Five Key Long-Term Economic Investment Trends To Watch In 2017 And Beyond

As I dust off my crystal ball to stare into its visions of the future I think back to the past. Things that seem so obvious now, like the crash of 2008, were not seen by the majority of people. Hindsight is truly 20/20, while the future is blind. That doesn't stop anyone from wondering though. So let's wonder.

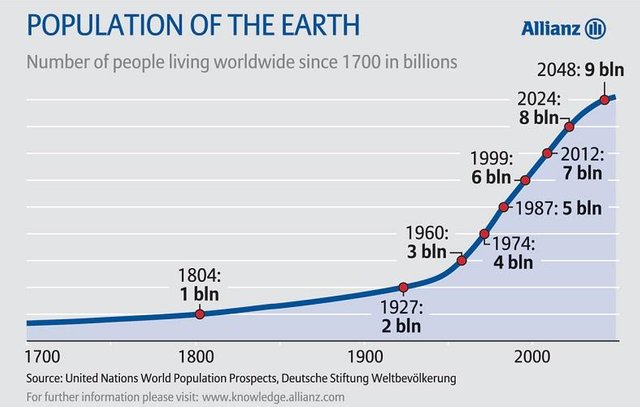

Increasing Population

Food & Water

People have to eat and they need to drink, so there will always be a daily demand for these most basic of necessities.-Farmland: There are only so many areas that can support large scale farming, meaning supply of this land is relatively fixed. Technology can advance, but the land will still be needed to grow on. It provides the most basic need of life, meaning that it will always have customers – and what did I just say about customers, there are going to be more of them every year. There are companies buying up farmland to lease back to others that farm the land, like Farmland Partners Inc (FPI).

-Lack of drinkable water: We have recently seen the drought in California, the tainted water in Flint, Michigan and the dirty water created by fracking. Not to mention all those lesser developing nations with their massive increasing population, which will require infrastructure to supply. This has led some people to say that clean water is the new oil, at least in drier places. Reports say that many underground water aquifers are being pumped out faster than they are being resupplied. Supply is becoming strained, both by a demand from emerging countries and old, inefficient systems in the developed world. Add in altered weather patterns, and some areas could see demand for water increase to a point that prices for it must rise as well. Those companies owning or supplying the water will be able to charge higher prices, and ones that manufacture pipes and machinery will stay busy as old infrastructure is replaced and increasingly further water resources are sought.

Waste

More people means more poop, plain and simple. Not to mention trash and pollution. Companies that make their money cleaning up after everyone else are sure to see an increasing demand for their services, ensuring profits for decades to come.

Ageing Population

People are living longer thanks to medical advances, but the health effects of ageing is something that still can only be treated, not cured. In the United States they say an average of 10,000 people are turning 65 each day. Globally, the number of people age 65 or older is expected to hit 604 million by 2019 – that would be approximately 10.8% of the population. They will require medicine, care, and assisted living.With a growing middle class in nations such as China and India means that they will have the money to spend on healthcare when they need it. The wealthier a country becomes, the higher the spending on healthcare as a percentage of GDP becomes.

Even if you live in a country where the government provides healthcare at no direct cost to its citizens, there is still money flowing to companies in the medical industry. With the election of Trump, this sector took a dive and some real bargains can still be found relative to their long term prospects. In my opinion, one easy ticket onto this train is to just grab a low expense ETF like Vanguard Health Care (VHT).

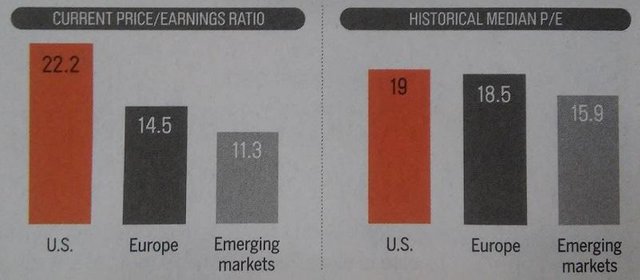

Foreign Stocks

-Valuations: U.S. and European stocks have historically traded at an average P/E’s of 19 and 18.5, but that has since become 22.2 and 14.5 respectively. Since the U.S. has had a bull market for the last 8 years and European markets have been hit by things such as the Euro crisis and Brexit as well as general lousy returns overall, it has left a 15% discount to the mean. Research Affiliates believes that foreign stocks will increase by an average of 6% per year over the next decade while U.S. stocks will see 1.1%, both numbers are inflation adjusted.

