The psychology of money is changing - and cryptocurrency is on the cutting edge

Money. To some, it’s power. To others, it’s time. It makes the world go round. It’s the root of all evil. And, perhaps more than anything else, it talks.

Indeed, the story money has to tell is a strange one. It’s come to represent many things and take numerous forms over its centuries of use by civilizations the world over, and even today, we’re still discovering new ways to use and think about money. In fact, the way we think about money has a pronounced effect on the way we use it, and vice-versa.

Of course, money’s not just the bills in your wallet, the coins in your pocket, and the numbers in your bank account. It’s all these things and many more besides, but at its core, money is just an abstract concept - one that’s been so powerful and ubiquitous throughout history that it’s almost impossible to imagine a world without it.

It’s easy to spend and earn money without engaging with the concept at the heart of it all. But if we take the time to do so, it’s possible we might uncover a few secrets about how money works on a psychological level that can help us to understand our relationship with money a little better, and to notice how that relationship is changing in the modern world.

The medium of exchange

It may seem strange to think so, but money is essentially nothing. It has no set physical form, no distinct value, no universal name. The various items we use as money today, such as coins and bills, hold almost no physical value in and of themselves. Instead, they’re what are known as mediums of exchange - that is, they ostensibly represent wealth that is held in a physical form elsewhere, and allow us to trade for goods and services using an intermediary store of value instead of having to barter.

Before standardized forms of currency were introduced, bartering was the only means of exchanging goods and services. One can imagine early man offering simple trades, such as a stone tool for a piece of meat, or a quantity of grain for assistance in building a shelter. Of course, bartering in this way is a time-consuming and uncertain process, but it represents the pure and simple exchange of equally valuable items without the use of a medium such as money. This makes it the easiest form of exchange to understand on a psychological level.

Interestingly, the first kind of money that we know of takes only a small step of abstraction away from bartering. As far back as 1100 B.C., the ancient Chinese began to use miniature bronze replicas of various goods, such as tools or weapons, to represent the actual items or their equivalent value. This provided the convenience of a type of money that was easy to carry and quantify without removing it too far from its true source of value.

Eventually, this system became even more abstract, as miniature tools became coins representing various denominations of value. The first official currency was minted in 600 B.C. by King Alyattes of Lydia (later part of the Persian empire), and took the form of coins made from electrum (a naturally-occurring alloy of gold and silver) that were stamped with images of various animals to indicate different denominations. This form of currency made the process of exchange even simpler, while at the same time adding a further level of abstraction from sources of physical value.

Agreement = value

At this point, it’s interesting to note the adoption of so-called ‘precious metals’ as forms of currency - a trend that's still strong in modern times. Metals such as gold and silver had little intrinsic value to ancient people, particularly since they had few practical uses other than as decoration. Even today, the idea of buying gold for some practical use is almost unheard of. However, for reasons unknown (perhaps even solely due to their aesthetic appeal), ancient societies began to agree that these metals were highly valuable, thus bestowing monetary value on them.

It’s the same kind of agreement that led to the widespread use of cowrie shells (which also held little physical value) as currency along the coastlines of the Indian Ocean as far back as 1200 B.C. This goes to show that it’s not so much the innate value of money that makes it useful as a medium of exchange, but the fact that many people simply agree that it has value. This is an important point that crops up throughout the history of money.

The beginnings of centralization

The growing popularity of paper money, which was introduced to Europe in the 15th century (although the Chinese had already been using it for centuries), made domestic and international trade much easier, and allowed for more money to be circulated without the need for the laborious process of mining precious metals and minting them into coins. Of course, the fact that so many people considered this money to be valuable, despite the fact that the the paper it was printed on was quite obviously worth next to nothing, goes to show just how well ingrained the concept of money as an agreed-upon medium of exchange had become in societies the world over.

The relative ease of manufacturing paper money also intensified the need for there to be central regulatory bodies to act as the sole producer of a nation’s official currency, both to control the rate of output and to keep counterfeiters in check. So it was that the first ‘central banks’ were created, and with them, a centralized financial system that has endured into the present day - a system that came with many advantages, but has also led to many drawbacks.

Perhaps the most striking psychological effect that the banking system had on our understanding of money is its translation from physical currency to the even more abstract level of simple numbers. This has never been more extreme than it is in modern society, where for most people, the vast majority of their wealth is to be found not in physical possessions or hard currency, but in numbers on a screen. And for most people, these numbers are enough - they don't question the means by which the numbers represent actual value.

