How Much Car Can You Afford?

Nowadays most people only ask the car salesperson “How much down and how much per month?” They want to have it now and pay for it later. Plus interest.

Personal finance experts say that 20% of your take home pay is the maximum affordable amount that you can spend on a monthly vehicle payment.

I think that is too much. Still, people don’t even listen to that rule.

You can double that if you are married and paying on two vehicles. Not to mention the increased insurance to cover a more expensive car. If you have an inexpensive car, you won’t need to have full coverage on it.

After I decided to become financially free, I came up with my own personal rule when it comes to buying my car. I will only buy a car that costs a maximum of 10% of my gross yearly income, and I will not finance it.

Last year I made just a little under $65,000 – so any car that I buy will cost $6,500 or less. This keeps me on track to invest and grow my wealth. When you buy an expensive car, you lose a much larger chunk of your net worth every month. If the car has already been greatly depreciated your loss is much less, and sometimes even neutral or positive.

I am a bargain hunter. If I can find the diamonds out there I know other people can too.

My brother-in-law is a car gearhead. He seems to have a new car every time we go to visit. He buys cars that are special, these are not your normal day-to-day type vehicles. I can’t even remember the models since he is in Europe, but from what he tells me is that the cars have a small but fanatical following. He says that his car expenses are low since the cars hold value. He might sell one car for just a few hundred less than he paid a year earlier, or even get to drive it for months and turn a profit on the sale.

When I rented a room in Hawaii, my landlord didn’t have a job. Instead he collected the rent from the other people renting rooms and spent his time flipping cars off of Craigslist. Sometimes they needed a bit of mechanical work, other times cosmetic attention, but most of the time he just cleaned them really well and took great photos.

That’s all he did and he lives in Hawaii – one of the more expensive, but gorgeous, places to live. People will sell their car for less than the actual value.

When I purchased a car for my wife, it was already 11 years old with around 150k miles. Three years later the car has dropped in value by $1200 (about $33 a month) and the only things I have had to do to it were change the battery and replace the tires. Oil changes? I make money off of oil changes by performing secret shop jobs that reimburse the cost of the service and pay me an additional $40 for my report.

Sure, because I am an aircraft mechanic maybe I have some advantage in spotting potential problems when I am looking a vehicle over, but it doesn’t take much skill to identify leaks or if the vehicle makes a strange sound when you drive it. Worst case is that you pay for an auto mechanic to look it over. Why worry about a one-time $100 for a thorough inspection when you normally pay a recurring $500 a month?

For most households the highest monthly expense is housing, followed by transportation. Buying more than you can afford in these two categories can bankrupt you, so don’t do it! Being free from financial stress is worth having a smaller house or an older car, believe me.

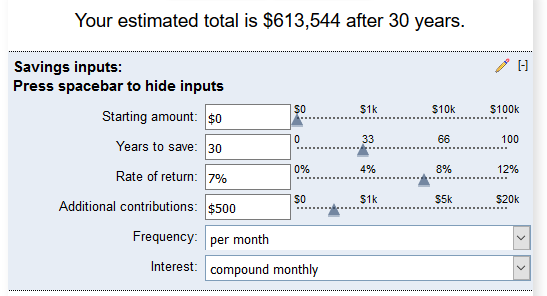

If you need any more convincing, let’s plug in the numbers and see what $500 a month invested at just 7% a year for 30 years turns into. Because once you pay off a car its time for another one, right? Car payments are just a way of life.

$613,544!

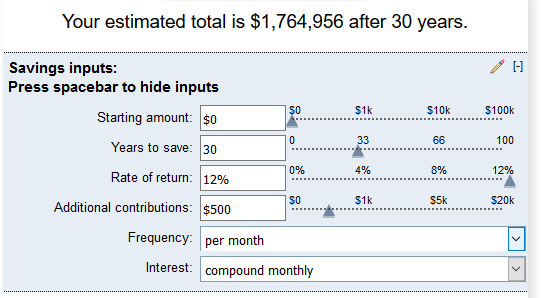

Dave Ramsey says he gets a 12% average yearly return on his money. Let’s see what that looks like.

$1,764,956!

Do you think driving older cars is worth it now?

The excitement and smell of a new car wears off, the knowledge that you are securing your future does not.

I changed from being a consumer to a saver and investor. This one simple change could send you well on your way to becoming a millionaire!

Stop spending so much on cars and start buying your freedom instead. Stop making the car dealerships and bankers rich off your hard work, and instead work hard towards your freedom. Once you have enough money invested it will work harder for you than you could imagine.

Pictures: Pixabay / Bankrate.com calculator / Images by bplanet at FreeDigitalPhotos.net

Using credit for luxuries is always a bad idea. No one is ever truly impressed by someones purchase. The only real satifaction in life is when you better yourself via education and provide security for yourself and your family.

Preach it Alex. :)

Re-Steemed because this is stuff that could help people.

I also hate paying interest. I bought my car with cash a few years back after saving. It's a little older, but I love it.

My grandfather always says that if you can afford to pay interest, then you can afford to save.

And that's what I've attempted to live by.

