7 ways to become wealthy and change your life forever

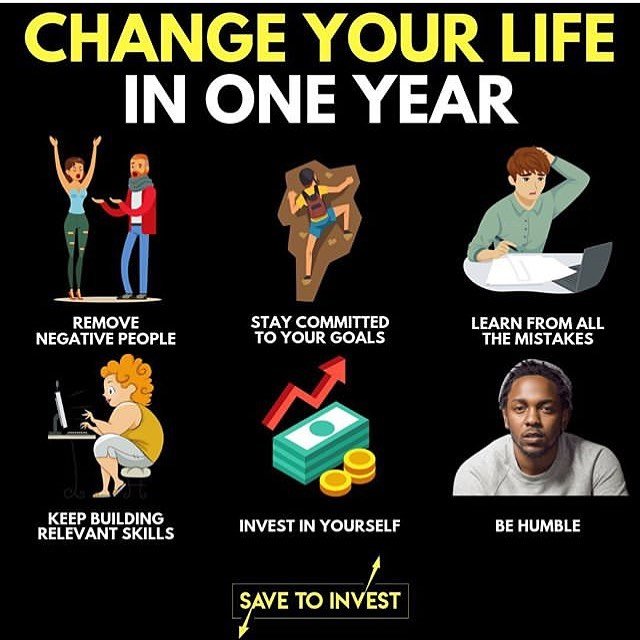

Most all financial books have common themes. The themes repeat themselves because they are formulas to building wealth. No matter the situation these principles work. In essence, becoming rich requires a break from “traditional thinking”. These seven points are what make wealthy people different than everyone else. Do you have any additional points that have helped you financially?

Pay yourself first

If we treated ourselves like the bills we get in the mail we would be much happier financially. For those with a 401K paying yourself first is easy because it comes out of your paycheck automatically. For others without a 401K other options are available. Opening a Roth IRA, online savings account, or broker account to trade stocks and mutual funds work.Automatically paying yourself is a way to build wealth on auto pilot. Automatic withdrawals eliminate the hassle, self control, and temptations associated with any other method of saving. Because online broker accounts and savings accounts both “piggyback” your regular checking account setting up auto-withdrawals is easy. They give you complete flexibility and control with your money. You will be surprised on how quickly you can save your money using this method.

Invest instead of saving

Saving will never create the same returns as investing in the long run. Compound interest is most powerful with more time and higher yield percentages. Most savings accounts are good for emergency cash reserves. The yields on these accounts are generally barely above inflation. Inflation in the U.S.A. is currently 3-4% a year and online savings accounts are about the same. In short, after you have your cash reserve you should put your cash to work in more lucrative investment vehicles.

Avoid paying interest at all costs (i.e. debt is bad)

Take some time and add up all the interest you’re paying every month. For most people interest and taxes are their #1 and #2 expenses. Interest costs are avoidable and therefore a waste of money. If you’re going to go into debt the asset you buy should appreciate more than the cost of interest. Things like your home and education are justified because they increase in value overtime. They also out pace the cost of the debt (i.e. interest payments). On the other hand electronics, cars, and eating out depreciate to worthless junk very quickly.For those who have bought the idea that debt is good, consider a few facts. Debt = Risk. The more debt you have the more risk you have. Companies that are burdened with excess debt are riskier investments. Their stocks are undervalued and their bonds are rated as junk bonds. If debt can destroy businesses it will wreck havoc in your life.

Stay off the “bleeding edge” of technology

The “bleeding edge” refers to the sharpest part of the “cutting edge” of technology. It is the newest of the new technologies. Those consumers who buy the newest technology fund its development until it becomes cheaper. They are paying a high price to be the first to have the newest toy. Let other people pay the premium and get the same thing in a year for a third the price.Try to avoid advertising and marketing. They are designed to persuade you that your old technology is useless and make a “want” a “need”. Companies pay a lot of money to convince you to make the switch. Take the initiative and avoid their marketing messages.

Financial education is worth the time and money

Everyone isn’t born with Warren Buffett as their father teaching them how to invest. Like most people, your childhood is probably riddled with neglect in many areas. So we have to work extra hard and learn all the stuff Warren would have taught us if we were his kids.Audio books, podcasts, blogs, books, and magazines are great ways to build your knowledge base. Read everything you can. Talk with people who really know what they’re doing. Copy the experts. Most importantly, experience is the best teacher. You’ll learn more in a week by actually trading stocks than reading for a month.Open an online broker account and learn the lingo, make some trades, run some screens, and find some deals. You’ll become financially literate and develop a style you’re comfortable with. Once you know how to read financial data you’ll be able to spot a deal across the room and make the returns you’ve always wanted.

Upset the Joneses by opting out of the rat race

Living a lifestyle that is not earned is stealing. Going into mass debt to LOOK rich isn’t the same as BEING rich. This fraudulent behavior catches up to all those chasing the Joneses. But the irony is that the Joneses are chasing someone else. There is no end to the cycle. So you need to opt out. Unsubscribe.Opting out of the rat race makes everyone still in the race uncomfortable. They’ll think you’re crazy, stupid, and out of touch. But that really is the point isn’t it? Moving in a different direction from the mindless herd confuses them. And if they can keep you in the trap, they feel better.

Rinse and Repeat

Most of the financial secrets out there are done over and over for a long time. Repeating a simple step for a long time will have staggering results. Compound interest needs time to truly expand your wealth. A little discipline and a lifetime of good habits will leave you retiring in style.

Hey there @jageshwar, welcome to STEEM. If you join @schoolofminnows, you can receive votes for free.

1. Your post will appear in post-promotion on the discord.

2. Your posts will also get featured on the school of minnows account on steem

https://steemit.com/@schoolofminnows

3. You get votes from other members.

4. The whole thing is FREE.

To join follow this link:

https://steem.host/connect/steempunks

yes sure

i will @lanmower