BlackStone Group Says The Market Is The Most Treacherous They Have Seen

There has rarely ever been another time like this.

Not since 1999 and not since 1929 before that, have so many billionaires, central banksters, financial elites and fund managers warned that we are on the verge of a catastrophic bust.

And now, Joe Baratta, Blackstone Group LP’s top private equity deal maker, admits at a WSJ conference this week, “You have historically high multiples of cash flows, low yields. I’ve never seen it in my career. It’s the most treacherous moment.”

The most treacherous moment!

Rarely before have we seen the US stock market at near record highs with so many people warning it is about to burst…and the last two ended with catastrophic busts. And now we have another multi-billion dollar fund manager calling now the “most treacherous moment”.

In a recent Bloomberg interview where Blackwater’s president Tony James made a point to express his support for Hillary Clinton, he also mentioned that the firm is currently offloading more than it’s buying. He said, “We are net sellers on most things right now -- prices are high,” he continued, “Interest rates are so low and there’s so much capital sloshing around the world.”

Now, as we near the end of the Jubilee Year, we have had a flood of big name money people coming out and warning that we are in, “unchartered territory”, as Jacob Rothschild said. Or, on the verge of a crash of “biblical proportions” as Jim Rogers said this summer.

Normally, when you see so many people expecting something, we run the other way. But, that’s just how crazy this entire financial and monetary system has gotten, that almost everybody can see it is just, plain, unsustainable and so far outside of the bounds of normalcy, that many people like Blackstone, don’t even know what to do.

Yet, the US stock markets continue to sit near record highs as nearly everyone is frozen like a deer in headlights.

The economy is in dreadful shape and the Federal Reserve still can’t bring itself to raise rates even 0.25% for fear it will collapse the entire worldwide financial system. Or, they are waiting until just the right time to do so, is our guess.

Many are looking scaredly out of their Wall Street high-rise windows, wondering what is going to be this crash’s Lehman Brothers that sets it all off.

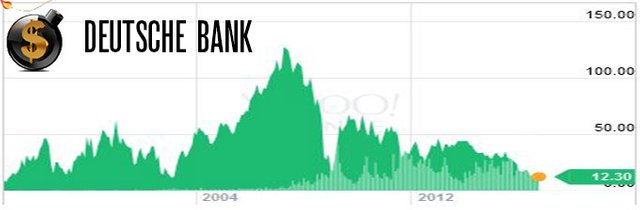

We said a year ago that Deutsche Bank should sit near the top of the giant list of black swans.

And it looks like we were right again with many now calling it the next Lehman Brothers. Angela Merkel has even said that if the bank were to fail, “there could be no government bailout”.

Merkel and the financial elites know full well that neglecting to bail out a giant like Deutsche will likely lead to a chain reaction of bank failures - something they want to see happen.

The Jubilee is a time of washing away and it’s a prerequisite for global governance. Commercial banks, and regional/national central banks need to fail to some degree in order for them to be pointed to as the problem. Once the blame is pinned to them, a solution involving a single world bank that issues a single world currency will be suggested as an alternative. This problem, reaction, solution, methodology is used over and over by the globalists, it’s called the Hegelian dialectic.

John Maynard Keynes was one of the first to suggest such a one world currency which he called the “bancor”. Keynes was also a member of a secret society called the Fabians who championed a wolf in sheep’s clothing as their “mascot” - something that further proves the malevolence associated with this agenda.

Many people have trouble following all of this market manipulation, especially because everything being done is so erratic. But the elite’s actions are purposely chaotic because their sole intent is to destabilize.

At the Dollar Vigilante we watch and follow the elites every move like hawks. It’s this kind of discipline that has allowed our senior analyst Ed Bugos to make phenomenal portfolio recommendations, some of which have earned over 4500%! Collectively, our overall holdings are up around 200% in the last year thanks to his expertise.

It’s not too late to capitalize on this chaos though! In fact, we believe it’s just getting started.

Subscribe to TDV to get up to date investment and geopolitical insights regularly.

When you become a member you’ll gain access to exclusive stock picks as well as a swath of invaluable information to help you and your family survive and prosper through these treacherous financial times.

Our next issue is coming out this weekend and will be the last issue before the end of the Jubilee Year. And, it will only get more chaotic from there.

Make sure you have access to some of the best analysis in the world from TDV, the fastest growing financial newsletter in the world.

Don’t be a victim, be a profiteer.

If DB fails, will we get the same kind of reaction from gold stocks as with Lehman?

time to buy bitcoins i think

Yes. I do think so:

https://steemit.com/bitcoin/@maarnio/crypto-of-the-day-bitcoin

Another masterpiece and thanks for sharing. Happy to upvote and share this on Twitter✔ for my followers to read. Cheers. Stephen

Thank you for posting Jeff Berwick. It seems to be right on schedule. Cheers.

Que pasa bien.

Next Monday we are a go for shutdown.

Thank you dollar vigilante!!

Truly worrying about Deutsche Bank, lets see if they are 'too big to fail'

In full agreement. The full effect of the 2008/9 was buffered by goverment bailouts and the printing of more money. The double dip is delayed but still imminent. We need to prepare for major market crashes globally within the next decade.

Apocolyptical week next week then!!

I read yesterday that Germany won't be bailing out DB but I can't find the article. I did find this though with some interesting info. https://www.thestreet.com/amp/story/13753418/1/germany-won-t-bail-out-deutsche-bank-but-creditors-should-read-the-small-print.html

This post has been linked to from another place on Steem.

Advanced Steem Metrics Report for 29th September 2016 by @ontofractal

Steemit Club 500 - 28 September 2016 by @topten

Learn more about linkback bot v0.4. Upvote if you want the bot to continue posting linkbacks for your posts. Flag if otherwise.

Built by @ontofractal