TRADING S&P 06/28/2017 Daily insight, S&P futures, ES

This is my daily preparation for S&P futures (ES) trading and it is for your educational purpose only and definitely cannot be considered as financial advice. There is a substantial risk in derivative trading and it might not be suitable for you. Don't rely on past performance as it is not indicative of future results.

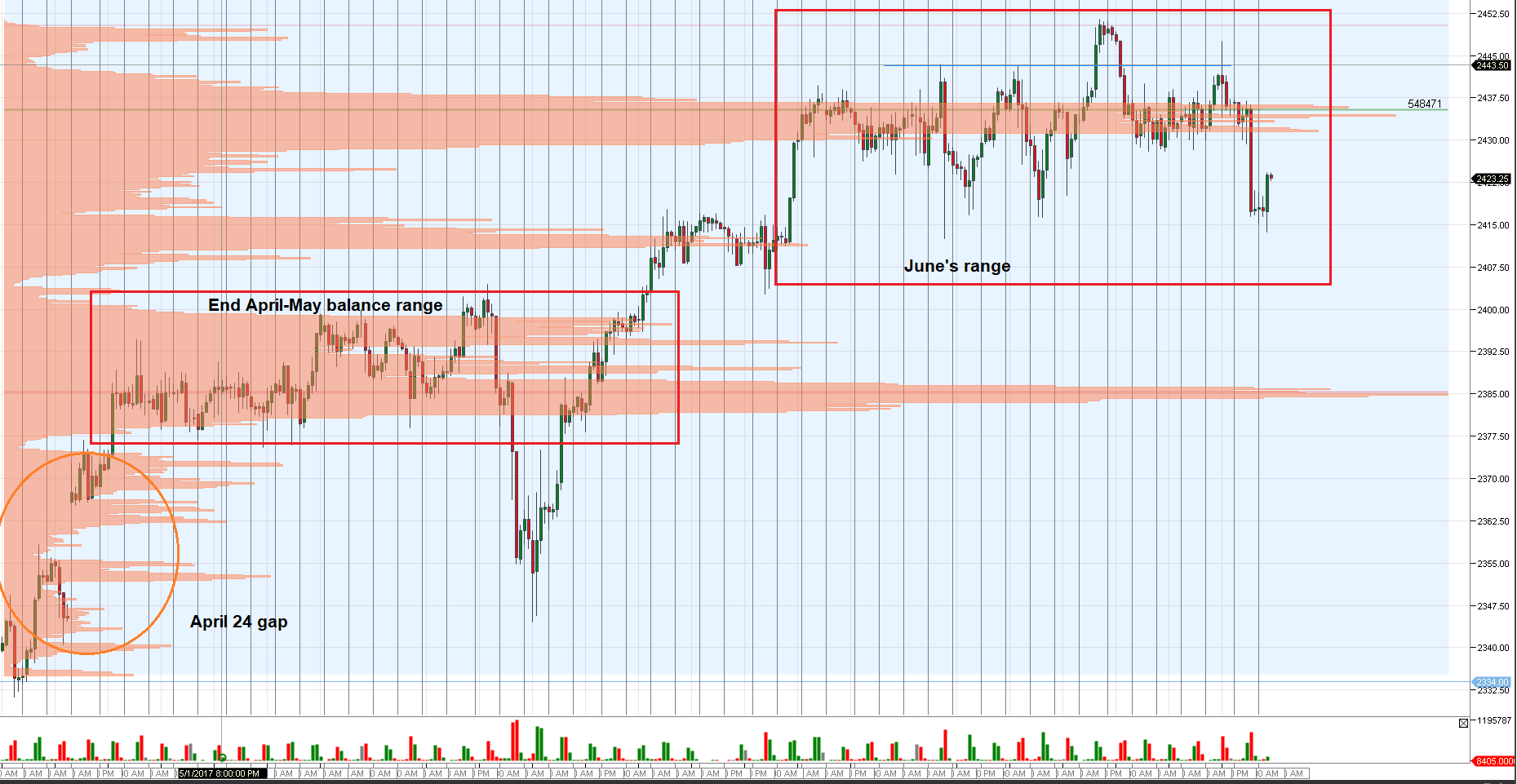

This week we started with the gap from Friday and pushed prices to the level of 2447.5 during the opening hour of the US session. After this market returned to previous week's value area. After facing some more resistance at the highest volume range 2429-2432 (established since the beginning of June), the market finally accomplished its target of 2420-2417 area, which is bottom of the same June's value range. Important to notice, that market lacked sellers around 2429-2432 prices during last Wednesday, Thursday and Friday.

Today I would expect that markets will try to check 2429-2432 area again, but already from the bottom and most trading to appear between 2417 and 2432 levels.

However, there are a lot of important news and more directional moves could appear as a result of these news. Among news to consider are 9:30 ECB Draghi, 10:00 Pending Home Sales and 10:30 Crude Oil Inventories.

In case these news will shake market out of the 2417-2432 range, some better opportunities to join the trend or fade the market are likely to appear in the afternoon.

In such scenario, after 2417 next major support areas are 2400 and 2386-2382. After that target to close April's 24th gap.

The resistance areas above 2432 are 2438, 2448 and all time high 2451.5.

Due to the news, during morning I will try to avoid trading or will try to scalp for few times in case some better setups would evolve.