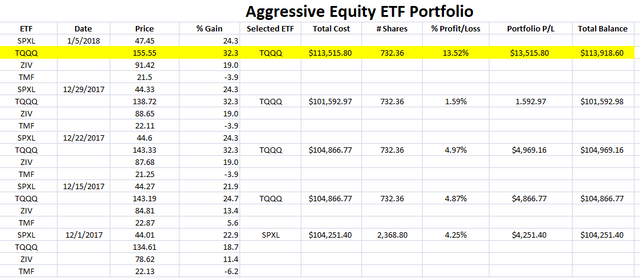

AGGRESSIVE ETF PORTFOLIO Update: UP by 13.52%

)

SUMMARY

I've used this technique to grow wealth. It is a very simplified technique of following the trend which is always smartest. I never discuss equities on this blog but introduced this Aggressive ETF Portfolio model. I was a bit concerned to see so many pour all their money into cryptos as such doesn't represent a de-risking strategy but only greed. I believe it is best to be well diversified amongst cryptos and equities and other hard assets. For that reason, I shared this portfolio to perhaps augment the readers' due diligences.

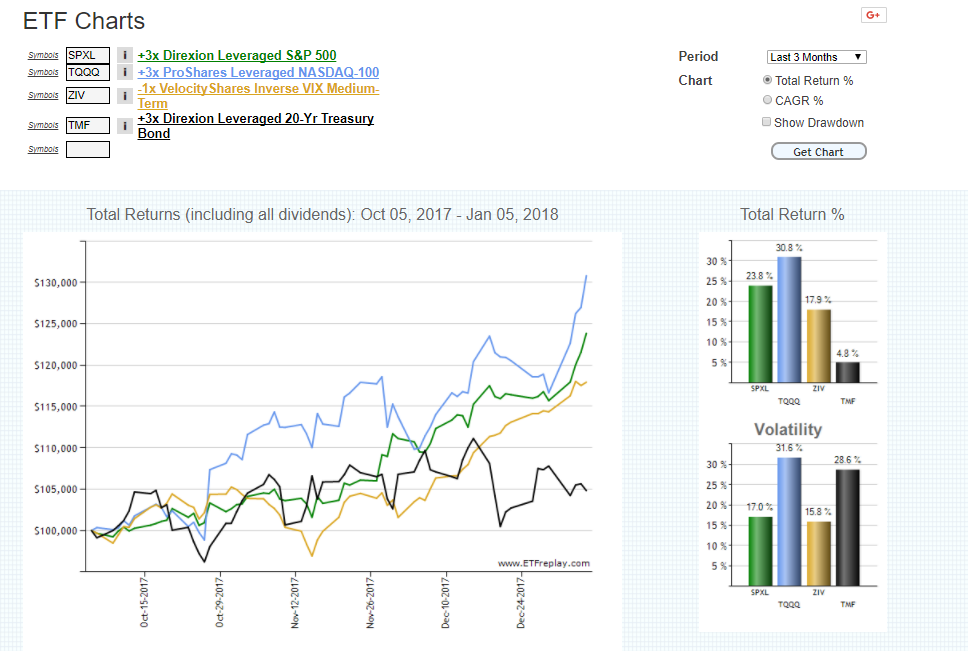

I missed last week's update on the Aggressive Portfolio update due to holidays and knee hurting ski moguls! It matters none as zero change would have been made. On 12/29; TQQQ was the resounding winner and today, TQQQ remains in the lead, as shown in below chart:

The below shows that this Aggressive ETF portfolio is up 13.52%:

I believe 2018 will be a great year not only for Cryptos for but equities!

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

These Technical Analysis Books: Elliott Wave Priniciple & Technical Analysis of Stock Trends are highly recommended

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTS Wallet - haejin1970

BTC Wallet - 1HMFpq4tC7a2acpjD45hCT4WqPNHXcqpof

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LecCNCzkt4vjVq2i3bgYiebmr9GbYo6FQf

Legal Disclaimer: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.**

I don't think that these types of equities are a great investment right now. Leveraged bonds, nasdaq and S+P, not my cup of tea, I can't believe they are still going up.

Not sure how that VIX equity works, but that might do well if you get paid when the VIX rises.

I have a medium share of my assets in cryptos, only because a small share increased so much! But the rest is in farm land and the installations on it. No matter what happens to the markets, I will be eating the very best bananas ;p

Blessings to all, please diversify and be rational!

You can easily switch to non leveraged mutual funds. Works quite well that way too.

If you don't mind me asking in what states are you buying farm land considering you mentioned growing bananas.

I don't mind! I moved to South America, and our farm is in Tolima. I wanted to buy undervalued farmland.

Can you say 1,2,3,4,5??!!

Look at the followers!!!

LOL!

