2017 Net Worth Increase [+72,103!]

My Net Worth Report for 2017

First, the bad news. I was unable to increase my net worth higher than I was able to during the 3rd quarter. But it was darn close! In Q3 I increased my net worth by $19,096. This quarter was slightly less, check it out.

You know what the most important thing to be doing if you want to increase your net worth? Track the damn thing!

I focus on increasing my net worth as I have the goal to become financially free.

Somone can have a large income but if they aren't saving and investing then it really doesn't matter. Oh they can have the nice clothes and the fancy car, but their life can change in an instant if they lose their income.

Your net worth is the sum of all your assets. Poor people buy things that decrease in value, while those with a wealthy mindset buy investments that usually increase in value.

It is important to note that your net worth is how rich you are, not how wealthy. Wealth is different. It is freedom.

You can be rich, but if you have to go out and work each day then you are not wealthy.

Robert Kiyosaki of "Rich Dad Poor Dad" fame said this of wealth.

"Wealth is a number of days forward that you can survive without working. Wealth is measured in time, not dollars."

So if you invest your money into things that pay for all of your daily living expenses then you are wealthy and free. That is my goal.

Now I am just talking about wealth in the monetary sense, but do know that there are plenty of different areas to be wealthy in - like happiness.

You can be wealthy financially, but it doesn't automatically make you happy.

Let's first go over my 4th quarter results.

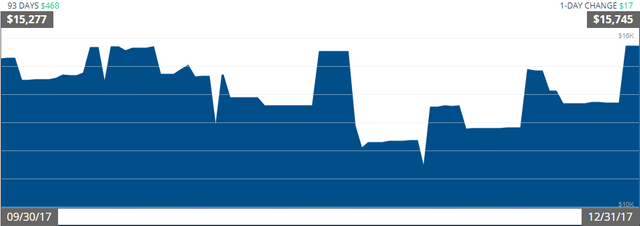

CASH

Starting $15,277 Ending $15,745 [+468]

I like to have around $10,000 in liquid cash, split between my checking and emergency funds. Towards the end of the year, however, I like to bump that up so I can drop $5,500 into my yearly IRA.

Which I have done.

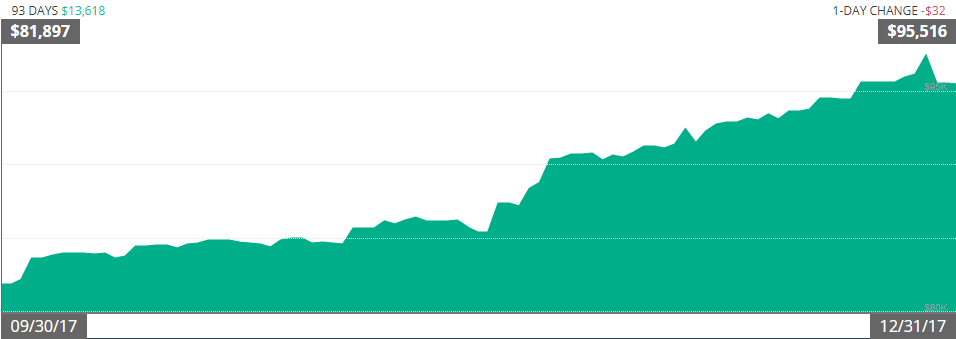

INVESTMENTS

Starting $81,897 Ending $95,516 [+13,619]

Through my work retirement plan, I invest approximately $1,100 per month into index funds. The rest is additions to my brokerage accounts.

I have two, my main one is Robinhood but I often find companies that Robinhood do not trade. To invest in those companies I have another brokerage, but it costs a commission. Not Robinhood though! That’s why I prefer to do all my trades with them.

If Robinhood interests you, sign up using this link to get a free share of stock (I will too). Sign up is free and you don't even need to deposit anything to get your free share!

It is possible to get a share of Apple or Facebook is possible, worth over $150.

One of my blockchain investments (BTLLF) took off this quarter and I sold it for a 200% gain.

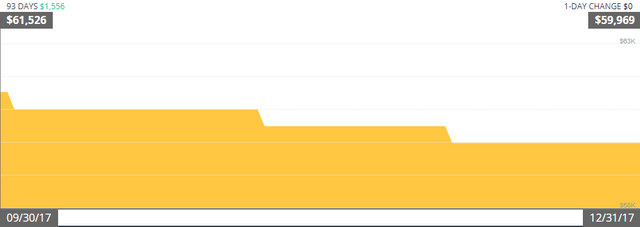

MORTGAGE

Starting $61,526 Ending $59,969 [+1,557]

My only debt!

I have been paying a bit extra, but I think I will stop that for the rest of 2018 as I see some potential investments I could put that money towards.

