Corrupt Banking and the Looming London Property Crash

Fractional Reserve Banking

Throughout history every currency has become worthless except Silver and Gold. Currencies usually loose value and become worthless due to excessive inflation, hyper inflation. We can see today that Venezuela is going through hyper inflation but hyper inflation and/or default is coming to all fiat currencies. It seems like a abstract idea to consider the currencies we use today failing within a short period of time because to the average person everything seems normal and stable in the economy. But the world currencies have been set up to fail by the very people who created them.

Finance as we know it is the foundation of social control and deception. I watch the politicians debating taxation policies and how to reduce the deficit on a daily basis and all that tells me is that they are either totally ignorant to the nature finance or totally corrupt and compliant to the system.

The level of Tax today is theft and there is no need for a deficit or even dept. Have you ever wondered who we are all collectively in dept to? The whole purpose of money should be to store the work we do in a form that we can realise in the future. If we were on an efficient resource based economy we would actually not need any money at all, but that type of society we have yet to evolve to. So we use money to store our productivity because if we did not do this the only way a blacksmith could acquire a shirt from a tailer would be by exchanging trades peer to peer.

On a gold standard we could be paid for or buy services, products and commodities in gold units. Seeing as there is a relatively finite amount of gold in the world, as the population increased there would be less gold in circulation relative to the services, products and commodities in circulation and the relative value of the gold units would increase. The only exception would be when a huge seam of gold is found or another civilisation is plundered such as when the Spanish pillaged the Aztec empire and experienced high inflation with all the extra gold circulating in Spain.

But our banks and governments have taken us off the gold standard, on purpose, and replaced it with a fractional reserve system. Fractional reserve banking is a dept based system where banks lend out more money than they have and charge interest on these loans. In essence every time someone gets a loan from a bank they themselves are creating new money in the form of dept. When the amount of new money being created grows faster than the services, products and commodities in circulation we get inflation. To be clear, inflation is excessive money creation.

Now people may say loans are paid back and depts are cancelled but this is not at the same rate that dept is created. If I get a loan to buy a car I create that dept/new money and the person I buy the car from deposits the new money back into the banking system. The bank can now make new loans from this already newly created money. To add to this craziness the fractional reserve is 10% meaning when you get a loan from the bank 90% of the loan is new money. Only 10% needs to already be on the banks books.

If this is not bad enough lets now consider interest and where the original money comes from in the first place. All banks are connected and the banking system is one entity. All money expands out from the Central Banks. The central banks charge regional banks interest and when a central bank creates money for a country it charges the government interest on this money creation which we the tax payers have to pay. Who are they to do this?

Imagine an economy of ten people on an island with me and I decide to set up a monetary system using official looking pieces of paper. I give everyone 100 notes to start the system, but I charge interest from everyone on this deposit. Even if everyone pays back all the notes to me they still owe me the interest. So where does that interest come from to pay me back? Somebody has to loose out and suffer through loss of assets like property, or they have to borrow more official looking notes from me with more interest.

This is how governments and banks through the fractional reserve system control the public and steal real assets. They create dept and scarcity and of course they create the laws to enforce the system. They keep us busy chasing our tails just to keep our heads above water. Like a huge game of musical chairs they create a situation where it is advantageous to step on each other just to make sure we are not the ones left without a chair.

But this is not the whole picture. Their end game is to own more and more real assets and become the kings of the castles because in reality its about total control and power. If you apply for a mortgage to buy a property 90% of the loan is money that is created out of thin air as long as you sign the contract to repay it. When the music stops anyone that can’t find a chair looses their property and the bankers have acquired a real asset from instantly created money. They control the credit system, they control the interest rates and when they want the music to stop they reduce the credit supply. They can make it more and more difficult to be eligible for a mortgage or they can reduce the income multiplier rate so less credit is available. They can also increase the interest rates so you can’t afford the interest payments any more.

The London Property Market

Just to get this concept home lets look at the UK property market a bit deeper. I use to flip houses in London so I understand this market quite well. We are lead to believe that demand drives the property market but this is not so, not exclusively. Seeing as most people will need a mortgage to buy a property, high demand will push the property prices to the maximum borrowing capacity. In central London you can be sure that most people are borrowing close to their maximum to be as central as possible where as in a small town with less demand this may not be necessary.

