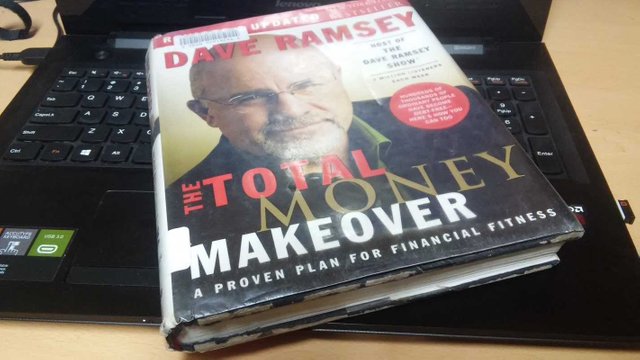

Book Review: Dave Ramsey’s Total Money Makeover

Dave Ramsey is a personal finance guru. Does this book live up to the hype?

If you have ever listened to Dave Ramsey, you know he is a man that despises debt and credit. He was once a 26 year old with a $4 million dollar real estate portfolio, but over a period of three years it all fell apart and his young family was bankrupt. He had built it all upon the altar of debt, and debt had come to collect what it was owed.

After that experience he decided to discover how to money really works, applied what he found and became a multi-millionaire again – this time for good! His book, The Total Money Makeover, is the distillation of what he found to be his path to wealth. It is chock full of good, but simple, advice for those struggling under the chains of debt that have no clue how to escape its heavy weight.

I would split this 13 chapter book into three sections; Psychology of debt, Actionable way out of debt, and Wealth Building

Psychology

These testimonials continue throughout the book to reinforce to the reader that all this is possible.

Dave also writes his thoughts on such things as credit cards and car loans (Hint: he hates them), how payday loans and rent-to-own places are almost criminal, and playing the lottery (don’t). He hits on common sense money issues that seem to trap so many people, giving examples of why such things are bad and what to do instead.

The Chapters

Denial: First, realize that you have a problem that needs to be fixed. Don’t compare yourself to others to see if you are in financial shape, that will lead to financial mediocrity as you think you are doing “well enough.”

Debt Myths: Here Dave explains why you don’t need debt or credit. Bottom line is debt makes the banks rich, not you.

Money Myths: This is where he writes that there are no secrets and no ‘get rich quick’ paths, anyone that is selling you something like this is a con artist.

Ignorance and Keeping Up with the Joneses: Ignorance doesn’t mean you are not intelligent, just that you lack knowledge in a subject. Learn about how money and debt works, it is so very important to learn about personal finance so you won’t stay broke and end up eating dog food when you are old. The Joneses? They are BROKE! Stop doing what everyone else is and climb your own mountain, Dave will be your guide.

The Baby Steps

Step 1: Save a $1000 emergency fund ; Start a budget, first thing. You need to know where every dollar is being spent so you can knock out unnecessary expenditures. Give every dollar a job. Use your freed up money to save $1000 for true emergencies, and ONLY emergencies. You need an umbrella for life’s rainy days.

Pay the minimum except on the one with the smallest balance, then throw every extra cent at the smallest debt. When that is paid off, roll your payments into the next smallest and so on. Every time you knock out a debt the payments on the next one get higher and higher.

Step 3: Complete your emergency fund; After you have knocked out all your debts other than your mortgage, save up between 3-6 months of living expenses. All you do it take your debt snowball money and focus it into a savings account.

Step 4: Invest 15% in retirement funds; Now you have no debt besides your home, and you have between 3-6 months of living expenses put aside FOR EMERGENCIES ONLY. Dave says that a normal timeframe from start to finish is two to three years, now its time to start investing in your future. First, if your job pays you a match in your retirement 401K put in enough to get that match. Next is to save enough to completely fill your Roth IRA, and any of this 15% leftover goes back into your 401K.

College is getting more expensive by the year, and Dave recommends using an Educational Savings Account (ESA) first before utilizing a state 529 plan. Always have them obtain any scholarships they can to avoid debt in the first place.

Step 6: Pay off the home mortgage; If you are at this point you are in the top 5-10% of Americans, congratulations! Dave always says to pay for everything in cash, but he understands that it is nigh on impossible for most people. This is the only time you will hear Dave say you can get a loan, but it must be a 15 year mortgage and payments must be less than 25% of your monthly take-home pay.

