Gold and Bitcoin - the last safe haven?

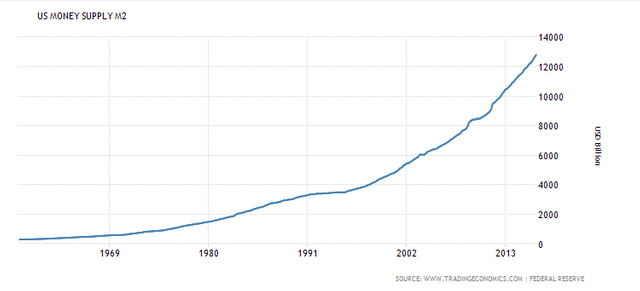

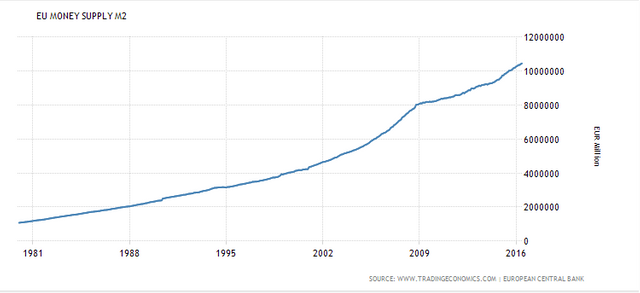

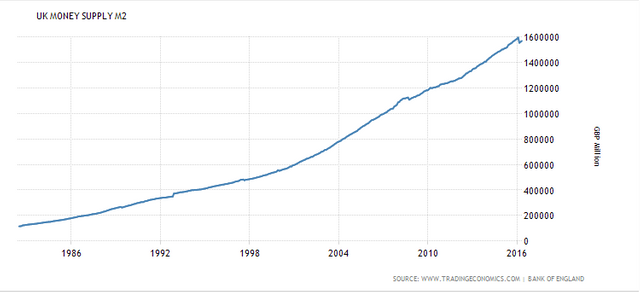

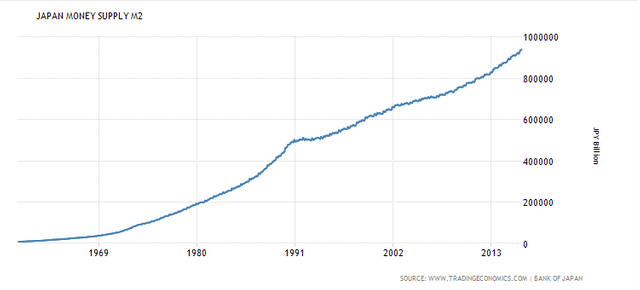

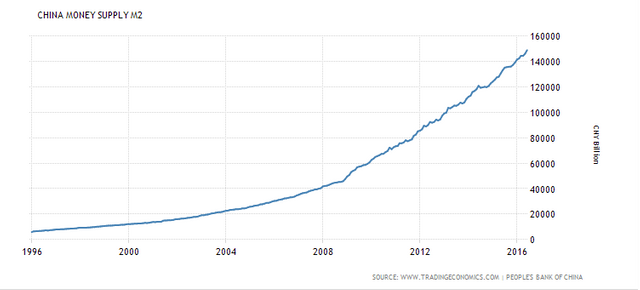

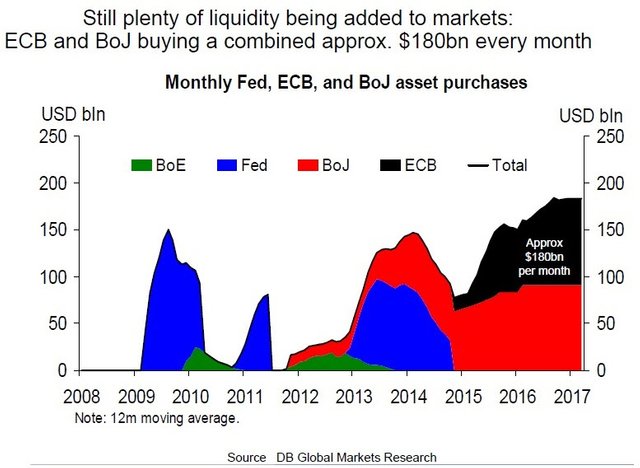

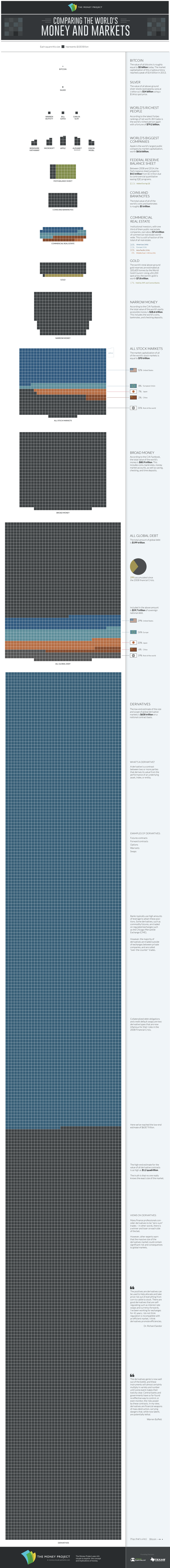

Central banks all over the world have heavily expanded the money supply within a short period of time. Quantitative Easing is everywhere. Whether it is in the US, Europe, England, Japan or China - the printing press is running nonstop and at full speed.

Officially, these actions were taken to help the economies. The expanded money supply, low interest rates and therefore easy and cheap access to loans were meant to lift the economies out of the recession that started in 2008.

But what are the consequences of these actions?

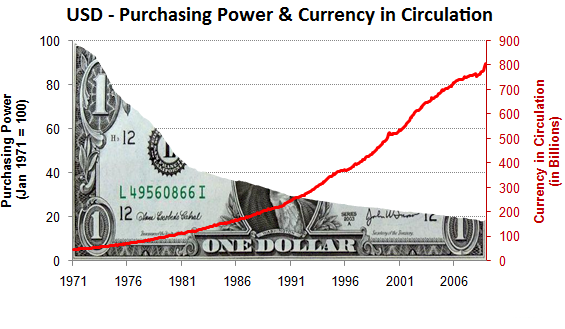

The markets got flooded with billions of paper currency, newly created out of thin air (therefore the name "fiat" money = "let there be" money). This paper currency will sooner or later - depending on the money velocity - find its way into the economy. As both - the amount of newly created currency and the already circulating currency - increasingly unbalance the ratio of money in circulation vs. the existing amount of goods, services and economic activity, two things have to happen:

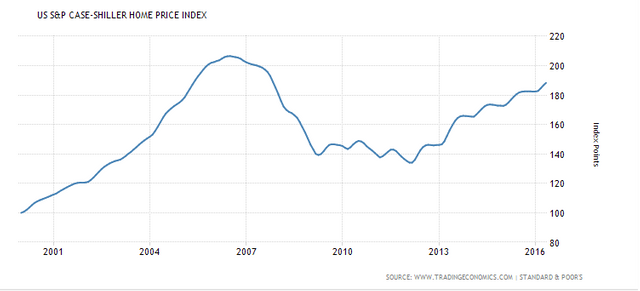

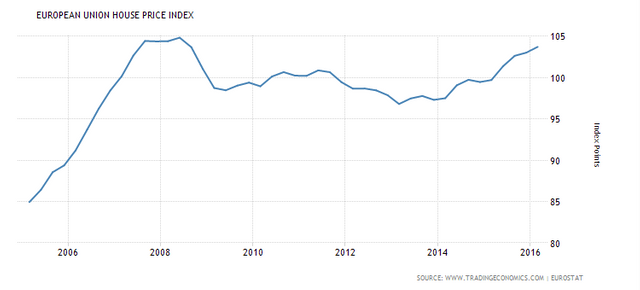

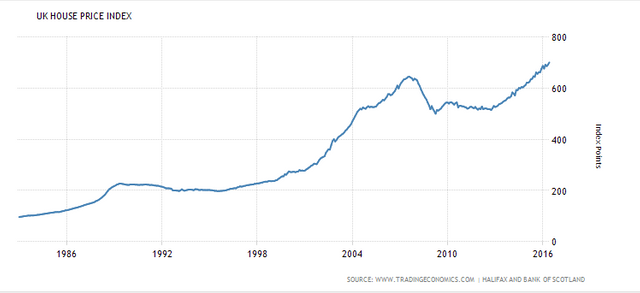

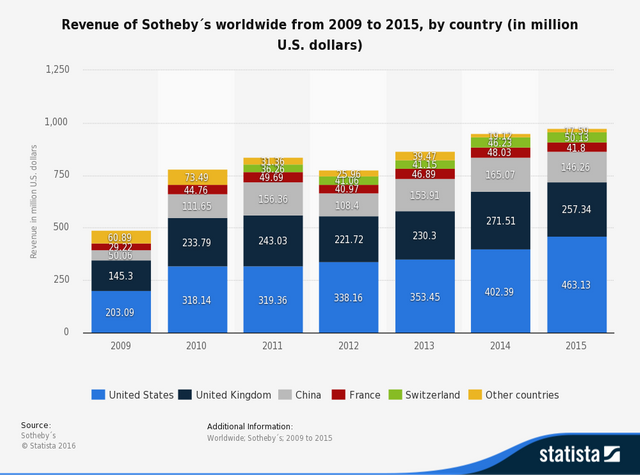

Prices in many sectors rise to fundamentally unreasonable and unsustainable levels (e.g. stocks, real estate, luxury goods). Asset bubbles appear everywhere.

Currencies depreciate in value. The people are losing purchasing power.

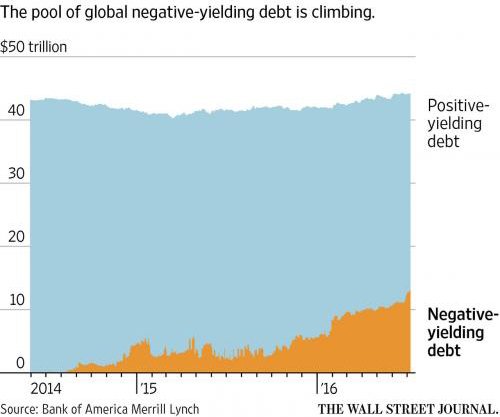

Point 1 is clearly and very easily detectible. After the Lehman Collapse in 08/09, Central Banks "rescued" the world financial system by flooding the markets with liquidity. They have done that by printing billions of paper currency and by manipulating the interest rates to virtually zero. On top of that, government bonds all over the world are on the brink of moving towards negative territory - if they are not already there.

These policies and global developments have created an environment, in which people, corporations and all other market participants are forced into risky asset classes to receive any yield on their money. Thus, the majority of market participants has moved its capital into the most obvious and easily accessible asset classes which in turn appreciated heavily in price.

Whether you look at stocks, real estate, luxury goods like yachts or auction prices at Sotheby's, the valuations in monetary terms find themselves at or near all time highs. This is happening in pretty much all major economies around the world.

Point 2 is harder to spot. The Foreign Exchange market is by far the biggest market in the world and the valuations of currencies are always fluctuating for all sorts of reasons. This depends on many factors for each currency. Some currencies are profoundly influenced by oil prices (e.g. Canadian Dollar, Saudi Arabian Riyal or Norwegian Krone), some by other commodity prices (Australian Dollar, Brazilian Real). A few are pegged to certain valuations like the Chinese Renminbi or the Swiss Franc (until January 2016) and many others get their valuation for very different types of reasons (e.g. the US Dollar as the world reserve currency). One can say that nowadays, all currencies are manipulated in one or the other direction by different market participants (first and foremost Central Banks), and for different types of reasons.