JUST A NOTE. THIS POST WAS SUPPOSED TO BE 100% POWER UP, AND WAS LEFT AT DEFAULT BY MISTAKE. THE POSTS TOMORROW WILL BALANCE THE MISTAKE TODAY. GOING FORWARD, IF THIS MISTAKE IS MADE, IT WILL ALWAYS BE BALANCED OUT AS WE AGREED ASAP.

Muy interesante su punto de vista, verdaderamente es bueno diversificar, las criptomonedas es una buena inversión, pero siempre es bueno, tener varias ramos en donde este invertido nuestro dinero, si alguno pierde fuerza tenemos los otros en donde apoyarnos, mucho éxito

Yes, that's diversification. (google translated your comment)

Gracias

Precisamente!

Hi @haejin,

I posted this comment on another aggressive ETF portfolio post, but in case you haven't read every comment I'll repeat some of it here:

I liked the idea of this strategy and decided I would investigate it further, which I have now done some of - I've run my own backtesting on it using your chosen ETFs and am more convinced to try it.

However I'm based in Australia, not the US. The platforms I can use at the moment don't have SPXL, ZIV, TQQQ, or TMF available. I am looking at further platform options to resolve this. Your alternative 'less aggressive' suggestions (SPY and TLT) are available to me, but I'd still be missing ZIV.

Could you provide some guidance?

My questions:

Thanks for your time.

you can just use three ETF. That's fine. No ZIV required. Or, if you have Australian volatility index fund.

Use even mutual funds, they will work just as well.

I was taught this by a mentor.

How do you choose the mutual funds to use?

I was thinking there may be a strategy to choosing particular ETF/mutual funds - e.g. a growth, a bond, and a volatility index, which would all have negative correlations in their movements, the bonds being a 'safe harbour' in troubled market times, so there's hopefully always one moving upwards. And then add in leveraging for higher risk/reward.

Not clear if it's something along those lines or just pick any and back-test them to see if they may work.

I would think so as well ... I just don't know very much about ETFs/mutual funds (I have some, but mostly in a buy and hold to follow overall S&P over decades).

Thanks for sharing @haejin! Nice to get a different class of recommendation.

I was wondering what your thought on REQ coin is? (Request Network).

It seems possible that it has hit a double bottom of sorts, and is on the way to a second wave of upswing?

Pictured is my TA/charting. Hoping to learn from you on this one.

I also found a relevant Elliot Waves approach of TA, dated a couple days ago. Hopefully I'm not being incorrectly bullish. The incoming rise of BTC will definitely be disturbing the altcoin market, and may delay an upswing.

Looks good. Remember the "Hurry and Wait" syndrome. Also, search my articles on phasic and non-phasic relationship between BTC and altcoins.

Will do. Going through your Elliot Waves tutorials as well :)

Likely an a,b,c,d,e triangle. Double bottom in a triangle might not be best.

Looks like it's happening! Hit 0.00007 BTC. Up over 40% since posted.

You know someone cares about their followers, when they tell them to do something they are not famous for. I personally plan to buy land, gold, and cannabis stocks. As well as I have a few business ideas I plan to get off the ground soon.

Now that is what I call well diversified! :)

This may work for US investors but I live in the UK and can not access the majority of these funds (I think I can buy one of them but not with my provider). I need to look at alternatives that could work here. Has anyone else

I’m in the UK. I’m using IG to trade these. I’m going to move to Switzerland soon though, no tax on capital gains

Wow. I didn’t know that

Have been considering the same. Cannot cash out in the country that I am in, the state will take almost half my money and I am absolutely not rich, yet..

Does anyone know of other countries where taxes of capital gains are low/none? - Is there a country where one can simply open a bank account (without living in the country), and have crypto gains cashed out to that account???

Could you please do an update on NEO?

Thank you for the discussion of equities as well and specifically the importance of not being greedy and being diversified. It seems not many are interested these days, but it's very important to diversify and across sectors. Right now is an excellent time to have an allocation to gold/silver/uranium and most commodities. They are extremely cyclical as you know and you get an up cycle every 8 years or so. We are solidly in the up cycle and are just at the very beginning for uranium. The cost to mine a pound of uranium is $60, but the price was recently at $20/lb. So the two largest producers announced big production cuts. The price is now at $24/lb and the uranium stocks have really responded. The demand for uranium is increasing as China/India bring on hundreds of nuclear plants. The last bull market for uranium ended with the average stock going up 20X and the best ones were much higher. My allocation recommendations are the following:

-Resource stocks (mining companies)- In a bull market

-Emerging markets- they are outperforming US stocks after years of underperformance.

-China specifically- Big money coming in over the next 5-7 years as they are allocated to index funds

-Tech companies

-Marijuana companies- Broke states will not forgo the big tax opportunity

-Big US companies with billions of dollars overseas that will bring it back under the new tax changes at only 15.5%