The Calm Before The Storm: Precious Metals Should Be Your Accumulation Strategy

Eerie Quietness in Precious Metals Markets:

Over the past several months, there has been a strange, quiet calm in the precious metals market as investors continue to buy their way into broader stock indexes across the market. While precious metals were flying high last year when the DJI fell 2,000 points, it is now sitting at an all-time low. Many investors who have become WAY too comfortable with the numbers in their accounts should be extremely cautious of keeping their money in the form of digital "paper" currency. Accumulating cryptocurrency in cold storage offline is a different story and has very bright sides.

The word on the street is that investors are no longer waiting on the price of silver to fall to start buying, rather, they are now waiting to see what happens to the broader markets. There is no holding back the investment into precious metals, as some investors are preparing for the worst. The MSM is completely deluded in their analysis of the markets being "stronger than ever." Even when Deutsche Bank claims that the possibility of a recession in the next 12 months is "remote", you can never be too careful in your financial planning...

Overextended Market Sparks Silver & Gold Accumulation Trends:

While this is a possibility, investors should realize the market is already SERIOUSLY OVEREXTENDED. Sure, it could continue to surprise all parties involved, but the shrewd method of investing in precious metals is not to make a perfectly timed purchase when the rest of the market is crashing, rather, it should be done on an ongoing basis. Investors should be purchasing metals over a period of time, not one large amount due to the timing of a market collapse. I just recently made my purchase of a few coins just to experiment, and I'm extremely happy with my decision to make an investment on my future.

Current & Past Prices of Precious Metals:

Though you should take their information with a grain of salt, it would be a good idea to check out www.usdebtclock.org and navigate to the lower right corner. You will see precious metals prices a century ago and then in 'real-time.' This feature only showed up in the last couple months, pointing to a more eerie possibility of something big happening soon. Silver and gold prices have stayed relatively stagnant over the last several years, but only because of price suppression. There is no telling what bounds precious metals could experience if a crash occurred.

If you take a look below at the DJI versus the Silver Price, you will see an extremely intriguing trend occurred when the Fed announced QE3 back at the end of 2012:

The price of silver started to take a serious nosedive as the DJI continued ever higher at 2012's close. Some investors believed that the next time the stock market crashes, so will the price of silver, as it did in 2008. This time will be different, however, because the silver price fell by more than 70% from its high in 2011, whereas the DJI has surged since, with some falters.

Market Crash Scenarios In Which Precious Metals Survived And Even Thrived:

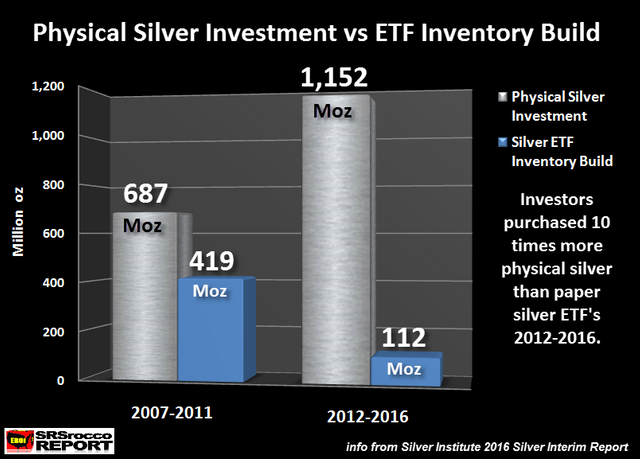

What happens when the DJI corrects more than 5000 POINTS??? We will see record numbers of investors coming to Gold and Silver ETF's. Take a look at the graph below, created just last year:

From 2007 to 2011, total physical silver bar and coin demand was 687 Moz versus 419 Moz for the net silver ETF inventory builds. Now look what occurred in the years from 2012-2016. Silver bar and coin demand NEARLY DOUBLED to 1,152 Moz, while the net increase in silver ETF inventories only increased a hair.

In conclusion, the Fed and Central Banks have defied gravity for almost a decade by propping up a market that has been artificial since the epic housing market crash of 2008, but not for much longer.

@lukekelley Having been in (in = cryptos and physical and mining shares) since 2013 and all in since 2015, I am cautiously optimistic. I have had nothing but modest gains in PM and stupidly huge gains in cryptos over the last year and am please with that. I do get the sense that something has been stirring since the early part of 2016 and is about to surprise the heck out of a lot of people. This is a post about some of the stocks I have had a lot of success with. https://steemit.com/miningstocks/@teaandkisses/3-mining-stocks-i-am-holding-long An upvote and Resteemit would be much appreciated.

Very interesting! Thanks for the article, I read it and learned a lot already! Upvoted

thanks for sharing

Thanks!

Keep stacking silver, be thankful that the manipulators keep the price artificially suppressed while we continue to accumulate!

Good post man, followed you