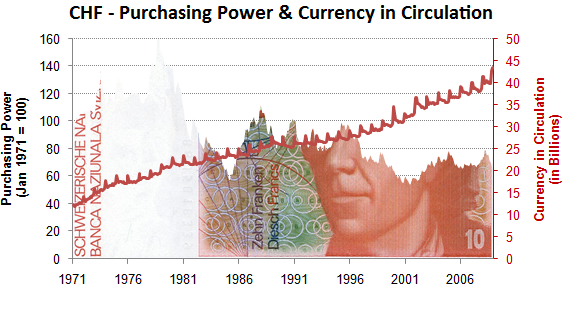

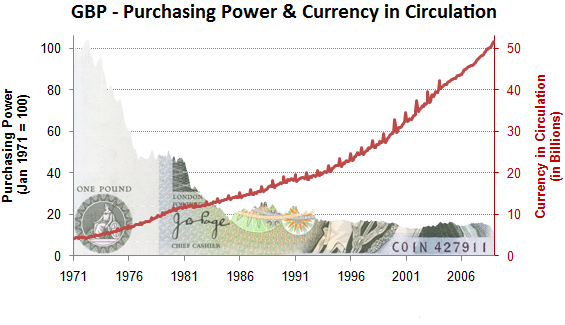

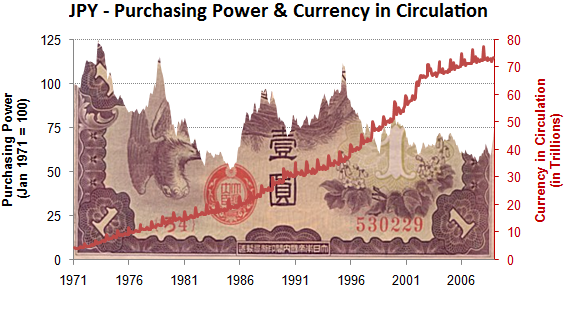

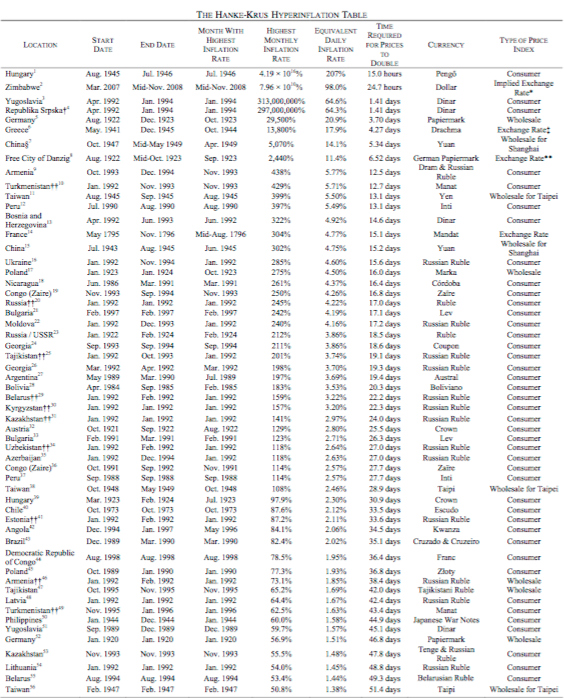

To be able to realize that a currency has devalued - in an environment where all currencies lose value - is only possible if you track prices of many goods and services over time. By doing that one can measure the increase or decrease of purchasing power. Research shows that every currency that is based on an inflationary fiat system has lost the majority, if not all of its value over time. The US Dollar alone has lost 97% (!) of its purchasing power since 1913. In fact, EVERY fiat currency since the Romans first began the practice in the first century has ended in devaluation (often by hyperinflation) and eventual collapse. Especially after 1971 (when the US closed the gold window), the devaluation of fiat currencies has accelerated.

Citizens all over the world are recognizing the devaluation of their currencies. Even though they are not always able to detect the devaluation by price, they are able to feel the loss of their purchasing power over time. Their income stagnates and the cost of living rises every year. People have to work harder and longer for less. Therefore they try to find ways to protect their wealth. This development is visible in the price of gold and in the rise of Bitcoin.

Gold, seen by many people as a commodity, is primarily a currency. That's why central banks all around the world hold it in their balance sheets. It can't be printed and is very difficult and costly to mine. It has been a medium of exchange for more than 5000 years because it is naturally scarce and has the additional attributes of being durable, divisible and transportable.

By the way, real money has to have these 4 attributes as per definition. The paper currencies we use all over the world technically don't qualify as money because they are not kept being scarce. Therefore they only qualify as a medium of exchange and solely depend on the trust of the population that uses it.

"Paper money eventually returns to its intrinsic value - zero."

Voltaire, French Philosopher (1694 - 1778)

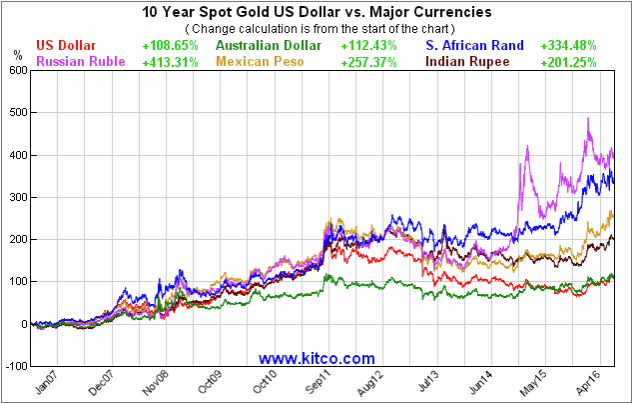

The accelerating development of fiat currency depreciation vs gold is clearly visible in the weaker currencies first.