-Return to the mean: Foreign stocks have increased at an average rate of 7.2% over the past 40 years, since they have been down 1.6% on average over the last decade, they could be due for some catching up.

-Dollar strength: The dollar has gained strength over many other currencies like the Euro or British Pound. This means that goods produced in those countries have become cheaper when exported, which could lead to better sales for those products and growth in companies.

-Emerging markets: P/E ratios of emerging markets are currently at 11.3 when they have been 15.9 on average historically. Often it is companies from foreign developed countries that are investing and serving customers in emerging markets. With a growing middle class many people are seeing disposable income for the first time ever. With ratios so low compared to average, you could be buying into a long term low right now. Southeast Asia is the area with the best growth prospects.

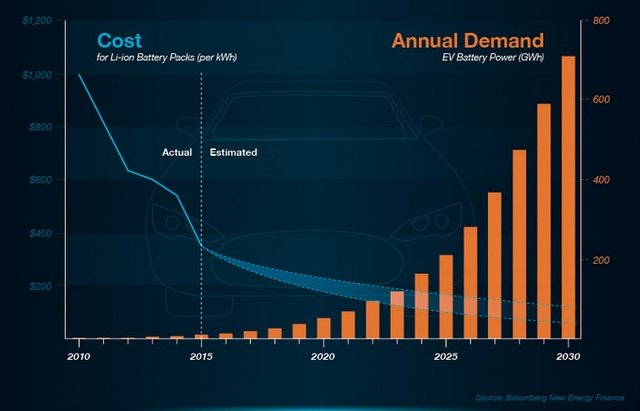

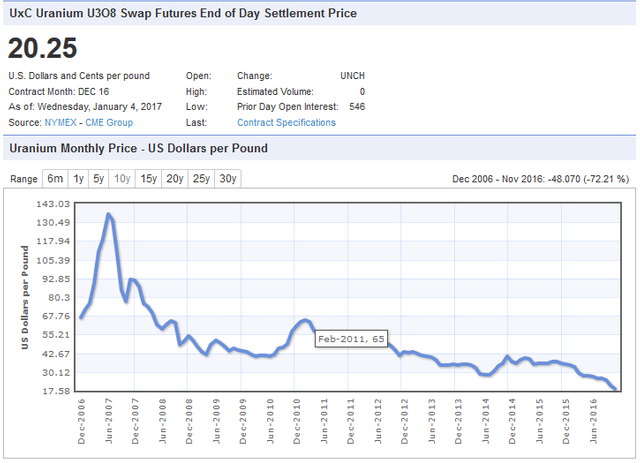

Energy

-Lithium: The storage of energy has become a trending topic of late. Electric and hybrid vehicles store their energy in lithium-ion batteries, and demand for these vehicles is expected to grow 700% by 2020, and with it the need for lithium. Then think of all the mobile technology devices that run off lithium-ion batteries. Raw lithium prices increased by 20% in 2016, from $4900 to $5900 per tonne, and some estimates think that it will reach $7000 in 2017 and between $10-12k in the early 2020’s before possibly stabilizing as more miners reach production levels (it takes at least 4 years for a mine to start producing) and battery advances hold more with less. Plenty of room to ride on this train.

-Uranium: Prices for uranium have tracked lower ever since the Fukushima disaster of February 2011 (from $65 to $20) and are now at levels not seen since 2004. Over 60 nuclear reactors are being constructed in 15 countries, mostly in Asia, uranium will be required to fuel these plants. With 440 nuclear power plants worldwide, these 60 facilities represent an increase of 13.6%. If you bought an uranium ETF when prices are at such a low, you might see some great profits as the price rises back to pre-Fukushima levels, if not at least a doubling back to the decade average of $40.

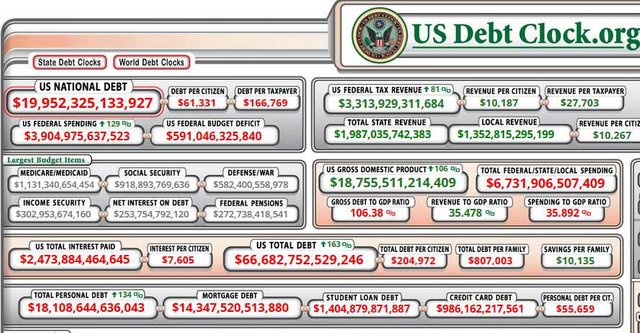

Debt & Inflation

-Precious metals: Physical coins or bars to have some in hand. You can always go down to your local coin store and anonymously pay cash for some bullion. Stock in mining companies is a great thing to have when the price of the thing they are mining goes up. Their costs are relatively fixed, and any increase in the metal price becomes pure profit. This means that mining companies tend to rise more than the percentage increase of the base metal price.

