App Review: Robinhood- Trade stocks with no commission

Many of us are very familiar with cryptocurrency trading. Since Steemit is based on a cryptocurrency, there are large communities dedicated to predictions, news, and advice about which currencies to trade on a day-to-day basis. This is largely due to the potential for gigantic gains, i.e. buying an inexpensive currency and seeing it rocket up in value over a very short period. However, I want to focus this post not on trading cryptocurrencies, but trading stocks- something people around the world have been doing for many years.

Not long ago, I posted a blog about the "Get Rich Slow" method of investing, which I recommend you read before reading this review, because it's more important that you understand the fundamentals of investing in a broad index before jumping to invest in individual stocks. But that's what I want to focus on today. Individual stocks.

Warren Buffett, whom I mentioned in my previous post about investing, champions investing in an index fund that tracks the performance of the S&P 500. However, he has also made most of his fortune from picking individual stocks, buying large quantities of them, and watching their value appreciate over time. For most people, index fund investing is the way to go. Often there are few decisions that must be made after an index fund is purchased. Simply buy it and leave your money there to grow for years and years. However, for those of us interested in learning more about individual companies, stocks, bonds, dividends, EPS, P/E, etc., brokerage accounts exist to allow individuals to purchase shares of stock in single companies. In fact, most brokerages allow individual stock trades within retirement accounts such as Roth IRAs. These trades often come with fees, however, which make it difficult to see immediate returns when purchasing just a few shares at a time.

Charles Schwab, the brokerage firm I have my Roth IRA with, currently charges $4.95 for individual stock trades. Let's say you wanted to buy one share of a stock that costs $5 a share. If you did so with Schwab, you'd be paying $9.95, so already you would need that one share of stock to double in value to make back just what you paid to own it in the first place, much less begin to make a decent return from that stock. Now this is an extreme example, but the point is that it's hard for someone with a few thousand dollars or less to expect any kind of positive return when having to pay brokerage trading fees. That's where Robinhood comes in.

Yes, Robinhood. A newcomer to the stock brokerage arena, it was founded in 2013 to bring commission-free trading to everyone. Robinhood's interface is based around its iOS and Android apps, which allow users to deposit funds and trade stocks without trading fees. That's right. $0 to trade for a share of that $5 stock you've been wanting.

Their business model is aimed at people who may not have a thousand dollars to invest right away. Robinhood's platform, with no minimum investment amount, makes owning stock as easy as downloading their app and signing up. Being interested in learning about the stock market myself, I signed up as quickly as possible when their Android app launched, and have been using the app for 2 years now. If you'd like to learn more about the company itself, check out this page.

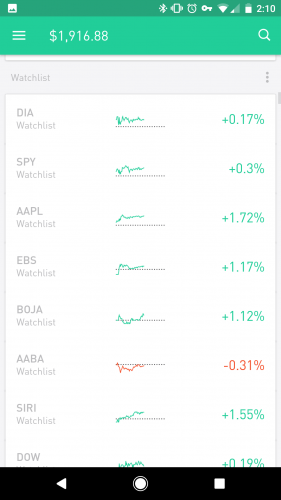

The app interface has become very polished over the past two years. When you launch the app, you're greeted with your portfolio page, which shows your current total balance, as well as a chart of the day's performance. Below the chart, your holdings are listed. You have the option of viewing that day's percentage gain/loss, your current amount invested in each stock, the last price for each stock, the total gain/loss, or total percent gain/loss. Robinhood will also update you with news items based on the stocks you hold or put on your watchlist.

The majority of stocks listed on major U.S. exchanges (NYSE, NASDAQ, etc.) are available to trade on Robinhood. So the only thing that keeps you from trading right away is whether your account is funded or not. Robinhood allows you to link your bank account using a routing and account number and make ACH transfers to your account. When the app first launched, it took 3 to 5 days to fund your account, but now, with the new feature called Robinhood Instant, any cash deposits you make to Robinhood are immediately available for trading while the bank sorts out the transfer information. This can be very convenient if a buying opportunity comes up suddenly.

You may also withdraw funds in a similar manner via ACH transfer, and the 3 to 5 days does apply to these transfers.

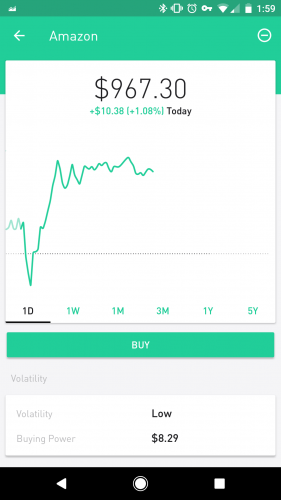

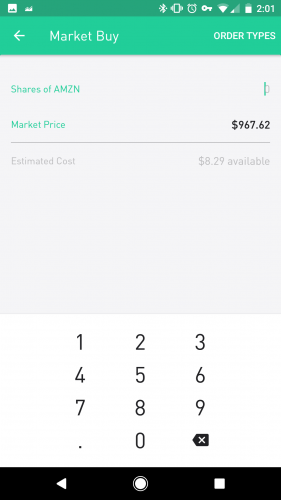

Purchasing shares of stock is as easy as searching for a ticker and pressing the buy button. Robinhood will let you know how much buying power you have below the buy button. When you click buy, it asks how many shares you want. It will check this number against your available funds to make sure the trade is possible, and then if you are making the request during active trading hours, the order will usually be filled as quickly as possible. Most of mine have been instant. I've only had issues executing trades a few times, and the issues were quickly resolved when I tried again. Robinhood offers four types of orders: Limit, Market, Stop Loss, and Stop Limit. You can learn more about the types of orders here.

