The Evolution of Money. Episode V: The Commercial Banks strike back

The story of the evolution of money from barter to what it is now is never complete before the role played by commercial banks is highlighted. While the practice of safe-keeping and storing savings had been around as early as 2000 BC in Babylon, the term ‘bank’ only started to be used around 1640 the time lending and credit began to flourish in Southern Europe.

The Origins of Banking

The first official bank in history was The Bank of Venice that operated around 1157 in Venice. It rose into prominence after, well, as you may have guessed, it began financing Monarch Wars. Modern banking can however be traced back to the English goldsmiths also known as ‘Merchant Bankers’ who appeared in London sometime after 1730.

The primary business of these individuals was trading commodities, government bonds, and issuing loans to explorers and merchants. It was not long before everyone in the community was entrusting their bullions of money and other items of value to the merchant goldsmiths. This practice spread fast and ‘bankers’ were soon among the most affluent members of the society.

The business of savings and safe-keeping required regular transfer of sizable amounts of gold and silver. Considering they had to keep customer deposits safe from thieves, these merchants invented deposit-taking paper-based banking. A customer would be charged a small fee and issued with a receipt, or proof that valuables of a certain amount is safely kept with a Banker. Whenever the customer made a purchase, rather than dashing to the bank to withdraw gold, he would instead write a letter to his bank instructing them to pay the seller a certain amount worth of gold. These receipts evolved to be paper money and checks (cheques).

This is where banks played a crucial role in the evolution of money. Because they could take deposits that did not have the marks of the owner, these goldsmiths began lending them out at an interest. However, to be sure that the few customers who might need to withdraw coins will get their money when they need it, the merchants kept some money in reserve, as banks still do today. It is safe to say that the bankers played a central role in making the gold-standard of money work.

Credit and Banking

In 2014, The Bank of England released a report called “Majority of money in the modern economy is created by commercial banks making loans”. In this revelation that mostly went ignored by the commercial world, the writer, on behalf of the bank, admits that most money in the modern economy that the bank moves around is not created from bank deposits but through loans. The Federal Reserve Bank, in it’s ‘I Bet You Thought’ publication wrote: “Commercial banks create checkbook money whenever they grant a loan, simply by adding new deposit dollars in accounts in their books in exchange for a borrower’s IOU”.

Here is how the fractional reserve form of money works to create money out of thin air: when a bank receives a deposit of $100 from customer A, to make money, it lends it on interest to another Customer B. The interesting thing is, the bank gives out as much as 90% of Customer A deposit to customers and in its place leaves IOUs worth $100, the amount loaned out. Note, however, that the IOUs are different from base currency because they are only numbers that exist in a computer. They are still money.

Therefore, aside from the amount loaned to customer B, the bank has now created another $90 to have $190 in in its books from a $10 deposit. Customer B will of course need to use the money borrowed to make a purchase. This means paying the seller, who will also deposit the money in his bank account. The bank will of course loan out the 90% of the same deposit, say $190, but in its books it will create IOUS worth $200, bringing the total amount of money in circulation to $300 from just $100 initial deposit.

With this scam pattern, money can be created almost forever with incredible ROI for the bank. Debts with interest created from deposits that are loaned to another customer as debts again — it takes a very good lawyer, a lot of courage and determination and you would have decent chances of winning a lawsuit against banks for lending you money they didn’t really have at the time of the loan.

While money can only be traced to use of gold and silver, credit has been around for much longer. In 2300 BC Babylon, everyday transactions were normally made in credit, and every loan overseen by a public official. This may have been the origin of credit as creditors offered harvest-day loans often to farmers. In Imperial Rome not too long after that, western pawnbrokers engaging mostly in money-lending appeared. There is also proof that credit was the most prevalent form of payment through the Dark ages between the 5th and 15th century, when the primary currency was labor in some places.

Considering the confirmation by the bank of England, Banks have thrived for centuries by creating money out of nothing. However, it is how they manage to keep the public indebted to the system that is genius. How the credit system works is simplistic in nature but practically it is a mess. For instance, when we say that currency and credit is practically the same thing, you may not be able to see the truth in it unless you look at interest. When a bank lends one unit of currency to a customer, there is at least one unit of debt and another of currency that is transferred even before the compound interest is factored in.

This explains why the total world debt at $247 trillion is more than twice the amount of total existing currency in 2018 according to Rational Wiki. Going by this logic, the global debt is not repayable because it continues to accrue interest. It is also because of this that real wealth is generated from an upward transfer of wealth via hidden interests in prices that companies and individuals pass on to consumers. To understand how this came to be, it is vital that we go back and examine the state of modern credit as a service offered by banks.

