6 $imple steps to financial freedom

Step 1: Make the Most Important Financial Decision of Your Life. In essence, you must first decide to become an investor, not just a consumer. This means automating a specific percentage of your income that goes toward your "Freedom Fund" i.e., your ideal retirement nest egg, which you calculate based on your desired financial outcome. If you can't commit the amount you need, there are great strategies, including the "Save More Tomorrow" plan, that will help you ease into the number you need to be saving every month. I will explain the "Save More Tomorrow" plan in my next posts.

Step 2: Become the Insider: Know the Rules Before You Get in the Game. Here, you shake off the nine most common myths about fees, actively vs. passively managing funds, real costs of specific investments, brokers vs. fiduciaries, target date funds, 401(k) and Roth 401(k) plans, and asymmetric risk. By understanding these misconceptions, you can minimize your risk of losing money and over-paying fees, and create tax-advantaged investment strategies. This is the equivalent of "measure twice, cut once" in the business world. If you know the rules of the game, you're less likely to lose when you play.

Step 3: Make the Game Winnable. This is when you calculate exactly the amount of money you will need for your financial freedom. Most people create an artificial number that feels impossible to achieve, so they delay starting their saving and investing. You also look at your spending habits and how you can speed up your plan to achieve financial freedom faster-from limiting your daily impulse purchases (i.e. coffee, alcohol, fast food, etc.) to reducing your taxes, earning more, relocating, and improving your lifestyle.

Step 4: Make the Most Important Investment Decision of Your Life. This is about asset allocation, rebalancing, and dollar/Euro etc. cost averaging. Before you begin investing, you need to determine your own risk tolerance, frequency of rebalancing to maintain this risk tolerance, and a monthly dollar/Euro cost averaging investment strategy. One interesting idea is to not just have two categories (i.e. "Risk/Growth" vs. "Security/Conservative") but to also include a "Dream" bucket that is clearly not about investing, but rather putting money aside for the things in life that motivate you. This can help propel you, as you save and invest more for your future.

Step 5: Create a Lifetime Income Plan. This is about understanding the returns you are currently getting on your investments compared with other portfolios and recommended asset allocations. This includes establishing a guaranteed lifetime income plan through various forms of annuities and tax-efficient life insurance strategies. These are the secrets of the ultrawealthy, as these tools are not widely known by most people and yet allow the ultrawealthy to minimize their tax exposure and protect their assets for their children, grandchildren, and great-grandchildren.

Step 6: Invest Like the .001 Percent. This is where you learn that the worst environment is your greatest opportunity: to buy when everyone else is selling in a panic, and to sell when the markets are going crazy in the positive direction. You don't always have to be a contrarian, but pummeled markets create significant wealth, and fear and other emotions distort true values. Most wealthy investors have figured out how to make asymmetric returns (i.e., risk $1 to make $5), while the average person risks the bulk of their investments to make 4 to 8% returns.

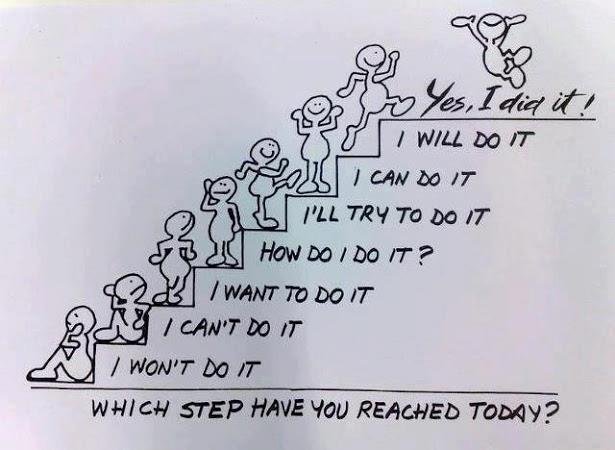

Perhaps the most powerful reminder is that "repetition is the mother of skill. Action is where all of your power is found...knowledge is not power, execution is." In other words, take massive action when you learn great insights.

@financialfreedom, very interesting post. Continue to post more of this for Steemians benefits!

Thanks! I'll do my best