Silver Leverage At All Time High; How Futures Work To Depress Price

You don't hear much about the precious metals markets in the mainstream, and believe me, this is by design. After all, the band doesn't stop playing just because you've hit an iceberg - in fact, it has to play even harder.

For quite a long time, precious metals have been a thorn in the side of money-printers everywhere. However, governments have finally rendered this threat mostly toothless in the era of modernized financial markets and un-backed commodity contracts.

The COMEX is the primary future market for the trading of precious and industrial metals - gold, silver, copper, and aluminum being prime examples. Other metals such as platinum and palladium have elements of both, and each is traded on their own futures market, allowing speculators or hedgers to gamble on future price movements.

As you can probably tell from the above graphic, the amount of "paper" metals traded absolutely dwarf the trading of the "real thing" (physical gold). Naturally, this creates a massive suppressing force on the price of the "real thing". It's hard to overstate just how great this forces is, though it is also very hard to attempt to calculate it.

Consider a market in equilibrium with 100 ounces of gold for sale, at a price of $100. Now, consider the effect of adding 42,300 new ounces of gold to that market. That is effectively what paper contract trading in gold in London and at the COMEX has accomplished in the last 50 years.

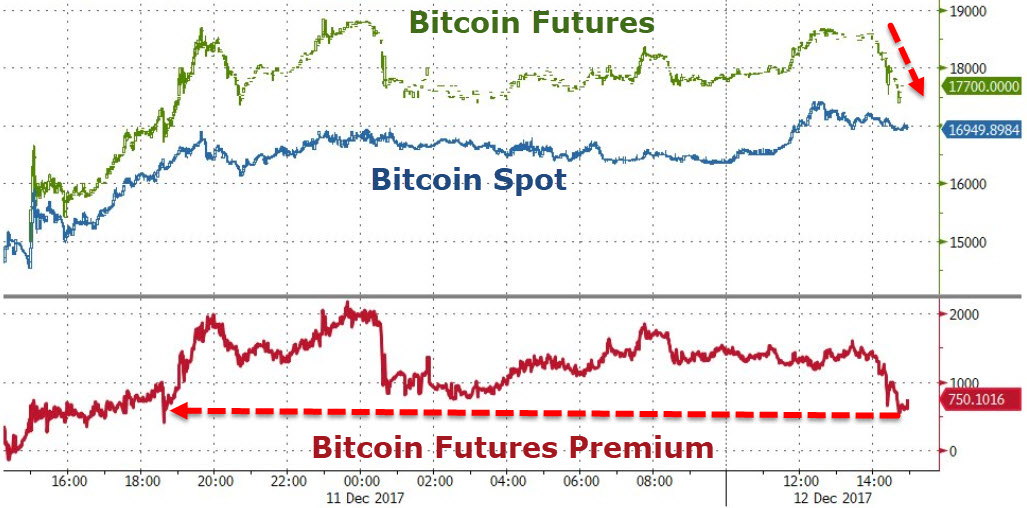

If you've ever heard crypto-enthusiasts who were sour in the implementation of futures for Bitcoin (or other cryptocurrencies), you need only review the previous two paragraphs to get an indication of why. They are worried that futures will be used either to suppress real demand by satisfying it with un-backed paper futures, or manipulate the price in ways detrimental to the "proper" investors in the market.

Anyway, getting back to the headline...the silver market is a perennial favorite of market manipulators for at least a decade owing to its lower public profile and substantially smaller size. Positions in the market are routinely out-sized relative to metrics like demand and annual market supply.

Nevertheless, the silver market has never been more leveraged than it is currently. Extreme situations like this tend not to hold for too long, although they often hold longer than you expect (or can remain solvent.)

Silver may well be preparing for a big move, and this could have something to do with the looming "trade war" with China. Keep an eye out if you are holding it.

We also have a Radio Station! (click me)

...and a 10,000+ active user Discord Chat Server! (click me)

Sources: Google, Sprott Money News, Wikipedia, Wells Fargo

Copyright: SmartSteem, PALNet, SPL, VisualCapitalist.com, Seeking Alpha, ClimateerInvest.blogspot.com

Silver just might be the most undervalued asset in the world.

It kills bacteria... and vampires. It is a pretty amazing metal when you think about it.

Nano-silver infused clothing for the win.

Werewolves too :)

people do not talk much about silver but once after the marked had crashed somewhere in 2008 it had given a magnificent return

Silver has got to be undervalued. I have thought that for years, but I never understood one fundamental reason why before your post. The leveraging of paper silver creates inflation. If investors actually knew that an ounce of silver backed every ounce they bought, the market would correct a lot. I wish that day would come soon.

It might not be the best thing to gravitate towards events that might potentially affect the silver market because doing this might create panic and unrest among the investors. Because personally I think the silver market is a stable market at least compared to cryptos

Watch this video by Mike Maloney. He talks about something new brewing up for silver. Comercial shorts have never been this low!

Isn't this also why Blockchains backed by an asset is also a stupid idea? You can just create more coins without actually having the asset. Tether is the worst. It undermines Bitcoin as well.

I am one of those that were not a fan of futures for BTC. The concept of the futures contract makes sense but the application of future contracts are rarely used for their intended purpose resulting in manipulation and distorted markets as you mentioned.

silver seems to be doing well amidst the trade war saga

I wonder which one will be more expensive in the future. Will it be silver or gold? I'm very curious to know because many are investing in it.

Thank for your clear explanation, really appreciated