kind of things return potentially much higher than 7% in terms of the value that you get back, even that value can’t be quantified precisely. Do you have any thoughts on that?

Thiel: I agree with you that we are too obsessed with things that are measurable, and we assume that anything that can’t be measured does not exist and has zero value. Now I do think that there are a lot of things that are somewhat qualitative, with a value that is somewhat indeterminate, and we need to think really hard about what the value actually is. There are probably cases where psychotherapy can help people tremendously. There are cases where it may just be a waste of money.

[Ellsberg note: the following paragraph is relevant to Steem. Thiel is saying that subjective value, because it's hard to measure, is priced inefficiently. Steem's mechanism of quantifying subjective value clearly addresses this inefficiency.] When something’s immeasurable, it doesn't mean that the value’s zero, but it doesn’t mean that it’s very high [either.] That's probably worth thinking about a lot more. The things that are not easy to measure are the ones that are priced inefficiently, and at least have the potential to be really good [investments.] If you can quantify everything, other people can do that too.

I think you’re right that you should always look at things that cannot be measured, and it’s worth thinking about them somewhat more than people do. But then the caveat is, you still have to keep your thinking cap on. Things like the education bubble involve something which is hard to measure the value of—when people project too much value onto it, that can be a mistake too. I think lack of measurement can go many different ways. However, it’s certainly a mistake to treat it all as zero.

Ellsberg: Last question. If you were writing a book on this topic, are there any major points that haven't been touched upon yet, or any big piece I'm missing here?

Thiel: I'd say, when one thinks about a long horizon, like 20-50 years, one of the critical questions is, "What are the kind of things that last over that time period?" One of the things that I come back to is relationships, which can last very long. So that's something I think is worth investing in.

One of the arguments against thinking on a long time horizon is that we don't know what the world is going to be like in 30 years or 40 years, and it doesn't make sense to invest. I do think the relationship part is one that is worth overweighing.

###

Further verification:

--> See my tweet about this post on my Twitter account.

--> See my post about this post on my blog.

--> For verification of my connection/interview with Peter Thiel, see my previous interview with him, published in the Epilogue to The Education of Millionaires, and his blurb published on the cover of the paperback edition of that book. Also, here is video of Peter Thiel introducing me at the launch party for my book, which he hosted at his home in SF in 2011.

###

Michael Ellsberg--brand new to the SteemIt community--is the author of The Education of Millionaires: Everything You Won't Learn in College About How to Be Successful (Penguin, 2011), The Power of Eye Contact: Your Secret for Success in Business, Love, and Life (HarperCollins, 2009), and co-author (with Bryan Franklin) of The Last Safe Investment: Spending Now to Increase Your True Wealth Forever (Penguin, 2016.) His writing has appeared on Forbes.com, Time.com, and on the op-ed page of the New York Times. Visit him on the web at www.ellsberg.com

Welcome to steemit Michael, hope to see more of your writings!

A very powerful statement or two, if not 50! Excellent piece of writing, thank you so very much for sharing such words of wisdom, opinions and news. Namaste :)

Steemit is like Facebook in the sense that anyone can use it but more like Linked in, in the sense that only cool people actually do use it.

Welcome to Steemit Michael, happy to have you here! Following.

Welcome to Steemit! I'll go give this a listen (more of an audio-visual learner myself). I enjoyed the book Zero to One, so I'm looking forward to this. Following for more in the future.

Thank you Luke! I like your stuff on AI and UBI. I've followed you and look forward to reading more! :)

Thank you!

Welcome to Steemit @michaelellsberg I am really looking forward to reading your posts! Upvoted + following you. Happy New Year!

Disclaimer: I am just a bot trying to be helpful.

Cheers, @michaelellsberg

Welcome nice post. I look forward to following you.

@michaelellsberg Thanks good post .