The possible fall of the dollar

It is common knowledge that paper money to have any value must be repaid by gold or silver of the country that issued the currency.

But in the United States, this is not the case, since they depleted their gold reserves in 1971, and to maintain their currency, they made a deal with the Royal House of Saudi Arabia, where they guaranteed the perpetuity and security of the royal house with the condition that the oil be sold only in dollars.

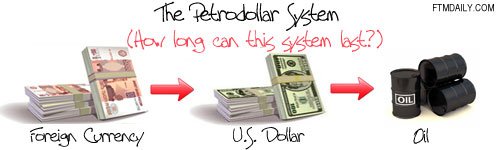

Thus the petrodollar was born and brought with it several changes, the main one being the conversion of the dollar into the international reserve currency. If oil is only bought with dollars, whoever wants to access must buy dollars.

This fact forced the countries of the world to change their currency to buy dollars and in this way access to oil, and leaves the United States in a very advantageous situation who technically lives off the sale of dollars.

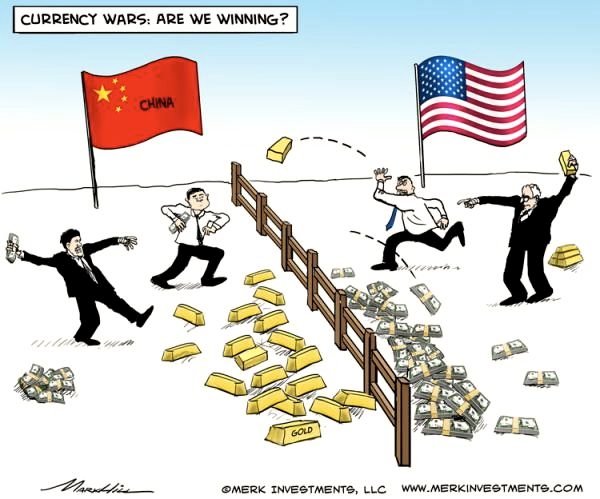

Now China joins the departure list with contracts to buy oil with yuan its local currency, with the conditional of being able to change them at any time you want for gold, as was previously.

We must recognize the ingenuity of Americans when it comes to making deals and win, now they must be alert to the threat from China that with its promise of gold can displace the dollar as the international reserve currency.

It only remains to see the struggle of these two great powers to see who will be victorious.

te cuento que no sabia como buscarte aqui jajja pero te encontre.

La desaparesida que no sabia que te uniste 😱