TRADING S&P 06/27/2017 Daily insight, S&P futures, ES

This is my daily preparation for S&P futures (ES) trading and it is for your educational purpose only and definitely cannot be considered as financial advice. There is a substantial risk in derivative trading and it might not be suitable for you. Don't rely on past performance as it is not indicative of future results.

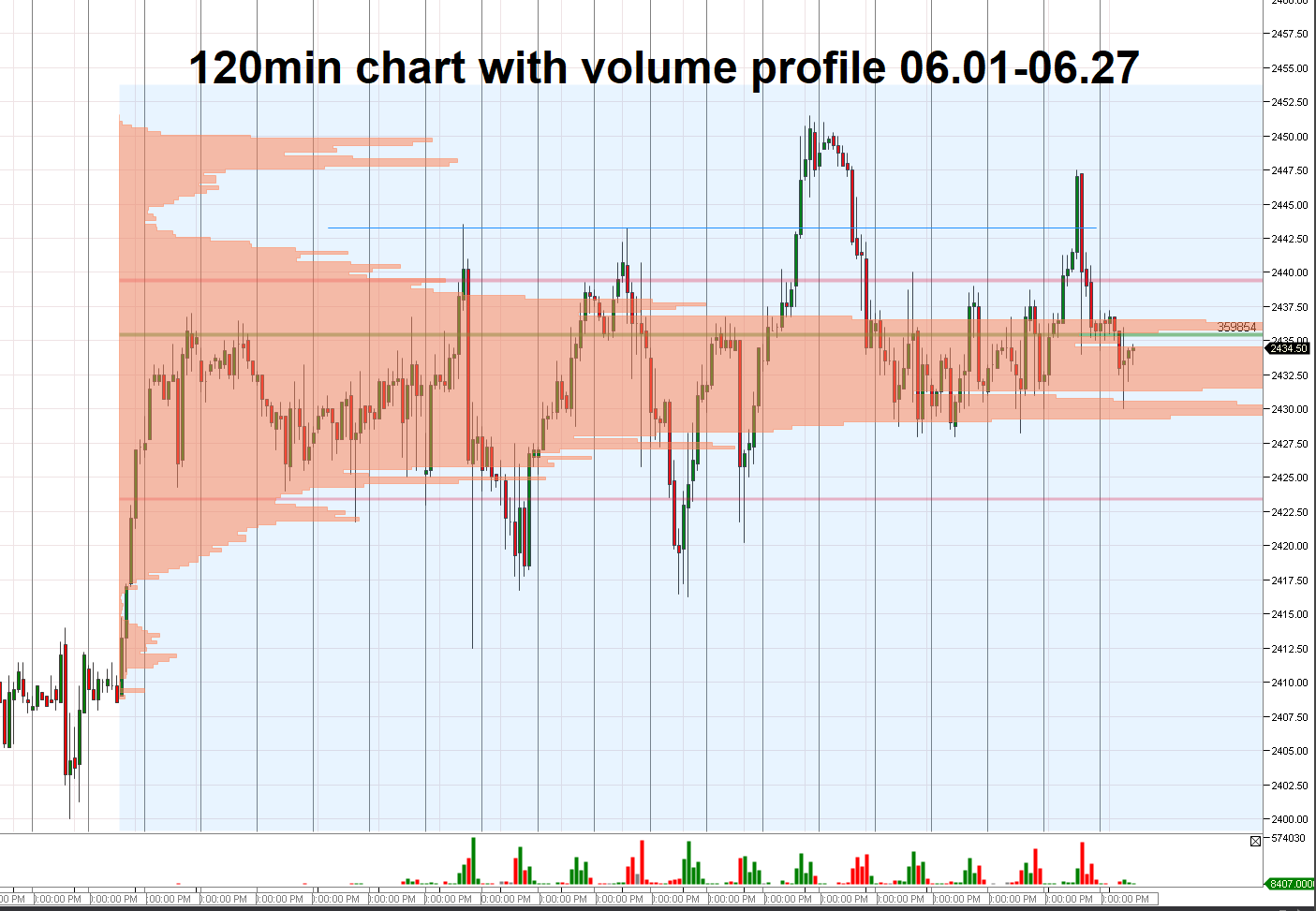

This week we started with the gap from Friday and pushed prices to the level of 2447.5 during the opening hour of the US session. After this market returned to previous week's volume and value are, where today's session is about to start.

On one hand, this shows that market remain balanced and ranging neutral day should be expected. However, considering yesterday's reaction above this balance area and aggressive selling back in to the range shows that market might try once again break 2429-2432 area in attempt to check bottom of the June's volume and value range (2420-2417). Meanwhile, considering the fact that we are in the middle of this range and there is an upward trend on daily charts, I would still be careful with selling. Although this target might be attractive to accomplish in short term, today or tomorrow.

Another scenario is that, today we will respect the highest volume are, that was established sine beginning of June (2429-2439) and we will be trading sideways inside yesterday's volume range (2435-2441).

The less expected scenario is that we will attempt to buy market, as Friday's gap is already closed and we are in upward trend on daily charts. In such case, if more buyers will join around 2440 prices move towards yesterday's high 2447.5 is expected, with most resistance is foreseen around 2445.

In case we will approach the bottom of the June's value area (2420-2417) towards the end of the week and the fact that it is final week of the month, some liquidation of longer term long positions might evolve. If this liquidation would begin around bottom of June value range, there is a good chance that we might end up month at the prices market was trading in May.

Keep in mind that today Fed Chair Janet Yellen will be speaking at the British Academy's 2017 President's Lecture in London, which might cause some volatility as well.