Global Elites: A Tripartite Confrontation

Introduction

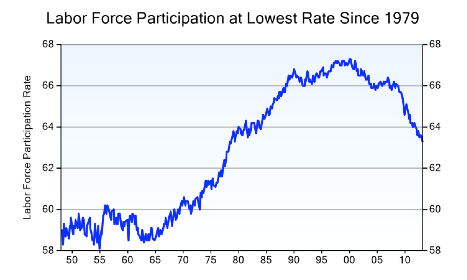

The global crisis which began in 2008 is still on-going. The US officials are carefully trying to hide it behind changes in their methods of calculating GDP, unemployment, and inflation figures. However, in reality, the US economy has been in decline for a number of years.

US Labour Force participation. Source

The world’s dollar economy, which has been stimulating economic growth for the last 30 years (since 1981), cannot continue to do so. There are not enough resources to maintain both the world’s financial system and the national economy of the United States. As a result, we can now observe a schism in the world elites, who were previously always united.

The Global Financiers

The first of the elites is the beneficiaries of the world dollar system; in other words, representatives of the international banks who are betting on the current global financial system, which is based on dollar.

The National Elites

The second part is national interests of the US (manufacturers, builders etc). They get their money from the real economy and do not care for big international banks. By the way, they exist not only in the US; the British elites supporting Brexit or the Austrian elites who cancelled Austrian presidential elections are all from the same camp.

The Great Confrontation

The result of the clash between these two groups was the Strauss-Kahn case and the end of the QE money printing policy in 2014.

Constant expansionary monetary policy is crucial for the financial elites. Without it, all the big international banks will immediately become bankrupt (as seen most recently by Deutsche Bank’s problems). To combat this the banks started stimulating money outflow from other places:

What Did The Financiers Undertake To Survive?

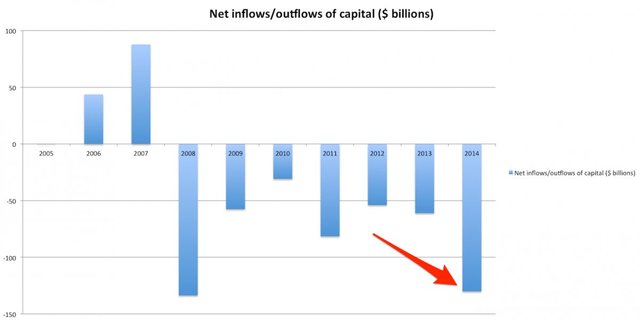

First, through their IMF interest rates and FX policies (which the Russian Central Bank is carefully following) they created huge and very volatile Rubble depreciation, which caused approx. $200bn outflow.

RUB/USD Exchange Rate Volatility. Source

Russian Capital Outflows. Source

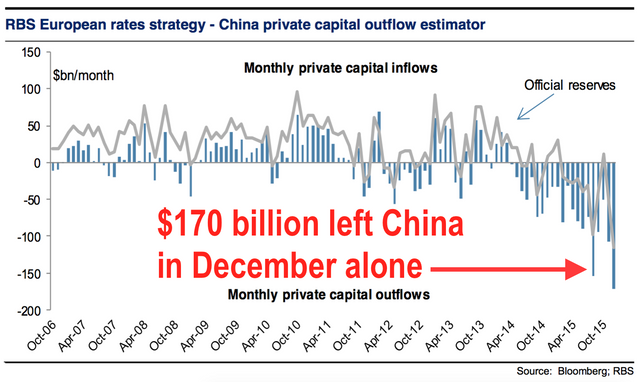

Secondly, by creating a lot of press speculation such as “China is defaulting tomorrow” they caused a massive sell-off in the Asian stock market in 2015-2016, and cash outflow from China of about $1 trillion.

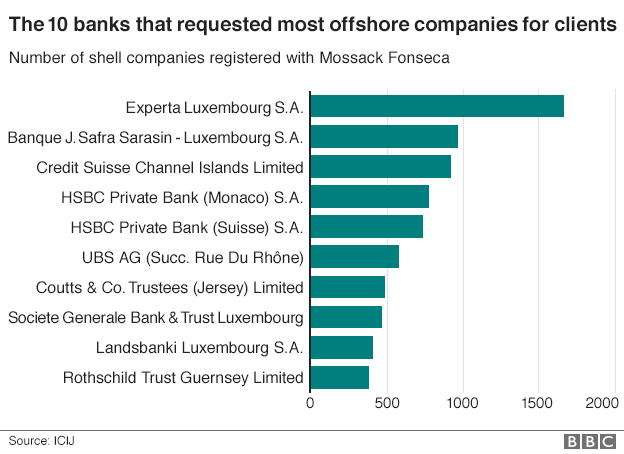

Lastly, they published names of the people who held Panamanian and other British offshore bank accounts. Although the majority of the ordinary people thought that this was a move against Russian oligarchs and Putin, this was only partially true - the main victim here was Great Britain! Just have a look at the name of the banks below…

No American banks….And if you look carefully – only one ‘offshore’ region was not mentioned in that report – the State of Delaware. Effectively, all the rich guys got a clear message: “If you want to keep your money safe, you should keep it in the US and in international, not British, banks…”

Using rough estimates, about $2 trillion currently held in British offshore accounts will be transferred to the US, sooner or later - this will be probably enough for another year or so. After this time, further policy changes will be needed to continue to stimulate the global economy, either by printing money, restarting QE, and/or by decreasing interest rates.

Obviously, it is against the national US interest as it will create inflation and further economic recession. That’s why we now see such a severe battle between the two representatives of these two groups: Clinton vs. Trump.

When Two are Fighting, the Third one Wins

In reality, there is also the third group of world elites - a much smaller one - for example the Rothschild family (who have a history of influence within the financial markets).

They believed that if the global dollar financial system were to fall (and the dollar were to become only the local currency of the US), then there would be a unique value measurement against which all other currency will be benchmarked; the only most obvious option here is Gold, and we can see how HSBC is rapidly growing its gold reserves.

Conclusion

Having read this, I think we all know now what you need to do if you do not want to loose everything!

looking forward to more posts from you!

Приветствую вас! Зайдите пожалуйста в steemit чат!

Global crisis has been and will remain forever, knowing what to do in order not to get crushed is key, cause it's a game one can't beat, you join. Thanks for the post, insightful