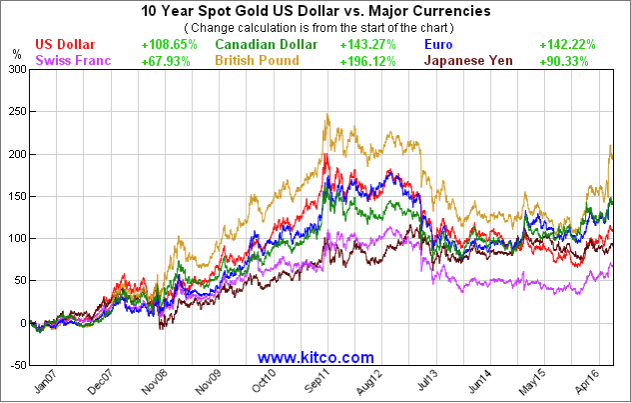

But also relatively stable currencies are seeing a heavy decline in purchasing power vs gold.

And even the currencies of some of the biggest and strongest economies are getting into trouble.

I expect this development to accelerate even further as more and more countries devalue their currency and central banks all over the world impose negative interest rates on their economies.

Now let's have a look at Bitcoin.

Bitcoin started in 2009 as a decentralized asset ledger and network allowing peer 2 peer transactions and exchange. This ledger exists without any middlemen or counterparties to process and check the network transactions. This is done by a decentralized pool of computing power that contributes resources to the running of the bitcoin protocol. "Bitcoin miners" are rewarded for providing this computing power in exchange for processing transactional blocks on the blockchain. These mined bitcoins are the currency. To utilize Bitcoin you must earn or purchase bitcoins, solely issued by the miners. The Bitcoin protocol regulates the issuance of bitcoins and has an artificial built in maximum cap of twenty one million units (21,000,000) which cannot be regulated or printed but only mined.

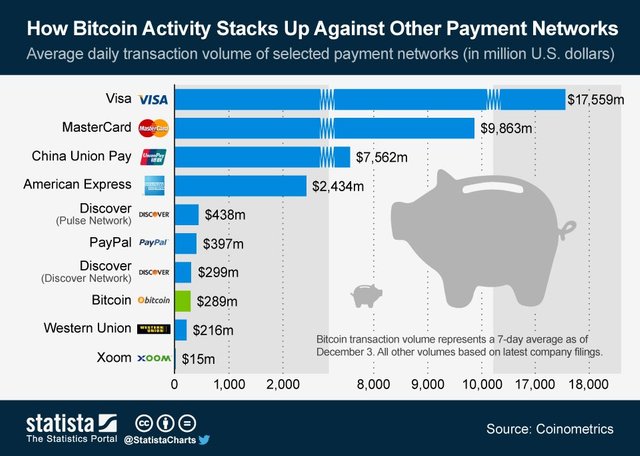

Bitcoin gets more and more widely accepted. Governments all over the world have started acknowledging Bitcoin as a currency, most recently the USA. But not only the worldwide acceptance is increasing, the general use of Bitcoin has skyrocketed in the last couple of years. The market capitalization sits at 10 billion US Dollars and the daily transaction volume is already higher than Western Union's. It is expected that Bitcoin will be quickly surpassing PayPal on its way to a powerhouse for international payment solutions.

Like gold, Bitcoin also has the attributes of being scarce, durable, divisible and transportable. Therefore it perfectly imitates gold - in electronic form. Because Bitcoin and gold are deflationary in nature (Bitcoin by built-in maximum cap, gold by decreasing mining output), they will gain purchasing power over time. This is contrary to the common, highly inflationary currencies circulating around the world. They all lose purchasing power over time.

Conclusion:

The music is still playing in the stock and real estate markets all over the world. One thing though is certain. At some point, the DJ stops spinning and asks everyone to leave the party. Bearing that in mind, a surge in gold and Bitcoin prices in the months and years to come seems very likely. These assets will consequently be able to protect the people from a possible global financial .

Congratulations @jiropo! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Congratulations @jiropo! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Hi! This post has a Flesch-Kincaid grade level of 9.3 and reading ease of 59%. This puts the writing level on par with Michael Crichton and Mitt Romney.