Wealth Building

This is baby step 7, but it isn't a baby anymore.Imagine you have no debt payments at all. No credit card bills, no car payments, no rent or mortgage – just your basic stuff. How fast could you become wealthy if you focused all that money into growing for you?

Dave writes that at this point money has three purposes: FUN, INVEST, and GIVE

One famous quote from Dave is “You’ve lived like no one else, now live like no one else.”

To have money doesn’t make you a bad person. Good people need to have money otherwise only bad people will. He goes on to write about several situations where self-made wealthy people have given away huge sums of money to those in need, often in creative ways.

Continue to invest, but now have fun too. Be generous with your fun, pay to take your whole family on a cruise or other vacation. Buy that new car you have been eyeing up in cash. You are a winner.

My Opinion

Dave is pretty frank with the reader in his introduction, he calls its What This Book Is NOT. It is NOT complicated. It is NOT revolutionary. But it is NOT wrong.

He writes to his audience, someone who is mainly ignorant about money and is struggling under a huge debt load. His simplistic writing style allows none to get lost with his reasoning, unlike a more complicated book might. I think of The Total Money Makeover as Money 101. A basic primer that shows you what you need to know without bogging you down in exact details, just what a large majority of the populace needs. It's not worth much if you have already been studying the subject for a few years though.

I agree with Dave about 75% of the time. The areas that I don’t are when he writes about not having credit cards, that debt is all bad, and his thoughts on college.

Just as he writes that money is not bad in itself, I believe that debt isn’t either – you just have to keep it small and under control. I will agree that going into debt to buy something that depreciates is a horrible idea, but a smart purchase using debt can be a great way to leverage into an asset. Debt is like fire, it can cook your meals and warm you up if you are in control of it or give you 1st degree burns and turn your house into charcoal if it gets away from you.

Third, I think deep down Dave understands that college is a bad deal for many people but he can’t seem to just say it. The version of the book I read is from 2007, so it is a bit dated and the price of a college degree has increased even further past where inflation should have it cost. He says his success comes from 15% of the knowledge he learned in college, I think with the availability of knowledge today a person can learn that 15% much quicker and for free. Still, that piece of paper is the first filter of hiring for most companies and without it you will have a hard time getting your résumé read.

Bottom Line

If you already graduated from Money 101, you won’t find too much of value in this book and should find something else to spend your time on. That being said the information is simple, sound advice and I listen to the two or three clips that he releases on his Youtube channel every day.

Pictures: My own or 1 2 3 4 5 6 7 8

Debt is a bad thing if you aren't able to leverage it and acquire income through it :)

True, but most people Ramsey is trying to help are those who have consumer debt like credit cards and car loans as their major debts.

As for student loans a lot of those that call in have ridiculous sums for dumb degrees. That hurts too.

Hey my bro!

Mr. Ramsey really knows what he's talking about. Being in debt is as much a psychological game as it is a financial one.

I will definately be looking into this book in more detail. Great job (as in your norm) and thanks for the heads up... 😀

Happy new year bud! 😄

Lol, was gonna wish you later today but seeing as you started it off already... :)

Happy new year and all my best wishes for 2017, brother!!!! Let's keeping climbing that ladder!!!

I love Dave Ramsey!! There are tons of financial "gurus" out there, but this guy is the real deal. I listen to his radio show all the time, and he is always giving great advise. I read his book as well, and it is one of my favorite books :) I have given copies to several people as well.

I've followed his stuff on Youtube for awhile, but this is the first of his books that I sat down and read. I can see it helpful for a good many people in the world, but I personally didn't find too much of value. This is because I am on his baby step 6. I just wasn't his audience in this book, but I will be on the lookout to see if I can find one of his newer books.

Debt is crippling... Thanks for re-sounding the clarion call! 😄😇😄

Wishing you and yours the best in 2017 @creatr 😄

Thank you, Friend! Right back at ya'! :)

Sorry for the two replies. I dug up this old post and thought you would find it fun: Dave Ramsey - Why He Should Join Steemit, and Why Every American Should Know Who He Is

(the post is no loner eligible for rewards)

Ha! I did search steemit to see if anyone had done a review of this book recently and did see your post there. :D