US Already Bankrupt, It Just Won't Know It For 5.6 Years - Why We Need Bitcoin

Back before I wrote regularly about cryptocurrency, I wrote regularly about government debt.

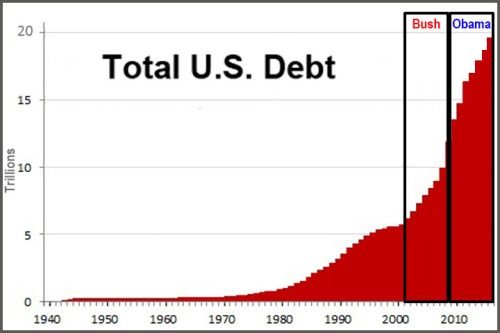

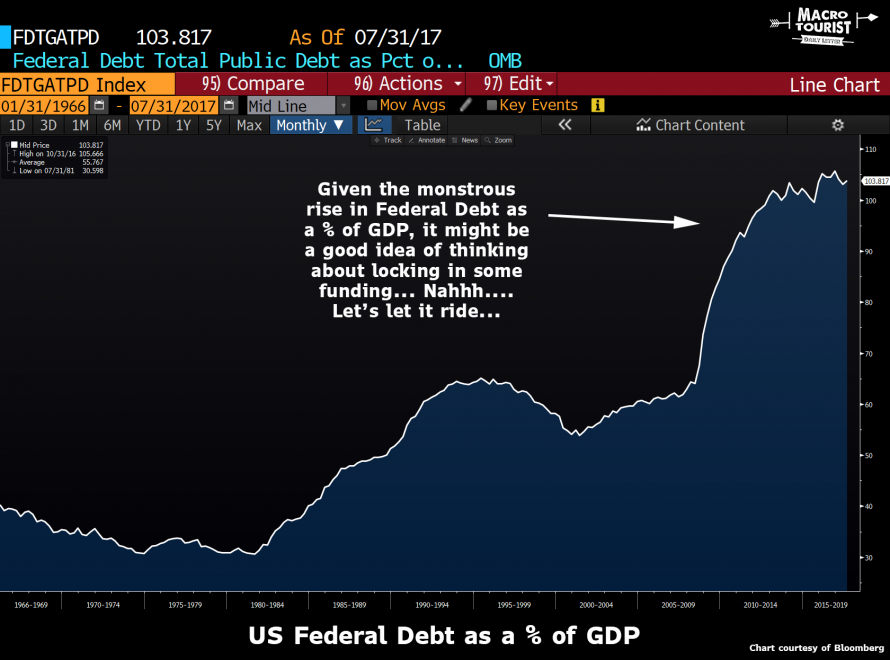

In between posting images like the one above, I'd post all sorts of scary charts with rather obvious, inevitable outcomes such as the following:

I've had to simply bide my time and wait, knowing that my calls for financial prudence and an end to money printing would fall almost entirely on deaf ears, but wanting to have my "I-told-you-sos" well established such that I can taunt everyone once the blood is running in the proverbial market streets.

Given Jamie Dimon just released another annual shareholder's letter chalk full of lies for his clients, directing them as usual to become bag-holders for his bank's future bad trades, I figured it was a good time to remind ourselves why he's openly lying to you when he says "“the Federal Reserve and other central banks may have to take more drastic action than they currently anticipate … reacting to markets, not guiding the markets,”"

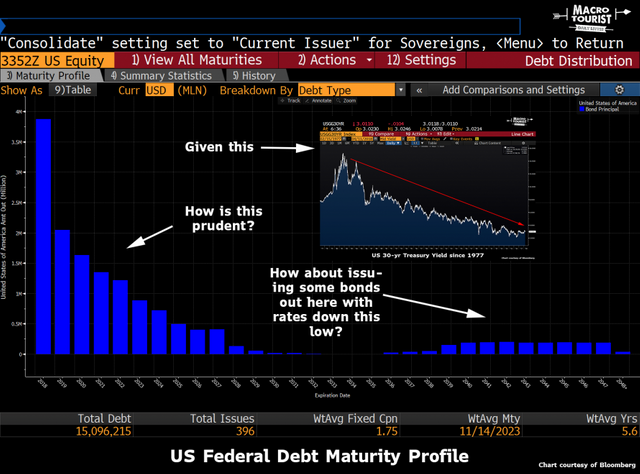

There's a clear reason why they are not selling more long dated treasuries (as you can see in the next chart below) - nobody is interested in buying the long-duration,sub-inflation-rate debt coupons of an openly bankrupt nation that has recently passed the Rubicon of 100% Debt-To-GDP and therefore has no mathematical chance of fiscal recovery without total currency collapse.

In fact, according to SGH Macro Advisors, this is already happening: "From what we understand, the Chinese government has halted its purchases of US Treasuries. Despite the direct encouragement, according to Chinese sources, by US Treasury Secretary Steve Mnuchin for China to "stay put,” Beijing has apparently discontinued purchases of US Treasuries “for the past few weeks.”"

