Is THIS The Bond Apocalypse?! - The Yield Curve Is Inverting!

In this video, I talk with author and economic analyst John Sneisen about the bond apocalypse happening before our eyes as the yield curve sees a partial inversion for the first time. This is massive news that we aren't seeing a lot of talk about in the mainstream despite the severity.

All the while we see the stock market tank with the Dow and S&P in a constant tail spin. Is this the end? There's no saying. It could very easily pick up more before it crashes, but it's gotten to a point of complete absurdity. The Federal Reserve is clearly propping up this decimated system with their zero dollar account on Wall Street. This is desperation at this point.

Who on Earth would buy a 10 year bond with the promise of losing money in total when factoring in inflation? Well it's being purchased, but one can only imagine fake money from the Federal Reserve is making up the VAST majority of the purchases.

Also in related news, Detroit, the city struck worst by the 2008 recession is selling municipal bonds backed solely by the city's ability to repay for the first time.

You know what to do folks. Be self sustainable, independent, decentralized, educated and responsible. Individuals must break free from the system on the verge of complete collapse and avoid the dependency of debt.

See the FULL video report here:

Stay tuned as we continue to follow this massive issue! Don't forget to Upvote & Follow!

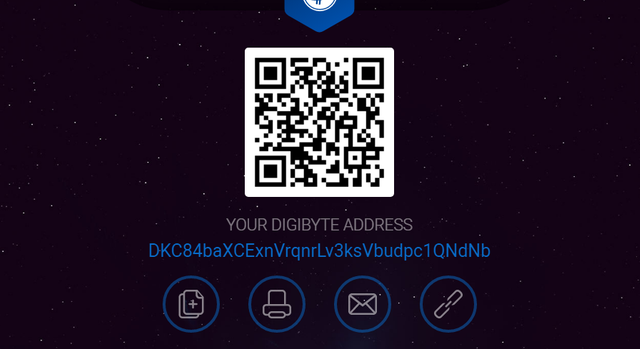

If you like what I do, you can donate to my Bitcoin, Dash or DigiByte addresses below! :)

Bitcoin:

Dash:

DigiByte: