May 2020 Budget & Investment Portfolio Update. Wow, what a month!

April Review

After such a ‘bad’ month for our investments in April, I wasn’t particularly looking forward to reviewing our investments for May, that was until I checked out the crypto charts for my investments… It appears my investments have gone from -22.53% to 20.69%, wow what a gain!

– The following article contains affiliate links. This doesn’t affect the price you pay but I may earn a commission if you decide to buy anything through my links. This goes towards maintaining the website and helping me continue to spread the Live Full Retire Early message| ad –

So with regards to our budget we have really stripped it back to basics, as I am on furlough and my partner is waiting for his government grant to come through. We decided to slash it by 20%. But we have increased our grocery budget by 15%. The reason why our grocery budget increased is because we aren’t shopping at the usual stores. We usually get most things from Aldi and Iceland but recently we have shopped at Iceland, Asda and a the corner shop, purely for convenience. But like you know, convenience comes at a price.

Investment Update

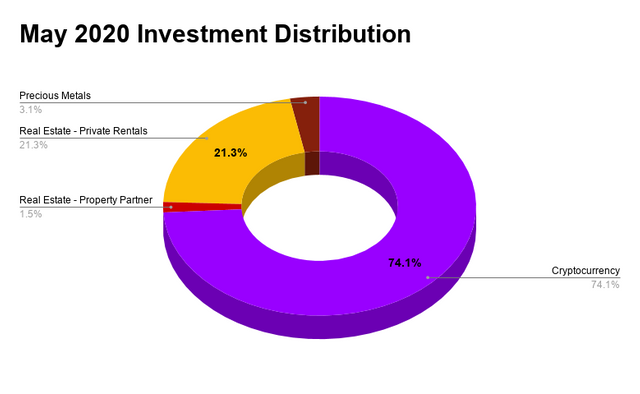

Cryptocurrency

| Money Allocation | Returns last month | Returns in 2020 |

|---|---|---|

| 74.08% | 20.69% | -30.12% |

Real Estate – Property Partner

| Money Allocation | Returns last month | Returns in 2020 |

|---|---|---|

| 1.52% | 0.00% | -1.09% |

Real Estate – Private Rentals

| Money Allocation | Returns last month | Returns in 2020 |

|---|---|---|

| 21.35% | 3.11% | -4.40% |

Precious Metals

| Money Allocation | Returns last month | Returns in 2020 |

|---|---|---|

| 3.06% | 4.04% | 12.29% |

Debt

| Debt | Paid back this month | Paid back in 2020 |

|---|---|---|

| Mortgage | 0.18% | 1.17% |

| Credit Cards | 5.14% | 31.15% |

| House Loan | 0.69% | 2.88% |

| Loans | 2.47% | 11.36% |

Comments on this months investments

Biggest Winner: Cryptocurrency 🏅

Biggest Loser: Property Partner 👎

Well, cryptocurrency … what a turn around from last month. I expected my crypto investments to increase because of the up and coming bitcoin halving. There is always a rally leading up to and after the halving – as proven in previous years, I’m hoping bitcoin hits $50,000 this year

My precious metal investments have once again steadily increased in value. Although you never get huge gains from gold or silver, these are the two most stable investments you can make (in my opinion).

As you can see my Property Partner investments haven’t given me any return this month, reasons of which were stated in April Budget & Investment Review.

We received a nice return on our private property investments this month as well, more than it should’ve been to be honest. Mid April we received our monthly statement from our letting agent, with the monthly rent and any management fees deducted. However, upon reviewing the statement I noticed a discrepancy. The agent, without consent from myself or my partner, decided to increase the rent by 2%. I have told my agent for the past 3 years not to increase the rent, and EVERY YEAR they have failed to follow instructions and put the rent up anyway! I have to micromanage everything they do as they failed to get some works completed in time and then they consistently ignore instructions.

I try and be a good landlord and keep the rent at a reasonable amount as I have really good tenants who pay on time and give me no grief. If I kept increasing the rent, greed would end up costing me money long term; pushing my current tenants too far and they could find somewhere else to live, leaving me with an empty property (with bills to pay) or worse, get really bad tenants. I’ve once again told them to decrease it back the original amount and apologise to the tenants.

Goal(s) For May

As most of the UK is unable to work and I’m on furloughed, I am going to have a ‘beans on toast’ budget. My beans on toast budget is a basic budget that only includes my mortgage, utilities, groceries and any debt repayments. Things like holidays, hair and beauty appointments and dining out are absolutely unnecessary in this economic climate. Our fuel budget has pretty much decreased by 80% because the only places we are driving to is to and from the grocery store and we still have a good amount available in our budget ready for when we can go back to work and it’s all systems go.

Previous Updates

February 2020 Update

March 2020 Update

April 2020 Update

👍 Like this article? Follow us Live Full Retire Early on Instagram, Facebook, and Twitter for regular tips, tools and inspiration. 👍

PIN THIS