A house built on nothing

This is where things start to get interesting. Until 1968, all US Dollars were backed by gold or silver - that is, you could redeem dollar bills for an equivalent quantity of one or the other of these precious metals, known as “lawful money”. It even said so on the bills themselves: “This note is legal tender for all debts, public and private, and is redeemable in lawful money at the United States Treasury or at any Federal Reserve Bank.”

Today’s dollar bill, however, simply says: “This note is legal tender for all debts, public and private.” The major effect of this change is that a dollar bill is no longer redeemable for any item of physical value whatsoever. The currency has become fully abstracted, removed completely from its original source of value and reduced to nothing but a number. The US Treasury explains this disconnect by saying that the dollar is now backed by the nation’s GDP - another abstract concept. To break this down into an equation:

GDP = C + I + NX + G

where:

“C” (Consumption) = all consumer spending in the nation’s economy

“I” (Investment) = the sum of all capital investment by businesses

“NX” (Net Exports) = total exports minus total imports

“G” (Government Spending) = the sum of government expenditures on goods and services

If we do the math, the implications of this equation for the current economic problems in the US become clear. At the moment, C is very low due to high unemployment and increased cost of living. I is also at an all-time low (due to the low level of C as well as factors such as low interest rates leading to decreased availability of loans). And NX has also been negative for some time.

This leaves us with G - which (no surprise) is increasing annually (particularly in the area of military expenditure), but only adding to the country’s debt as a result.

The upshot of all this is that the money we’re using today is not only abstract in the extreme - it’s purported value base is all but non-existent. In fact, the only reason that the Treasury can continue to print more money, and the reason the dollar still has value everywhere in the world, is because we agree that it does.

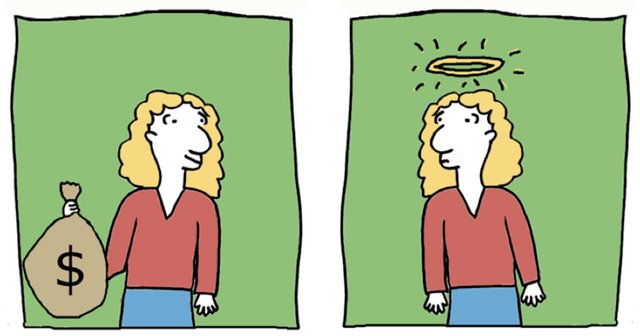

The morality of money

The situation described above goes to show why the world is quickly growing tired of the current economic system. Today, terms like GDP, which are so freely thrown around to justify economic decisions or point out their successes, are often insufficient and outdated, and no longer serve as effective economic reference points. We may have embraced the abstraction of money, but this has opened the door to a potentially dangerous realm of economic obscurity.

In the post-depression and baby boomer generations, people simply wanted to know that enough money was being made - thus quantitative measurements like GDP worked for them. Today's information generation is more willing to question the validity of such measurements, and to demand a qualitative measurement on top of that - they want to know whether that money is coming from good or bad sources, and going towards worthy or unworthy recipients. This adds an interesting new psychological and moral component to our understanding of money, which in turn affects the way we use it.

Decentralization = freedom

Which brings us, finally, to cryptocurrency. The growing desire to be able to follow the flow of money more closely is a major reason for blockchain technology’s popularity with the switched-on generation of today, and it's why cryptocurrencies are the future. Finally, we have a totally transparent, decentralized record of every transaction ever made that's an integral part of the currencies themselves. What’s more, by writing the laws governing this money right into the stuff it’s made of - the code - cryptocurrencies also prevent the corruptible and fallible human element from having central authority over this form of money.

Whereas the dissociation between fiat currency and its original sources of value poses a problem for its long-term stability, the same psychoeconomic mechanics that gave money its value in the first place are doing the same for cryptocurrency. We agree that these totally abstract blocks of digital information have monetary value - and, importantly, we do so free from the illusion that they are inextricably tied to some physical source of value. The more people enter into this agreement, the more valuable and useful we can expect cryptocurrencies to become.

A new crypto-based economy is already here. As soon as it really takes hold of the public consciousness (and Steemit, as a blockchain-based social network, is by far the best means we've ever had of making that happen), governments, banks, corporations, retailers - basically everyone who uses money - will either have to get on board, or get left behind.

Gold simply isn't as shiny as it used to be.

if only more knew how much better crypto was than their fiat garbage ^_^

Agreed we will get there however.

Indeed

Congratulations @generalspecific! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Congratulations @generalspecific! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Semi Finals - Day 1

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @generalspecific! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!