Our grandparents lived in a time where credit wasn't as relied upon as it is now. Sometimes the old ways are better, and I believe that is certainly the case when it came to their spending habits. If they wanted something, they saved up the money and bought it - not how most people do things today.

Thanks for the comment and the re-steem!

Now I upvoted, too, I forgot to the first time around. :D

With Uber, the younger folks are seeing less need to 'have' a car especially in Singapore where cars are one of the most expensive in the world.

I would agree with that! I heard that some countries have a tax on new cars that basically double the price of them! Doesn't Singapore have a great transit system? I thought I read that it was one of the best in the world. Just like if I lived in New York City I wouldn't have a car there either.

You said it man! People think about payments as opposed to cost.

That's the wrong way to think, keeps people poor.

I can't remember who, but they did an excellent video on ThouTube.

Where, you want an expensive car?

Each month, save your amount you would pay for a car.

Buy a used car for that amount, drive it for a year, while saving the same each month.

Then sell that car (for almost what you paid for it) and use that and your savings to buy a better car.

Repeat until you have the level of car you want.

I think I have seen that one of Dave Ramsey's Youtube channel. It really opens your eyes!

Great article and I couldn't agree more. I've bought one car on time and wound paying it off with an income tax rebate (my wife wanted a minivan). Every other car I've owned I paid cash for. I'm like you, I DO NOT like paying interest on anything. One thing that really gets to me is people buying groceries with credit cards. To me there is just something fundamentally wrong with paying interest on your food.

I pay for my groceries with a credit card. I get a little cashback and religiously pay it off in full every month. But I think you are talking about people who put it on the card and make minimum payments. Yea, that'll keep you paying interest forever.

Exactly! I had an American Express that I paid off religiously every month so I could avoid interest payments. Before I put my friend Larry to work in Ohio, he lived off credit cards. He would max one out, get another with a higher limit and pay it off. Kinda like the national debt!

I love older cars, man! And your awesome post just reinforces that argument. I mean, you even broke down the figures! How great are you, bud!

You keep on knocking them outta the park and we all salute you for it. Thank you for your well-informed and helpful advice.

You didn't post for only a few days and already Steemit just didn't feel the same without you. Bless, my brother! :)

Haha, thanks! I had a bit of writers block or low motivation or something. Couldn't think of anything that I wanted to write about.

We all go through that, man. A few posts ago, I felt just the same way, but a little timeout was all that was needed. So glad to see you back though, really. :)

I don't understand how people can do the whole get it now, buy later thing with cars. I don't know how they can accept being in debt.

I've always said the only thing I'll be in debt for is my house in the form of a mortgage. For all other things, it's very simple, if you don't have the money for it, don't buy it!

There is a huge percentage of people that hardly think twice about going into debt for this stuff. Then complain that they don't get paid enough or never have any money.

I just have my mortgage debt, and even though it is a 15 year mortgage that only takes 15% of my income per month I still want it gone. I struggle against that and the numbers that say investing the money will make a better return. So I pay a little extra on the mortgage and save in a brokerage account so that once I have enough to wipe out the mortgage in one blow I can do that.

Seems like you've got it figured out! I try to pay a little extra on the mortgage once or twice a year aswell, just to get the numbers down. I have the debt down far enough now that I'm sure if I am ever forced to sell the house, I'll get back more than what I still owe in debt. That's a good feeling.

Ha, I checked my mortgage and they listed the taxes and interest that I paid in 2016 and I was not happy. I saw the numbers and thought of all the other things that money could have gone to.

Anyways, since you seem interested I will link a recent post in which I broke down my networth during 2016. I don't know if you have seen it already. https://steemit.com/money/@getonthetrain/my-personal-2016-net-worth-update-and-finances

Wow, you're quite a lot deeper into all of this than I am at the moment I see! It seems you're doing quite well.

I've always tried to be smart about the money I spend (I like saving much more). The returns on money in savings are quite minimal here these last years and they seem to keep dropping, so I still want to look into better ways to hold my money.

For now though, seeing as my boyfriend and me have decided to live together, there'll first be a house that needs to be sold, which won't yield as much as it needs, so there's not a lot of money to invest in anything just yet. I think it'll be a couple of years, before I need to know all the ins and outs.

No problem, just acquire the knowledge as you build back into a position of financial strength.

It goes deeper than that, like a cancer the need to have shinny toys on credit plagues humanity. Looks like we really hate ourselves. Great post!

Thank you @linzo! Many of us earn enough during our lives that if we invested the money instead of buying the fancy new things, we could become wealthy. But we don't.

I fully agree with you. I had to buy a bigger car at some point (kids), and had no choice to take a loan. My previous car, that was roughly ok in term of size (even with kids) was a cheap used car fell suddenly apart. The price to repair it was more than half the price I originally bought the car 9 years earlier (so that I didn't fix it).

So trust me, I would have avoided to get a loan, but sometimes, you can't. I was lucky enough to negotiate a very nice interest rate of 2% so that at the end, it didn't cost me too much... :)

I'm thinking that I will have to buy a larger vehicle because I will soon have a second kid. I will keep it under my target price though.

If you have the time to browse the market, then you can probably get a very good deal! Good luck with this! ;)

Yea, not being in a rush is important. Most times you have to wait for the prey to come to you... :)