How to make money when cryptos go down

Short selling CFDs

You have analyzed the market and you are predicting that the cryptos will go down in value. So how do you capitalize on this? And how can you protect your longterm investment without exiting your position?

Value depreciation

As a trader it is important to tackle that prices go down, it is the nature of the markets. Corrections must occur to give incentives for investors to buy and to provide liquidity. As a longterm investor we can choose to sit back and ride out these downtrends, or we can try to capitalize from them.

Short selling

Short selling is selling of an asset that does not belong to you or that you have borrowed. Among shorter term traders it is common to seek these opportunities when a decline in price is expected, especially for stocks. Short selling is often condemned as immoral, but we must remember that it is important for liquidity and to prevent hyped-up, bubble-like price hikes (that do not have a fundamental reason).

CFDs

CFD stands for “contract for differences.” It is a contract between the trader and the broker about the price difference of an asset's value between the current time and the contract time. If the price difference is positive the trader earns that difference, and if the difference is negative the trader loses that difference.

One advantage of trading CFDs is that you have no restrictions for shorting, it works just like shorting a FIAT currency. Another advantage is that you can use higher leverage so you can hold a larger position without having the actual capital. Just remember that leverage also increases your risk on the trade.

Hedging

So let us say you expect Bitcoin to go down in value. Instead of selling part or all of your position (which is more expensive) you can hedge your position, which means that you take a trade in the opposite direction of your original position. Or you can trade another instrument that has a negative correlation with Bitcoin.

You would then have one longterm position, holding actual Bitcoin. And you would have one short position, holding a Bitcoin CFD. Then when price goes down far enough for you, you exit your short position for a profit successfully having hedged your longterm position.

Brokers

There are several brokers offering crypto CFDs, most of them are typical forex brokers.

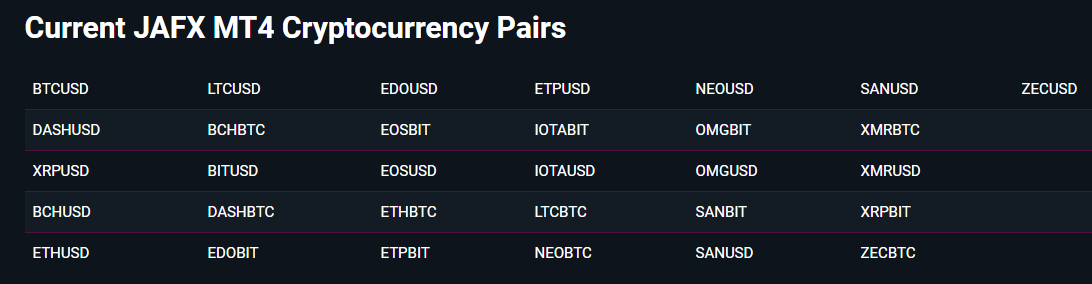

One example is JAFX which offer these CFDs (I am not affiliated with them):

Conclusion

Short selling CFDs can be a good way to secure your longterm investment in down markets, and also just to profit on down markets without holding any coin. Just be aware of the risk, especially if you use leverage.

This is not meant as financial advice, I am just sharing my own trading experiences.

Happy trading!

good content, man!

Check out my trading posts.

u got a new follower

Thanks for your comment!

I will look out for your posts (vielleicht kann ich endlich mein schlechtes deutsch benützen).

Feel free to use your german.

I use my bad english, too :-)

;-) Cheers! :-)

This post has received a 2.09 % upvote from @drotto thanks to: @mariuse.