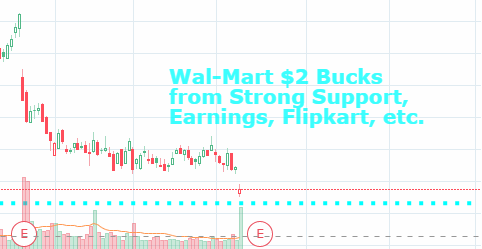

Wal-Mart $2 Bucks from Strong Support, Earnings, Entry into India. . .

Many believe India and China are the future of retail.

Wal-Mart seems to agree, and on 5/9 announced a $16 billion USD bid for a 77% stake in Flipkart, India’s premier online retailer.

Wal-Mart paid up to beat out Amazon for this exposure to Asian retail. Will it be worth it?

Hi Steemians, I'm @holsturr.

This same article is on our website with our affiliate link to a free trial of TradingView Pro.

Thanks in advance for lending me your attention!

Luxury retail is in great demand but everyday retail is struggling, especially in the United States. Wages remain stagnant, consumers are turning more and more to debt, and western countries don’t offer much in the way of growth for retailers (indeed, several retailers have been driven to bankruptcy in recent years).

Wal-Mart provides a place for the everyday consumer to buy everyday products, but margins can only continue to compress as: 1. the cost of goods rises with a consumer that can’t handle increased costs passed onto them, and 2. WMT fights to reorganize to take market share in attractive online and Asian markets.

Wal-Mart needs to catch up to compete with Alibaba and Amazon in markets with growth potential, and seems to be taking the right steps to do so. In the short-term, that could be bad for share price – or is the “bad” already baked in, and are traders\investors ready to pay up for Wal-Mart stock?

Wal-Mart has to compete for its share of fruitful markets, even if it means margin compression.

Looking at the technicals, Wal-Mart has abruptly fallen to near strong support in and around $81 USD. WMT reports Q1 2018 earnings on 5\17, and it’s conceivable the numbers can’t come in much worse than the downside upset from Q4 2017’s earnings call back in February. Is disappointing news baked in to the price already, with Wall Street already expecting a little pain as Wal-Mart transitions into the company it needs to be to take on Amazon and Alibaba in shifting online and global markets?

WMT paid up to jump in to growing East Indian (and Chinese) retail – it more or less had to, and “had to” isn’t a good place to be when negotiating deals – but will an exploding Asian retail scene lead to explosive moves upward in the price of WMT shares? The move up may or may not be today or tomorrow, but presently, the company’s decisionmaking seems to bode well for Wal-Mart’s future.

💰✨Remember… Every single person is their own trusted expert and seeking to promote yourself in that role is vital today, now more than ever.

This has been @holsturr, thank you for reading!

Please feel free to comment, resteem, and follow me!

EBT cardholder? Get Amazon Prime discounts!

Recent votable posts:

- Microsoft - not a top yet, AI and cloud efforts, etc.

- Billionaires baggin' on Bitcoin. . . Why?

- T-Mobile hanging at support with speculative interest. . .

- Quick poast on a key technical pattern in the SPY.

- Did the Dow pop on a jobs report that is fake news?

- And this is my website, holsturr.com!

We participate in affiliate programs to fund content creation, please see our disclaimer for details!