The Indentured Servitude of Credit Cards

The next invention after cash and checks that banks can be held responsible for is the widespread adoption and abuse of the plastic credit card. A bank credit, the product on which plastic credit cards are based on, is essentially an agreement between banks and cardholders where the bank trusts the customer to repay the funds they use together with interest, at a later date. This service allows ordinary citizens to purchase goods and services in credit with the bank as the guarantor. This means that at the end of the transaction or the credit period, which is typically 12 months, the card holder must pay the bank for the amount used, associated charges, and interest.

The public is very unsuspecting. There have been tens of dedicated individuals who have gone the extra mile to try to uncover the grave social and economic consequences of the kind of credit banks offer, but most people are often too deeply engrossed in resolving their own problems that they do not really care. In the United States, for instance, the Federal Reserve issues notes that are actually ‘liabilities’ of the Federal Reserve Bank, a private bank. Because these notes are not redeemable, they are essentially ‘Monetized debts’, liabilities that cannot and should not be used to pay off debts.

The Indentured Servitude theory suggests that all or most money that come into existence is actually a debt repayable to a bank. A country’s central bank such as Bank of England in the UK or Federal Reserve in the US issue credit to smaller banks, who in turn issue it to individual borrowers and businesses. While most people believe that money is controlled by the government of the day, the truth is that the privately-owned banking system that runs the modern economy is not in place to benefit a country or its people, but to earn interest for the owners of the bank.

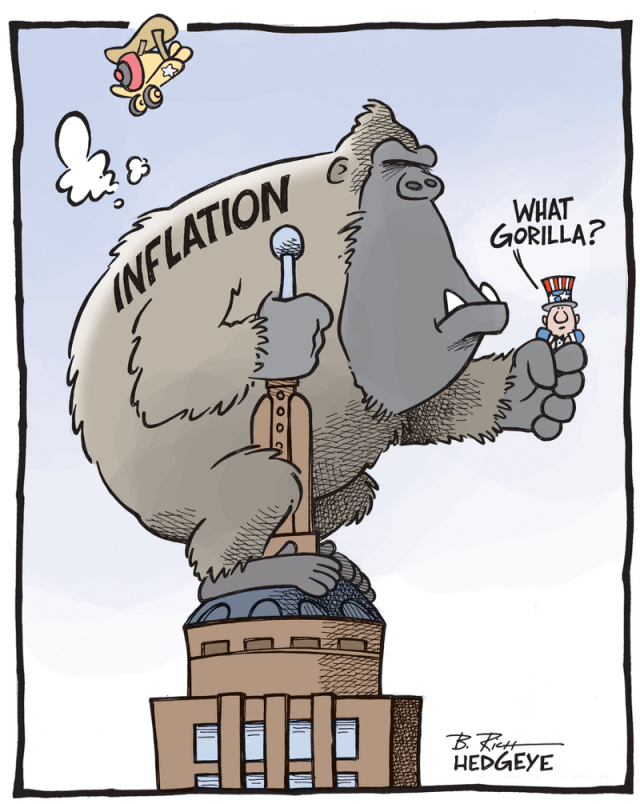

Artificial Inflation

Inflation? What inflation?

There is a good reason why conspiracy theorists believe that the average American household is a slave house that just cannot admit they have indentured servitude towards commercial banks and those they represent. There have been many steps that led the global economy to where it is, but one particular practice that banks have perfected since the invention of currency is the inflation of money. Inflation, in technical terms, is an increase in the general price of goods and services within an economy over time while decreasing the money purchasing power.

America experienced one of its worst cases of artificial inflation in the mid-1960s during the Vietnam war. This happened because wars have always been expensive, and when President Johnson chose to commit American forces to Vietnam, it brought about the kind of inflation that exerted a lot of pressure into the then new financial world order. As the war that was expected to be won within a few months dragged on year after year, the US military needed money to finance all the effort, and the US Dollar having just been declared the reserve currency of the world a decade earlier, some “geniuses” at the Federal Reserve thought it wise to print more money in US currency.

The result of minting more money to meet an immediate need dealt a serious blow to the value of the US dollar. If you have ever wondered how a loaf of bread cost 45 cents in 1960 and 70 cents in 1970 to $3 in 2019, it is all about inflation. Yes, the wages and salaries have also gone up since, but if you take a closer look, the inflation was always slightly higher than the wages/salaries rise…. Inflation was so bad in the mid-1960s largely because the minting of more US currency had a global domino effect, which means that the hit the US dollar suffered in value as a result of excessive supply had direct impact on the value of every other currency in the world.

Can the debt be repaid?

The average American household today carries an average of 203,163 US dollars in debt. This is often a combination of various debts accumulated from different banks for student loans, service fees, car purchase loans, mortgage, and credit card debts among others — all borrowed from banks. This system of debts is rigged such that the amount repaid, often over a period of several years, is multitudes higher than the original amount borrowed. Factoring in inflation, it is almost impossible for the average American to escape the chains of credit slavery. People with such debts work their fingers to the bone to pay off debts, but they have to take on other more expensive debts just to keep their heads above water.

