The Crisis Chamber : Ep 01

This is the first post of, what I hope to be, a mini-series about the economical situation of the world.

We are in trouble , yes again , but this time it is going to be a bit worse than "just" a financial crisis.

The truth is we are not told how bad things are.

I can't blame them , today's the " information super high speed times".

For example : if FED Yellen is hackish , the next 3 seconds markets will overreact sending USD pairs on rallies across the board.

They just consistently tell us the US Stock market are at a historical high , economy is doing well.

Are US stocks doing that well ? the economy ?

I mean , USA should be in a historical economical thrive , right ?

No.

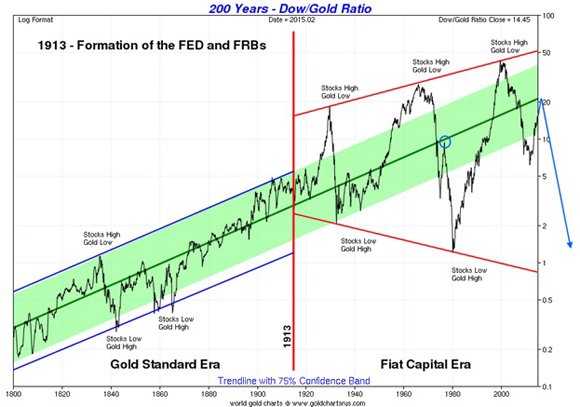

What stocks did is : nothing - nothing if you compare stock value to gold value , the "historical" value is just the product of inflation as you can see in the correlation chart , that's all !

The World economy is on the brink of a new crisis , a big one , and will kickoff if any of the big economies goes under.

Some notable players :

The FED - USA

All ears are tuned to Fed Chair Janet Yellen's speech scheduled for August 26 ( yeah , later today ) at the annual central bank conference in Wyoming.

A rates hike is exactly what the , already doggy and oversensitive markets , needs to react in a negative way thus pushing the economy towards the next crisis effectively telling investors to withdraw support to emerging businesses and placing to the safer , and higher yielding —U.S. bonds.

There is a problem : For the FED it's September or never , none is good but a aggressive hiking attitude will jeopardize the US economy probably sending the world economy of it's balance.

The PBOC - China :

The biggest problem with communist China is the (un)reliability of Chinese statistics and the lack of time to prepare if things do go bad.

They are well known to manipulate currency for their own lickings , remember black Monday as The People's Bank of China devalued the currency of the yuan by almost 2 percent.

They are doing this again and again and no one seams to do anything about it.

What is not-so-cool again in China ? They dump industrial product on the markets with total disregard to other players , for example : Steel

Cheap steel is slamming the markets and killing steel manufacturers in EU and US.

Europe's Tata Steel

USA's U.S. Steel

China is a big player on the Asian continent and should be watched closely as ripples are felt all over the world economies.

The ECB - EU

Grexit , Brexit , Franxit... EUxit ? - it's referendum time in Europe and the Eurozone countries have lost the majority to date.

Europe's ECB ( European Central Bank ) needs to take control of the single currency but odds are it will fail , leaving the cluster of countries divided and economically struggling remembering the Euro as a failed experiment.

Great Britain has already set the precedent

The only question is : when and how ?

Europe is a key player in the world economy and has to power to drive the it past the cliff all by it's own.

The CBR - Russia

I personally have always admired the Russian stile of doing things in their own way.

They also live the crisis in there very own way and responds differently than other nations , remember the December 2014 rate hike ?

The Russian central bank said it would raise its key interest rate to 17 percent from 10.5 percent.

Russia is worried that a key rainy-day piggy bank may be empty by the end of the year and has discovered that reaching agreement with China can be just as difficult as with the West.

The population fear a history-repeating savings wipe just like in the "1998 crisis".

If you add a tad unpredictable Puttin to the mix which could even consider reneging on the country's foreign debts , we might see some ripples coming out of the former URSS.

Last but not least ,the Middle east

Middle East country cluster have an impact on the world economy as well :

Refugees , oil , conflicts or local market struggles to name a some have shown to affect our economies.

Bad news from Middle east :

Saudi Arabia bank stock SABB:AB has already lost 40% in value.

UAE considering to de-beg from US Dollar.

Why will this crisis will be worse than the 2008-2009 crisis ?

If a new world economic crisis is triggered before today's economies have a chance to really recover it will be a very ugly one.

Why ?

It's simple : in 2008/9 crisis the world banks had some tools , yeah — the interest rates and/or bailouts just to name some...

The world was able reboot the economy or ,at very least, to offer some support.

Today the situation is rearward.

Today the world is already in recession ,interest rates are already low , money printing is not the answer anymore , reserves are not what they used to be , even oil prices are at record lows and the world is in conflicts everywhere you look.

The sad truth

The world is now connected over the internet - you know in 2 minutes an earthquake has hit , a conflict is underway or any economical news right in your palm. People are able to panic even faster now , and we are educated on the 2008-9 crisis to do so in a full blown fashion.

I do not blame.

It doesn’t take long to lose confidence in the entire system, when that system is built on the rock-solid foundation of unicorn tears and puppy dog tails!

Has it already begun ?

Banks have already cocked up a product identical to the last CDO crisis , now it's called "bespoke tranche opportunity" ( Bloomberg's news on this ) . Troublesome a decade later is the fact that the country could be experiencing déjà vu , an expensive one.

Deutsche Bank share price is falling at an ever greater pace besides currently dealing with 7,000 lawsuits and regulatory actions. The situations looks increasingly similar to Lehman's before 2008.

Bloomberg's news here.China's economy looks very much like the U.S before the crisis.

China’s banking system has more loans than deposits and is already been bailed out by the government.

Bloomberg's news hereA new round of EU bank bailout's has already begun :

Italy's Monte dei Paschi $5.58 billion bailout

Portugal's Caixa Geral de Depositos (CGD) $3.05 billion bailout

What do you think about today's economy ?

Get involved and I will try to get into details in my next post's

Hey Cryptoninja, I believe I accidentally transferred around 379 STEEM to your account. I would be very grateful if you could send this back. As you can see, my name is also cryptoninja so I don't understand why steemit allowed me to create an account when the name was already taken.

Thank you.