The ratio that caps this borrowing is called the income multiplier. If the income multiplier is 3 then someone can borrow 3 times their salary. The case by case eligibility varies and is made quite complicated as the Bank of England changes the rules such as the option of adding a spouses income, and this is the problem. If the ratio was fixed and the income multiplier was always at 3 then there would be a cap on London property prices that would only vary with changes in income.

The huge gains in the London property market is mainly due to the Bank of England increasing the income multiplier ratio. Oversea investors add to the demand by sitting on empty houses but they do not buy over the odds if possible because that would defeat the objective of a good investment. They buy at the current market value set by the maximum locals can afford to borrow according to the income multiplier ratio.

When we have a credit crisis the Bank of England reduces the income multiplier ratio and therefore the maximum Londoners can borrow drops and property prices have to drop if they are to be sold. Below is the best chart I could find, funny that there are not many of these charts available. I can tell you that in the last three years the ratio and London property prices are well off this chart. I believe the maximum ratio has hit 4.5 although I have heard of 5 and then consider adding a spouses income at a reduced ratio of 3 and you can see how the market has gone so high.

.png)

See how the income multiplier ratio and property prices correlate.

Hyperinflation

In recent years the dept based economy has reached a tipping point and in 2008 we saw the entire boat nearly roll over. Since then the entire financial system has been on life support with 0% interest rates and the central banks buying back the bad dept and unwanted bonds to keep financial institutions solvent. At will the elite can pull the plug on the life support and the entire system will crash, they are just waiting for all their chess pieces to be in place, some of which are fixed in time.

I saw what was about to happen in 2008 and sold my home in 2007 to invest in more profitable assets. I thought that 2008 was going to be the big one, a huge default, and never expected the scale of the bailouts that followed. We the public never saw any of this money, just ask anyone that lost their home in the subprime scandal.

I have a theory that the 2008 credit crisis was triggered in advance of the big one so that all the players could get payed off with gross bonuses for their compliance. Take Jamie Dimon who has become a billionaire, I bet he is invested heavily in Bitcoin, gold and silver with all his dirty cash.

This time it is different, London will be one of the centres that will see huge losses among others and the rest of the world will find out which bank or pension fund is holding the repackaged dept. We are also about to enter an environmental crisis that has been hidden form public view that I will get into as soon as I can. This environmental crisis is time fixed and I believe they wish to coincide the coming depression with this environmental crisis for maximum effect. Secondly just look at the chart below, again I could not find an up to date chart and I chose the US dollar because it is the worlds reserve currency. The current US dept value today is over 23trillion, again well off the chart.

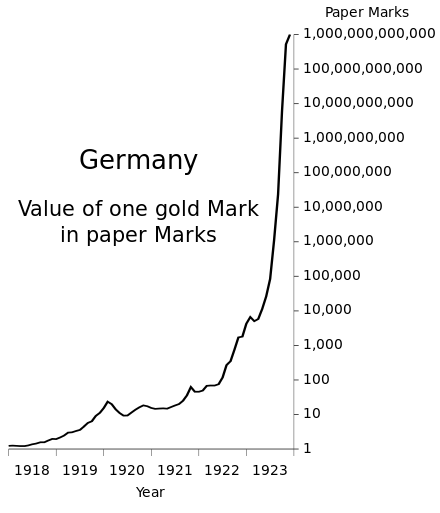

Now how does this compare to the hyper inflation of the Weimar Republic

Once a fiat money system gets to the hyperinflation stage it goes very fast and I would say we are already in it. Its only due to the life support that the public is not being effected yet. In fact the public is oblivious to this situation and oblivious to the how the fractional reserve banking system works because it is not show on the BBC, CNN, ABC fake news. The public is so uninformed that they are remortgaging their homes to go on holiday and buy second properties increasing their leverage and liability.

This explanation is making the financial system as simple as possible for those who don’t yet understand it, to give you an idea of how totally corrupt it is. It is a rigged game that has to result in collapse and is always stealing from the public. If you understand these basics then it makes political legislation of financial control ridiculous. Many of the problems that politicians debate and create legislation for, are just to solve the symptoms of a fraudulent financial system. Many of these solutions make the situation worse. People are in poverty because the financial system makes them poor through interest driven scarcity. Austerity measures to cut deficits that don’t need to exist in the first place increase the tax burden on the population causing more people to move into dept and poverty. Dept is poverty when the credit drys up.