I love having a small mortgage. The monthly payment is so low I could hustle up enough to pay it every month even without a job! That is some peace of mind. Still, I would like to have it paid off and have to only pay the government and insurance.

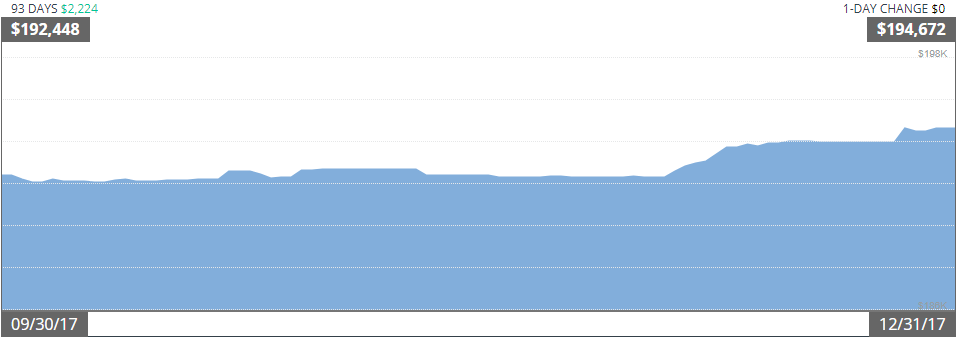

ASSETS

Starting $192,448 Ending $194,672 [+2,224]

Three cars and a house fall under this asset category. Nothing else.

I haven't marked down the car values this quarter, so the increase is the house value according to Zillow.

I have other assets not listed here but I choose to not use them to calculate my total net worth.

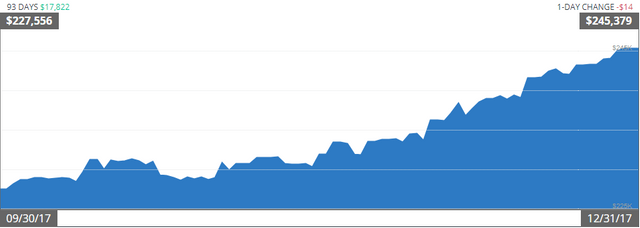

All together this comes out to a net worth of $245,379!

A TOTAL QUARTERLY INCREASE OF $17,822!

The flat level at the beginning of the quarter is due to our family vacation to England. I also took a solo detour to Lisbon, Portugal to attend Steemfest2 - which was absolutely amazing! It did cost a bit of moolah but it was money well spent.

Bring on Steemfest3!

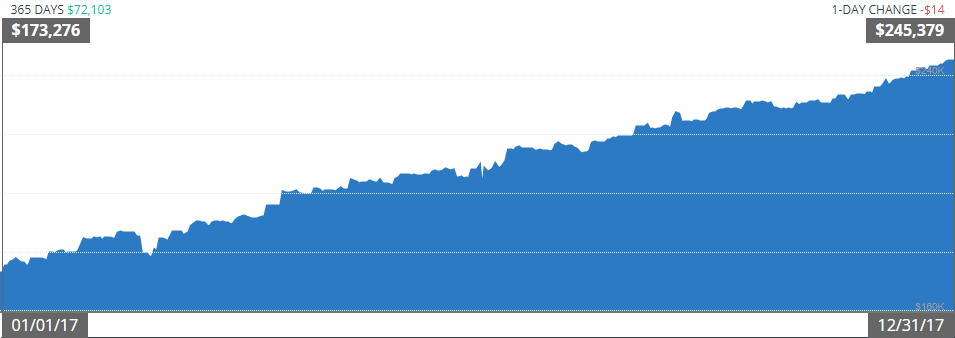

THE BIG PICTURE

2017 is over and I can calculate what I was able to achieve during the past 12 months.

I was able to increase my net worth by an outstanding

$72,103!

An overall 2017 net worth increase of 41.6%!

To put this increase into perspective, I am the only earner in a family of 4. My total gross (before taxes) income for 2017 was $66,600.

So to increase my net worth by this much with comparatively little invested (under $100K) is a testament to how a total money mindset change can work so quickly.

It wasn't like we were hermits either (no matter what my wife says), we went on week-long vacation to Boston, MA as well as a few weeks in England and we spent a week in a rented cabin in Arizona.

One important thing is about NOT spending on frivolous things that don't really matter to you and only spending on things that matter. Even the small things add up.

I truly believe that anyone can experience similar results compared to their income level, but most won't. I believe this because I am not special, I am just a normal person with the desire to become financially free.

If you really want it, you can get it.

How is your journey to financial independence going? Let me know in a comment below.

Click HERE to read my report from 2016.