-Cryptocurrency: No need to explain this to the crowd on Steemit. Owning cryptocurrencies is a future trend that still is in its infancy. Yes, just because you live/eat/breathe cryptos it doesn’t mean everyone else does, most people in the world don't know anything about it.

Marijuana legalization

-Big Tobacco: There are many new and small companies fighting in this burgeoning field, but I think big tobacco will step in and buy whatever operations they want once legalization hits nationwide acceptance. The junior marijuana company field is quite hard to research, and picking a winner seems like it would just be luck at this point.

A long term play on MJ would be to just purchase the big tobacco companies and wait. This allows you to grab a decent dividend yield and less worry than if you held the small caps. Of course, the profits will be reduced - less risk, less reward.

Wildcard: Technology

Anything is possible with a technological breakthrough. What that might be, I know not. Trying to guess which idea will be the next big one is nigh on impossible, if I knew how to do that I would be rich. Just know that the next big tech is coming, but who makes it or what it is is anyone's guess.

General Advice Disclaimer. Information provided in this article is for entertainment and discussion purposes only and is general in nature, it does not constitute financial advice.

Pictures: 1 2 3 4 5

We should be bound for another recession soon, this bull run has been artificially inflated for so long now.

I've thought that for quite awhile now, still there are always pockets that do well even in a down market.

Cryptocurrencies and precious metals will be clear winners, if another recession hits soon, probably coupled with high inflation this time.

Very true, my portfolio is mainly set up for this.

Enjoyed your article. Solid forward thinking on Energy. You mentioned a Uranium ETF any considerations in the Lithium Space?

Hey thanks. I own the big guy Albermarle and small guy Lithium X Energy (LIXXF). There is a guy named Matt Bohlsen who writes really good articles about lithium on seekingalpha. Here is a link to one of his more recent posts about making your own lithium ETF as the current lithium ETF is mostly users of lithium - not producers.

http://seekingalpha.com/article/4034589-top-12-lithium-miners-create-lithium-etf

I wrote a section in my investing journal a few weeks ago about Lithium. There is an ETF - LIT - you do need to dig a little into what the holdings are to find the pure plays. I would add to this a new thought - where Lithium goes Cobalt will follow.

https://steemit.com/investing/@carrinm/tib-today-i-bought-and-sold-an-investors-journal-10-aegon-insurance-us-banks-lithium-and-usd

Awesome list of insights into your future economic predictions, my bro! I particularly like the one about cryptos! :)

Something told me that you would, lol :D

Nice summary of a complicated topic.

A couple of thoughts about food production

Aquaponics is the way to grow the most food in a confined setting. So if there is demand for 'locally grown' produce in cities then entrepreneurs will fill that niche - more expensive but local produce. It is an interesting example, and I have read about the people that have used their backyard pool with a chicken coop over it so that the chicken waste fell into the water and the tilapia ate it.

I see it all as just a niche type system for areas that have no arable land. If arable land is available, it is much more cost effective. Most people buy the cheaper version of an item.

aquaponics is definitely worth an article of it's own...I'll add that to the ever-expanding and never shrinking "to do" list LOL

Nice list! Let's watch and follow ^^

I am bullish on miners of lithium and gold the most.

Somehow I didn't realize the overall valuation disparity with the US, Eurozone and developing nations. Time for me to add a little foreign exposure to the IRA portfolio. Thanks!

Hey no problem, I found it out too while researching this one. Just when everyone forgets about a market is when it seems to rise.

I disagree regarding farmland. Indoor/vertical farming will be the future. Eventually, 3d printed food will become the norm.

So there will be large multistory buildings built - with all the upkeep and lighting and electricity bills - instead of using the land that is there and natural free sunlight? Not even touching on the robotics or labor that would be required to take care of the crops in a vertical situation. Again, more cost when self-driving tractors and GPS are here already.

Not seeing it in any large scale for food crops in the foreseeable future.

3d printed buildings will lower costs. Electric bills obsolete using solar energy. Software can maintain crops with very little human intervention. The tech to accomplish this already exists. The "old way" is no longer relevant.

Sure and interesting way of thinking :D

Any other macro-trends to watch for future growth?

This post has been ranked within the top 50 most undervalued posts in the second half of Jan 05. We estimate that this post is undervalued by $9.63 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jan 05 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.