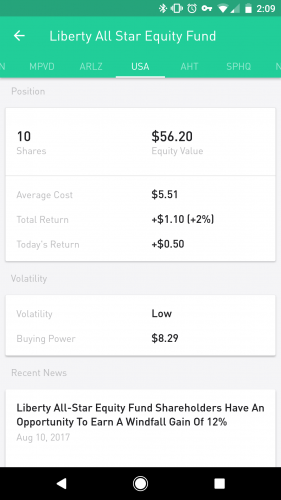

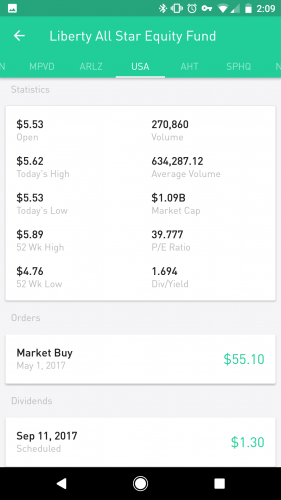

Once you've purchased shares, the ticker will show up on your main portfolio page. Tapping the symbol will bring up that stock's individual page again, but this time, there will be more information if you scroll down, including your holdings, gain/loss, news items about that stock, and the newest feature, a graph that tracks the company's latest earnings statements. Information about market cap, price to earnings ratio, dividend yield, and volume are also here. There is also a company summary at the bottom of the listing (this is present for every stock, regardless of whether you purchase it or not).

You may also add an unlimited amount of stocks to your single Watchlist. These stocks will appear below your holdings in the main portfolio screen. When a stock is on your Watchlist, you'll receive news items about it, and cards will appear in the section below the main graph on the portfolio page that tell you when a company is going to post earnings.

There are many more small features that make Robinhood not only good for checking on your portfolio, but also checking quotes and news about stocks, since the information is updated in real time.

I've enjoyed using Robinhood. It's fun to be able to deposit a few dollars and use them to buy shares of stock and then immediately begin seeing a return without worrying about paying commission. I can't say I've had incredible success overall. I've had a few good picks, but they've been weighed down by my other picks that didn't do so well. All in all, I'm beating inflation, so that's good, but I think it's been worth using simply for the learning experience. I've been able to research stocks, follow them in real time, purchase a few, and follow news around earnings season. It's been a valuable tool that I believe many Steemit users would enjoy checking out.

I've only had to contact their support a few times, the first time involving a reverse share split that occurred when I didn't have a clue what such a thing was. They were helpful and assured me that the change would reflect in my account the next day, which it did.

I highly recommend using Robinhood if you're interested in buying stock with no commission, or even just learning about the stock market. In fact, now is a great time to sign up, as they're giving new accounts a free share of stock just for signing up. I believe this is only if you're referred by someone, so feel free to sign up with my referral link if you want to take advantage of this offer (Full Disclosure: I will also receive a share of stock for referring a new user, so it's a win-win).

If you'd rather just sign up like usual, feel free to do so on their homepage. It's fairly simple to set up, and the app is available for iPhones and Android phones. Right now, Robinhood does not have an online interface. I believe they are in the process of developing one, but for now, you'll have to manage everything on your phone.

As a final note, Robinhood also does offer premium services if you have over $2000 in your account. Dubbed "Robinhood Gold," the program is basically margin lending, where you pay them a monthly fee for extra buying power. You can check out the details here.

I hope you've enjoyed this review of Robinhood. I know I've enjoyed using it for the past two years, and I'm glad they are making stock trading affordable even for those of us who don't have millions of dollars. Remember, with any form of investment there are risks, so be sure to only invest money you can afford to lose. Hopefully you'll be successful. I'd love to hear success stories or tips on what to avoid!

For more information about Robinhood, including Terms & Conditions, FAQs, and more, visit their support page here.

I've been using Robinhood for several months and I consider it an excellent product disrupting the established business model.

Yes. I didn't really touch on that, but if it continues to be successful, it could force the big brokerages to lower costs again. I certainly hope this is the case. Until then, I'll just keep using Robinhood for individual stocks, and my Schwab account for index funds.

I have been using Charles Schwab for my trades under $10,000. It's $4.95 and it's pretty easy to do just purchased some GLD ETF .

I've heard lots of predictions about a bull market in gold. So that could be a good move. I have some GDX, so I'm hoping for some upward movement too.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by ethandsmith from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews/crimsonclad, and netuoso. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.