Oh my God. I just feel blessed to always reading your posts. each day is a new lesson for me.I do have little work but sincerely speaking I've not yet reached the level of investing and monitoring my personal growth. At least with steemit i have started saving some little money.

I believe that i will be financially stable one day and for sure i want to start monitoring my progress, not to just work to survive but to progress. I will be glad to have more investment lessons from you.

However, if i work 13 hours a day while steeming, i can now reach approximately 6 USD a day, so i keep 2 USD for food and accommodation and keep the 4 for university loans and may be some few Ugandan shillings as savings but rarely. So, as i grow on Steemit i believe i can reach 10 USD per day cause with steemit we have first to send through bitcoin and then to Airtel mobile money through bitpesa.

That's me for now

It is hard when you are living simply and still don't have much. But Steemit can be the way for you, Jona!

As you do better and better here, you will be able to save so much if you continue to live as you do now. The reason people never have money is because they inflate their lifestyle to their income. They earn more, but spend it all on "stuff."

People that become wealthy by themselves have the future money mindset and think of what that money can grow into in the future instead of what they can buy right now.

Yeah...i want to start posting at at least once or twice a week and try to comment at least from 10 to 15 posts per day. I want to make steemit part of my life and see if i can progress. I will be writing more about Uganda and steemit impact in Africa may be people will like my comment as i grow on steemit

Hell yeah my friend! What I love about these posts is not only seeing your progress but that it reminds me to update my tracking sheet!

I smell a post in the works - even if you don't want to list exact numbers you can go off percentage increase/decrease

Hey this is great stuff, a man after my own heart, you've made great progress, I'd be very happy with that!

I track mine slightly differently - I discount my property wealth (one of) because I have to live there, and my work pension, given that it doesn't kick in until I'm 60 - so my 'freedom fund' is whatever I need to get me through from now (45 yrs) to 60.

I'm more or less there.

I'd recommend putting in your age ( if that's not too sensitive) or maybe a target in no. of years until yr financially free.

I like that definition of wealth as time.

How did you find the UK btw?

Oh the UK is great. I actually lived in Cambridge for 4 years from 2006 to 2010.

I'm 36 and I will be financially free next February as I have a ~$2,000 per month pension that goes into effect in March of 2019.

I can then focus on what I really want to do and not be burdened by a normal job.

hello sir i need SP on lease 10000K i pay in advance check you wallet thanks

Good job! I take it that's just from a diversified portfolio?

The pension? No. A pension is granted for my career after working 20 years. Started when I was 17, so just one year left.

I must say I'm surprised the rules are so very different in the States, you can't claim a pension until you're 55 here!

Wow, that's a good solid amount, about 3-4 years annual salary here!

Hey, that just means that you can achieve financial independence with much less. :D

Around 15k, which doesn’t seem like much, but it was around -16.5k at the start of 2017.

I think this sub is certainly motivating in the financial aspects of life, although it can sometimes be detrimental to some other aspects (at least for me) if I focus too much on the money. @getonthetrain

Hey, many people spend their entire lives with a negative net worth. To flip it around and start to become wealthy is a huge deal, so congrats!

Just read your 2016 Networth report.... I really need to get on the saving train.

Remember, money isn't wealth until it is out there working for YOU!

If you spend it on things that don't pay you back, there better be a darn good reason. You have a hustle mindset, so I know you will do well financially. But it is important to turn most of that into real wealth. Delaying gratification is a key indicator of the wealthy person.

Wow, this is really inspiring. Being able to increase your total net worth by that amount while paying off mortgage and other expenses and not working a job is what it’s all about. I’m only twenty, but I definitely see myself going down the same path, making smart investments and becoming financially free. Thanks for sharing, and here’s to a great 2018.

Fei

Ps. Great book recommendation by Robert Kiyosaki.

Oh, I have a job right now. Next year I will not.

Good to see you starting so young. You can accumulate a ton of wealth before most of your age group has even begun to think of it.

This is great. I do see the importance of tracking your progress. This was meticulously done. Rich Dad Poor Dad changes my life. People need to read it. I love Robinhood too.

That was the book that got me started too!

Congratulations. This is truly amazing. Tracking is definitely one of the most important things you an do to become successful - it's helped me become extremely disciplined. Keep going!

You gotta know where you are before you can get to where you want to be!

That's exactly right. On top of that, you have to keep yourself accountable for every action and reaction, for better or for worse. Mastering emotions is key to success.

Very nice @getonthetrain. And thank you for being open with this. You are on your way to financial freedom and you present some points that are very helpful to any of us who want to keep more money than we spend. Bravo :)

I've never thought of finances as something you can't talk about. By sharing you encourage others to stop wasteful spending and start building a fortress of wealth.