The Next Financial Crisis will start in Asia

All pointers, indexes and economists say that the next Financial Crisis hit us pretty hard and it's just a corner away.

So what are the factors and countries investors have to watch closely?

Why will it be Asia and how can you protect your wealth / money from loosing its value.

The Potential Candidates

- Japan

- China

- Korea

Japan

One of the most obvious countries for anyone predicting the next financial crisis. Japan has a shrinking population that creates less and less wealth while the majority is about to retire.

The current government spending are already at an all-time high and Prime Minister Abe is trying everything he can to fuel the economy.

So far over the last years all his ideas have proven to be not successful. The current depth 229% of GDP and nobody expects them to repay it.

"My main three goal are currently the economy, the economy and the economy"

Abe speaking at the UN 22nd September 2016

As Abe just outlined his three main goals are the economy, the economy and the economy. For any investor this is a clear sign: if this is the only point on his agenda the Japanese economy is in serious trouble.

His problem : more money doesn't help - the economy is shrinking even though he's flodding the market with cheap money.

China

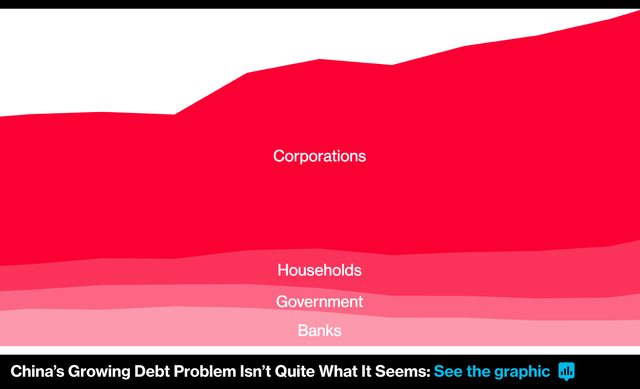

Similar to Japan China is sitting on a huge pile of debt; and it keeps on growing. The problem here is that its not only the governemnt and the central bank the has these massive debt but China has a huge shadow debt market which is even bigger then the official market.

This graph from Bloomberg clearly shows that the biggest debt is in the household market and the corporations. As soon as the housing market collapse it will have an impact on the corporations as vice versa.

Make one struggle and it will collapse like a nice house of cards.

Korea

Following the crisis at hanjin anyone in the shipping market knows Korea is already in deep trouble and the next GFC might have its roots here.

Hanjin is the biggest Korean shipping company and port operator as well as the owner of Korean Airlines.

Just in the city of Busan over 11 000 jobs are on risk when they announced bankruptcy on August 31st.

With more Koreans becoming unemployed due to this historic bankruptcy, less people will be able to spent money on products made in Korea : just take Samsung as an example.

If these companies are not able to produce at the current levels they will have to lay of more and more people - starting a death spiral.

By the end of 2016 we will know and see the impact of this massive bankrupcy. My prediction: this was the start of GFC 2017

Summary

Governments and central banks have already flooded the market with money - this time they can't pull even more money into the market - it will be a disaster and there is nothing to stop it from becoming a fire that will quickly run around the world kill on economy after the other.

The 1920 will be a joke compared to what we will see in this century.

What ever, when ever it will happen spreading you money into non- distractible assets is one of the wisest advices.

With gold and silver prices already on the rise we can see that the rich started to shift their money away from stock markets and other high risk assets.

Modern investors, espessialy from Asia decided to move their funds into crypto currencies - therefore an Asian GFC will result in a massive increase in Bitcoin and other crypto currency prices.

Just shared on twitter. Great post and happy to up-vote. Following and looking forward to reading more of your stuff. STEEMIT needs more quality posts like this. Recently I posted a couple of articles/TARGETS on GOLD and SILVER. You may find them interesting to read. Your article is now on Twitter✔. Cheers. Stephen