Perhaps more interesting than why the CEO of an abusive multi-national bank would be lying, is why public officials are actively making the impending fiscal crisis worse by refusing to finance at longer durations while rates are obviously suppressed below the real market clearing rate.

More than half of the US debt is going to have to be rolled over within 6 years and refinanced, in what can mathematically only be a far more hostile future credit market with a far less solvent borrower (the US, 6 years from now.)

Heads should literally be rolling...from the guillotine...where they used to be attached to the heads of corrupt US politicians.

Instead, they try to distract you by launching more illegal wars in the Middle East.

Let's get on that, shall we?

PS - This is why we need immutable block-chain currencies with a ledger that can't be edited, in case you were wondering.

We also have a Radio Station! (click me)

...and a 10,000+ active user Discord Chat Server! (click me)

Sources: Google, Macro Tourist, Bloomberg, SGH Macro Advisers, Zero Hedge

Copyright: SmartSteem, PALNet, SPL, Macro Tourist, Bloomberg, LaDepeche.fr, Polination

If that happens it will have far reaching consequences not only in the US but in the rest of the world. Surely there should be a remedy for these oversight.

US debt is not hidden from anyone. but when you are in debt, you are safer to default! because China and Japan (major lenders) won't let you down. if US economy fails completely, they will lose a massive money.

I agree cryptos will be hot topic for the times of war, uncertainty and economic turmoils, but I don't think the US gov defaults...

This has been a long time coming. From the beginning of the system there has always been more debt than money in circulation. It's only a matter of time before it all falls apart. I was pretty worried about this before the blockchain came along. Now we have a safety net.

Exactly! We're right where we need to be!

While I do agree with your premise. My question is, what responsibility does the ordinary citizen have in all of this? We know that the Fed is out of their control. But as far as the politicians are concerned. They did not fall from the sky. They did not get into office by a coup. The US, despite its shortcomings, is a democracy. And while their approval rating is so low, the fact is that US citizens vote for them.

One also has to take into consideration the consumerism that is a mainstay of the US culture that is helping to keep the system purring sweetly. And you also mention the army. The 1% is not sending their kids to fight wars.

Again, I agree with pretty much all of what you said, but at some point, should the people not bear some of the responsibility?

It's not a democracy. It's a republic. A corrupt person is always going to get voted in no matter what. If a good person happens to get through and starts making changes they'll be removed or assassinated.

Point taken. But having spoken to people on both the left and the right, they go along with what is given to them. But look for example on the left you had Bernie and you had Jill. You also had libertarian candidates. Now, whether or not you liked their policies at least they were coming with something a bit different and many people rejected them.

Ok so Bernie get's elected. He tries to take away power from the elite and gets murdered like JFK and Julius Caesar. No more Bernie.

Statistically, there is no choice. The politicians are not in control of the system. I live in California. Because of the broken electoral college my vote doesn't count. The democrat wins California every time no matter what.

The Federal Government doesn't control the Federal Reserve. The strings are being pulled from above. It doesn't matter who gets elected. Politics is a distraction.

Point take. And I have had similar concerns. Do you think it is even possible to get rid of the electoral college?

And

Concerning the Feds. How does one even approach that issue? Can anything even be done to the Feds?

The day of reckoning is near. This bloated debt-based economy will no longer be able to sustain itself. I thought it was all going down in flames but perhaps the blockchain can smooth out the transition. That's honestly why I'm here in the cryptospace.

I couldn't agree more.

But even though the blockchain is here many are gonna suffer horribly. Some people I reckon are not gonna embrace this solution. But who knows. let's see.

They are equally partners in crime, the days are coming for them to be judged too. Natural Law is fair.

I think that's a little unfair.

It is only in the last few years- the internet years- where people have had access to the information. Information we never really had access to, and only a small group until then, in control to decide the information the public had.

Up until then, we had a naive trust we put in our politicians, media etc...

So equal partner in crime? - gullible maybe, not criminal.

i.e., what goes around comes around?

Lock in some of your purchasing power while you can - gold, silver, Bitcoin (?)

It's unbelievable what they've managed to get away with, treason comes to mind!

This is off-topic but I was wondering if you were going to be wall of coins crypto meet up tonight?

It's not just the US that has this problem. I wrote an entire article on why bitcoin was created, the worlds debt, govt currency and the importance of decentralization. It just happened to be in reference to the Bitcoin -vs- Bitcoin Cash debate...but all those topics are covered. Let me know what you think:

https://steemit.com/bitcoin/@workin2005/bitcoin-btc-vs-bitcoin-cash-bch-the-great-block-size-debate

US needs war = income to solve their debt crisis. Simple as that. We will soon see missile flying over Syria.....................

sadly true history repeating itself

A individual filling for bankruptcy mean that the government takes control of the your assets and comes to a conclusion rather than continually taking your income to pay your creditors.

No one has the ability to seize the income of the United States. So sure we can decide not to pay. And others can either attack us over it, or refuse to do business with us again.

The house of cards that the monetary system is about to fall, get ready and stack some coins and precious metals :)