TRADING S&P 06/30/2017 Daily insight, S&P futures, ES

This is my daily preparation for S&P futures (ES) trading and it is for your educational purpose only and definitely cannot be considered as financial advice. There is a substantial risk in derivative trading and it might not be suitable for you. Don't rely on past performance as it is not indicative of future results.

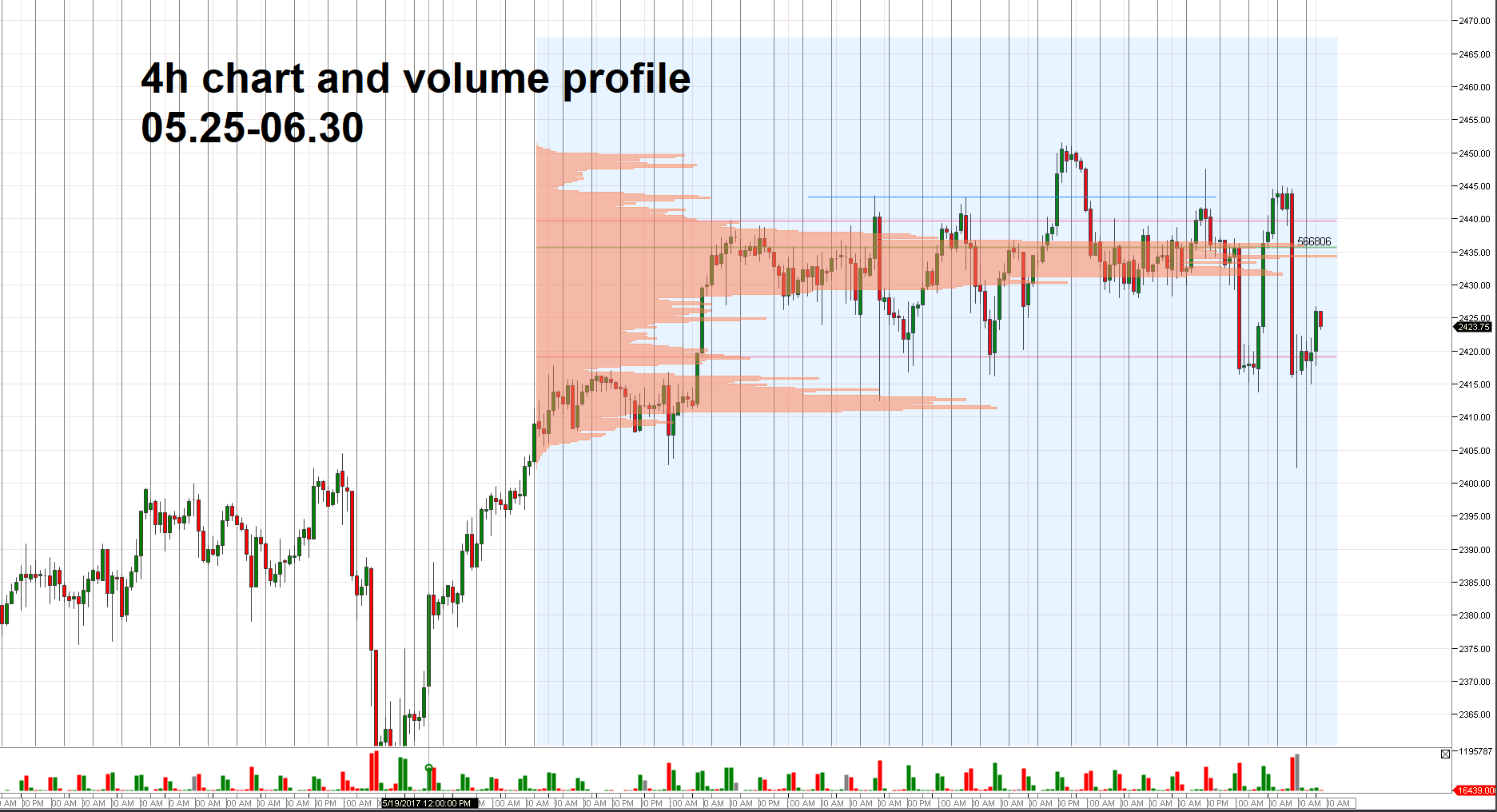

This week we started with the gap from Friday and pushed prices to the level of 2447.5 during the opening hour of the US session. After this market returned to previous week's volume and value area. After facing some more resistance at the highest volume range 2429-2432 (established since the beginning of June), the market finally accomplished its target of 2420-2417 area, which is bottom of the same June's value range. After market's inability to break 2429-2432 zone last week, a break through this level on Tuesday allowed the market to revisit bottom of the June's range (2417 area). Then after observing a significant support in this area on Wednesday the market rallied up to the top of the range. Yesterday (Thursday), ES futures went to the bottom of the same range once again and finally broke it, causing a sell of down to the 2402.25, which was also a low of 31 May. Considering that this is the end of month such move most likely was a result of the liquidation of longer term long positions.

Today, the market sims to open inside of the June's range. However, volumes are expecting to be low, as most market participants are likely to end day early before 4th of July bank holiday. Considering this, I would rather avoid trading and simply observed market to see if new selling (liquidation of long position) will occur or not.

My primary expectation is that most trading will develop below 2429 prices, as market might make an attempt to check high volume area that was formed during June and then will direct towards range developed between 25th-31st May, but due to lack of participants will lack power to go below.

Considering yesterday's active buying from 2402.25 a trading in a range of high volume area (2428-2437) is also possible as a secondary scenario.