CVS, Getting Over Its Cold

Mar. 19, 2019 2:45 PM ET|About: CVS Health Corporation (CVS)

Summary

CVS's business as been deteriorating the past two years.

The Aetna aquasition puts CVS back on the growth path.

Because of Legeslation like the individual mandate, heathcare is an attractive sector.

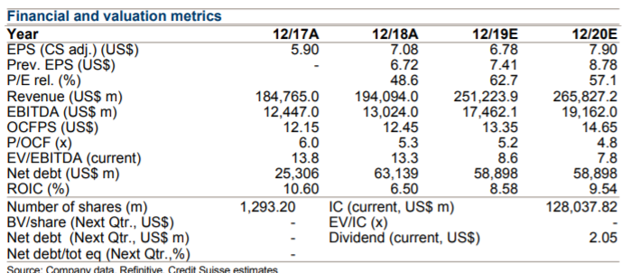

Guidance appears to be the end all be all when it comes to earnings reports these days. This held true when CVS reported Q4 which topped estimates but CVS issued lackluster guidance for 2019. In light of the recent downturn in the stock, I believe CVS is a buy, right here, right now. CVS reported Q4 EPS (2.14), which was above the consensus ($2.09). However, they initiated their guidance at a range of ($6.68-6.88), which was below the target of ($7.35). With these results it leaves much to be desired, however, the earnings estimates have already come down. Credit Suisse lowered their numbers to reflect this ($6.78 from 7.41). As well as lowering their price target to $79, from $86. With CVS and their acquisition of Aetna, there has been a generally negative view of this aquasition (look no further than the share price). However, as time progresses, and investors begin to evaluate CVS going forward, I believe that there will be increased positivity surrounding the deal. One of the great secular growth trends in this decade is the aging population in which CVS is now poised to capitalize on with Aetna. This positivity should come from the company as they will offer greater disclosure on its longer-term outlook for the combined company. CVS hosts its investor day on June 4th, and I believe much of this color will come during their conference. CVS prior to the Aetna deal was a slow growing company which bordered on no growth. However, in recent years, there has been large growth in the Medicare Advantage business as well as integrated medical-pharmacy-retail companies. This should allow for a return to growth mode, fueled principally by Aetna. One more deal that mimics CVS that comes to mind is the Cigna Express scripts deal. There should be two noted risk factors that are attached to this deal and those are integration and reimbursement.

Evaluating the business as a whole leads me to a mixed result. CVS has above industry average revenue growth, good cash flow from operations, and the previously mentioned Aetna growth path. However, running counter to these strengths we find deteriorating net income, higher debt management risk and poor return on equity. Revenues for CVS rose by 12.5%, beating the 12.2% industry average. However, it should be noted that there has been a tick down in EPS, signifying that the revenue growth at 12.5% has not found its way to the bottom line. CVS has experienced a large decline in EPS as noted before, and this trend has occurred for the past two years. This trend should reverse in the coming year, however, as the market is expecting an improvement in earnings ($6.78 vs $-0.55)The debt to equity ratio of 1.26 is high when based against the average in the industry, meaning there needs to be a watchful eye on the balance sheet. This problem is exacerbated by a quick ratio of .55 meaning CVS will have issues covering any short term liquidity needs. After the Aetna aquasition, one would expect CVS to be in a cooling period, however, it could still manifest itself as a problem in the future. Looking Forward, Where Can This Stock Be?Healthcare as an industry isn't going anywhere. From Hospitals to facilities, long term care center, assisted living, outpatient, and radiation oncology. The industry has experienced continued growth helped along by an aging population, and increased awareness of health trends and advancement in technology will continue to offer strong growth in the years ahead. Overall healthcare spending in the United States tops 2 trillion per year. There has been a large shift from the private sector to the public ones as more baby boomers enter the Medicare system. This is helped along by legislation in regards to comprehensive healthcare reform including an individual mandate to have health insurance will greatly help spur growth in the industry.Looking more towards the future, brand name drugs will continue to enter the market as generics in the next three to five years. Some could argue at an increased rate. The individual mandate creates a large base of customers for healthcare providers like Aetna, that will help spur growth in the CVS Pharmacy part of the business as well.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CVS over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.