It is true to say that there are individuals, or families of individuals, that are rich beyond imagination. Most of these people are directly or indirectly benefiting from the modern slavery system that keeps people in debt for most if not all their lives, selling them dreams and making them feel responsible for financial situations that are clearly engineered in a laboratory. If you live your life servicing a debt that prevents you from chasing your dreams of happiness, what does that make you?

R. G. Hawtrey, one-time US Assistant Under-Secretary to the Treasury and writer of the book “Trade, Depression and the Way Out” is quoted saying “I am afraid the ordinary citizen will not like to be told that the banks can, and do, create and destroy money.” In his book, he reveals that the credit system that runs America and the rest of the world is designed not to have an obvious exit for the oppressed. The lie that banks lent money when it did not, is powered by the trust the parties involved in the transactions have in such a deceitful system. Since real money can only be earned by creating wealth or doing work and not from computerized bookkeeping, as long as the average citizen and business spend all they make in servicing never-ending loans, the current financial system is hell-bound to keep everyone enslaved to it.

How plastic perpetuated modern credit

From the start, the evolution of money has always leaned towards convenience and value over everything else. With the invention of modern bookkeeping, bank notes, checks, and coins were rendered unnecessary. The emergence of credit cards revolutionized how money is owned and used. For the first time, all your money could fit in the pocket, it was safer than ever before, and while the card that carries it has no intrinsic value, it is classy and fascinating to use. Little do people realize that it is also a great spying device, keeping you under control in a reality where every penny is watched.

The idea of using a replaceable cardboard card that identifies the cardholder and the transaction was used in America in the 1800s during the westward expansions. Merchants could use these cards to extend credit to ranchers and farmers to pay back with their harvests. At the turn of the 20th century, a number of oil companies and department stores took this technology a step further by introducing their own proprietary cards accepted only by approved partners.

Banks started issuing real charge cards in 1946 after John Biggins, a Brooklyn-based merchant, introduced the Charg-It card. Even then, the ‘closed loop’ card system was too complicated with middlemen who reimbursed merchants for their sales. This meant that the card could be used locally and at authorized merchants only. Five years later, the Franklin National Bank in New York began issuing full-fledged credit cards. Diners Club Card was debuted around that time in 1950 and America On The Go also began issuing a credit card.

The American Express card, issued in 1958, took the credit card game to a whole new level by making it plastic and international. Within 5 years, close to 100,000 outlets had signed up to serve the 1 million plus holders of the American Express Cards. Major banks began issuing their own cards throughout the 60s, but with a different twist. The credit card was no longer a bill to be settled in full at the end of each month but a revolving credit service which charged cardholders a small fee to carry over their monthly balance.

The next major development in the credit card industry was the formation of the Interbank Card Association by a group of Californian banks. This would later evolve to become MasterCard, the second largest card service in the world today. This association chose to use ‘an open-loop’ system that required cooperation between banks to transfer banks. This made it a lot easier and cheaper for banks to manage their credit cars and to increase the number of outlets that accepted their brands.

The future of banks

The history of banks, unless it highlights the many crises the greed in the industry has almost crashed the world, is incomplete. Banks will not preach about this but in the Victorian era in 1866, bill broker and bank Overen, Gurney & Company collapsed, taking with it a whopping £11m in customer deposits. The financial crisis that this event caused was unprecedented at that time — so much that it threatened the standing of The Bank of England. The panic of 1907 in America, caused recession in a single day when a dew bank decided to retract loans against procedure, a decision that led to the birth of the Federal Reserve 6 years later.

There have been many instances in history where banks manipulate the nature of money for personal benefit. The Wall Street crash of 1929, for example, caused losses of $14 bln at the New York Stock exchange and the banks were directly involved in the events that led to this problem. The situation was so bad at the start of recession that 11,000 of the 25,000 American banks went bust and stock prices plummeted by over 75%. The speculative boom that preceded the Great Depression is a lot like another that happened almost 100 years later in the banking crisis 2008: a few individuals pocketed most if not all the money that others suffered as losses.

Conclusion

The problem with the modern banking system cannot be resolved without upsetting the present financial system on which the global economy runs on. The system problems that have been inherited for generations from the first merchant banks and overseeing banks such as Bank of International Settlement, the World Bank and IMF, and central banks of independent countries such as The Bank of England and the Federal Reserve. Industry experts argue that it is because of the hopelessness of the financial situation we persevere in that decentralized currencies are gradually taking over from the existing financial system. Is this true?

In the next article in the series, we will cover the main problems in the current financial system that the new form of decentralized currency can help cure once and for all.

You can join us on Telegram for a follow-up of the market throughout the day.

For any question, our team will be happy to answer you on our support which is open 7/7 days.

For any information about our subscriptions, please visit our website or contact @Butler_4C_Bot directly to get all the information you need.

See you tomorrow for a new market analysis ! 🚀