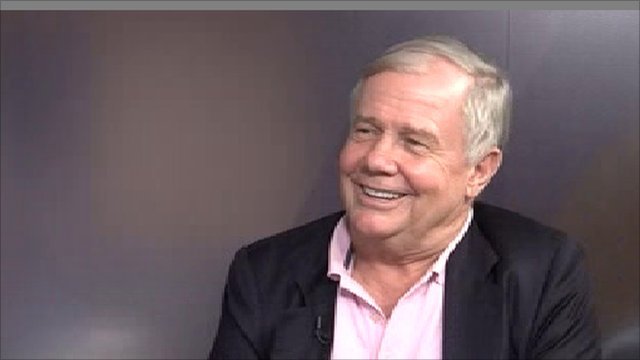

14 ideas from successful investor Jim Rogers.

Jim Rogers, who earned the nickname "Indiana Jones of Wall Street," he had established a fund called Double Eagles Hedge Fund with George Soros, but with guidance. A different way of thinking makes Jim separate Hedge Fund is a fund of its own. Living and traveling the world with his wife .. Jim Rogers has a reputation in the commodities market, which has been hailed by the media as a guru ever.

Jim Rogers is of the opinion that the bull market will come to Asia. In particular, China While American and European markets is not a market that generates good returns to investors. Investors who need to be rich to invest in Asia.

And this is the best 14 ideas from successful investor Jim Rogers has anything different.

1. Most successful investors, in fact, do nothing most of the time.

2. If you want to make a lot of money, resist diversification.

3. It is remarkable how many people mistake a bull market for brains.

4. On Wall Street there's no truer adage than … markets can remain irrational longer than you can remain solvent.

5. No matter what we all know today, it’s not going to be true in 10 or 15 years.

6. If you want to be lucky, do your homework.

7. Swim your own races.

8. If the world economy gets better, commodities are very good place to be in ... even if the world economy does not improve, commodities are still a fabulous place to be.

9. The most sensible skill that I can give to somebody born in 2003 is a perfect command of Mandarin.

10. Become a Chinese farmer, that's what you should do.

11. If you can find ways to invest in Myanmar, you will be very, very rich over the next 20, 30, 40 years.

12. India is not a place for investors, but it's a fabulous country for tourists

13. I haven't met a rich technician

14. I was poor once, I didn't like it, I don't want to be poor again

Jim Rogers.

WOW

Good Advice Here!

Steemon!