The depth of banking corruption goes far far deeper when considering the repackaged dept that is sold on and placed in your pension. Credit default swaps that bet against the failure of these dept packages and speculative derivatives backed by nothing that create such hugely leveraged liability that when this all unravels it will take down the whole global system. They use rating agencies that are all part of the gang, government property buying incentives, easy lines of credit and suggestive media campaigns all to herd the public where they want them, in dept. The more one studies the financial system the more shocking it is.

The Great Depression 2.0

Now to the main point of this Chapter, the end game. Every 8-10 years we have an economic crisis, a credit crisis, a recession, which can be triggered at will by the bankers and spun to the public through the media who are also compliant to the same group of crooks at a bare minimum through silence. Every time they do this they amass more real wealth from public losses. But once in a lifetime when nobody in living memory remembers the previous system and the current system has run its course they implode it and take everything they can.

Before the hyper inflation of the Deutsch Mark in the Weimar Republic, 1 gold Deutsch Mark = 1 paper Deutsch Mark. At the end of the hyper inflation 1 Gold Deutsch Mark = 1 trillion paper Deutsch Marks. At that point 100 gold Deutsch Marks could buy an entire city block.

This is about to happen again but this time it is different, this time it is not one country, today the whole financial system is connected. This time the whole world is about to go into hyperinflation and/or a depression. How can this happen? Well as I explained above the whole system is now on life support, zero % interest rates and at any time they can pull the plug on the derivative market or stop buying back their own bonds and crash the bond markets and send interest rates sky high.

Also zero % interest rates have herded anyone with savings into property and stocks of which the central banks are large buyers and I expect the first sellers. Investors have been pushed into investments that are in huge bubbles. Institutions and pension funds that wish to hedge against this risk and have invested in gold and silver are mainly holding ETFs or some derivative that will be worth nothing.

False Flag

Now if they pulled the plug on this scale with nobody to blame the public would go crazy and heads would roll. Don’t forget we have the numbers. So they need someone to blame, they need a false flag event. They need an event that will take the blame away from the banksters.

I don’t know what this event will be but if I look at the news today I can have a guess, North Korea. Trump and Kim are not acting like normal world leaders and the narrative being set is that they are playing with fire. I suspect that they are both part of the same club, actually most world leaders are but thats another chapter, they could be part of or being manipulated by the same group that controls the banks and the stage is set.

If this scenario plays out then I expect there will be an exchange of fire between USA and NK to put it mildly. Maybe a staged hacking event, maybe a first strike, then NK will retaliate on South Korea, Japan or Hawaii and that will be a big enough economic and geopolitical event to blame. Then they will pull the plug and the whole house of cards will fall.

It could well be something else but a large event is imminent that will be blamed for the financial collapse. It is important to emphasise the roll a false flag event plays in this set up. I fully expect to be having conversations in the future where people are exclaiming that it was impossible to see this financial collapse coming because how could we possibly know that a cyber attack from North Korea would cause this sequence of events unfolding. I don’t expect to get through 2018 without this playing out. They need to get the new system up and running to coincide with the global cooling and if you look around the rats are already leaving the ship. Insiders are dumping their stocks with excuses of course, Jamie Dimon, Mark Zuckerberg.

Obviously don’t just take my word for this and please don’t overlook this as impossible, take the time to study the fractional reserve system yourself and how this financial system enslaves us all. I don’t know how fast this will all play out, I expect a sequence of dominoes to fall over years but it could be a lot faster.

I recommend listening to Mike Maloney. In my opinion he gives a very eloquent and detailed presentation on the corrupt nature of the fractional reserve system. Just search for ‘Hidden Secrets of Money’ and you will find his best work. His business is selling gold and silver but don’t let that put you off. It takes an expert to explain a topic in detail and people tend to become experts from many years of experience in an industry.

Or course there are exceptions to this, Janet Felon, Fed Chair just said that banks are “very much stronger” due to Fed supervision and higher capital levels and that another financial crisis is unlikely “in our life time” How this did not start a bank run I do not know.

In the next Chapter I will write about the new system that they will move us into that has already begun ~ Crypto Currencies