Bretton Woods, Global Financial System, World Elites, and Where This is Leading Us To…

In this article I am going to talk about how the current financial system was created, what effect it had on world elites, and why it led us to the edge of one of the biggest conflict in the history that we witness now…

Image borrowed from Cardow Cartoon

In my article Why Global Crisis is Inevitable? Part 4 – Finale I already said that following World War II only 2 technological zones remained: the American and the Soviet, all the countries (markets) were divided between these 2 zones.

I am not going to talk about which system was better and which was worse. In summary, in the FIRST system you are offered liberty, freedom to do your own business, a great variety of cars to buy, BUT you needed to pay for healthcare, you needed to pay for school, you needed to pay for university.

The SECOND system was offering only 3 types of car (or any other product), BUT you got FREE healthcare, FREE education, and a FREE house (after certain work experience).

I am happy for my readers to choose which one they prefer. Clearly, if you had money, you would choose the first one; if you didn't then you would prefer the second one.

If we come back to the original topic, after the 2nd World War there were 2 major conferences: political issues were discussed at the first one which took place first in London (and UN was created), and then in Teheran, Yalta and Potsdam. The second one was focused on the economic future of the world and took place in a small US city, called Bretton Woods.

Bretton Woods Conference, New Hampshire, United State, July 1–22, 1944

Bretton Woods conference and a fatal mistake

3 INTERNATIONAL Institutions were discussed and established following this conference:

- International Monetary Fund (IMF)

- World Bank

- Agreement on Tariffs and Trade (GATT), which then became World Trade Organisation (WTO)

Theoretically, the 4th Institution should have been created with an independent, INTERNATIONAL currency...

However, a mistake was made…

The US Dollar was chosen as a base currency for these institutions. In other words, a NATIONAL currency was chosen to play the role of an INTERNATIONAL currency and the entire Bretton Woods system became a system of dollar expansion, in accordance with the market expansion logic that I outlined in the article Why Global Crisis is Inevitable? Part 3: The Big Lie – all lending to countries was in dollars, foreign investments were in dollars, and international trade was in dollars.

But what if as a NATIONAL currency the Dollar goes into conflict with its INTERNATIONAL functions?

At that time, it did not seem to be an issue as after WWII the US economy was 51% of the world economy. However, it has now become an issue… and we can observe the BIGGEST SCHISM BETWEEN ELITES!

There are number of people who think that Bretton Wood system ended when Nixon ceased the Gold Standard in 1971 and this is JUST WRONG. As I said, the Bretton Wood system was created as a mechanism of Dollar expansion, and nothing changed in this respect. It just facilitated further Dollar printing without an obligation to have a corresponding amount of gold in the FED’s vaults. But let’s go back to our story…

Short History of World Elites

Prior to the 20th century the elite was mainly comprised of (i) old European (and local) aristocracy and (ii) people who benefited from the industrial revolution in the 19th century, ie manufacturers and producers (for example, the Rockefeller and DuPont families in the US). In the beginning of the 20th century old-style bankers were also included in the elite (for example, the Morgan family).

The five Rockefeller brothers

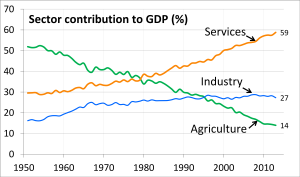

By the time the Bretton Woods agreements were signed the US financial sector was generating only 5% of GDP (which I would say is arguably a standard margin for an intermediary that does not produce anything and just provides service). 5 years later, in 1949, financial sector accounted for 10% of the US economy; in the 1970s it was 15% of GDP.

**When Reaganomics launched, in 1981, financial and adjacent sectors’ share of GDP was 20%, which grew over the next year to 70% (!) by the time financial crisis started, in 2008. **

In other words, financial elites (beneficiaries of the global financial system and transnational banks - let's call them "Financiers") were redistributing for their own benefit 70% of profit that all the economy was generating.

In the article Why Global Crisis is Inevitable? Part 4 – Finale I already explained that this mainly happened because financiers started getting interest not only from producers, but also from consumers (Reaganomics was about economic growth driven by growing consumer debt).

As you can imagine, over the last 35 years this “financier” representative also entered the world elite. Moreover, given the amount of profit the new financier elite was taking vs all others it took a dominant position on the political and economic arena. The rest of the elites were fine with this because prior to 1981 the US economy was in recession and after that financiers were able to provide economic growth. And everything seemed fine, UNTIL…

….Financial Crisis happened!

The Biggest Schism Between Elites

Following the start of Reaganomics, economic growth was driven by growth in the private consumer debt. As a result, the aggregate money supply in the US economy got a big shift towards, so-called, “credit money”, ie money that banking system is creating.

By the beginning of 2008, credit multiplier (proportion of “credit” money to real cash money) in the US raised to as high as 17x times: for every $1 deposited in the bank, the bank was lending $17 dollars. This multiplier started falling after 2008, financial system started collapsing and the US government undertook a lot of actions, including monetary expansion and bail-out mechanisms to save it.

As a result of this aggressive money-printing, cash money in the system (M0 aggregate) increased from $800bn in 2008 to $3.2trn in 2014 – a 4x times increase over 6 years (!).

Cash money supply in the US

As I said above, this happened together with the falling credit multiplier. Putting these 2 effects together, the broader money supply (cash + “credit” money) stayed at the same level, and hence, there was no inflation in the US, in spite of the fact that a lot of cash money was printed.

However, nowadays in the US the credit multiplier has already come back to is normal levels of approximately 4-6x times and further dollar emission will just result in inflation (money supply will be significantly more than 100% of GDP).

So, from NATIONAL American perspective, the dollar emission needs to be stopped in order not to allow inflation!

From INTERNATIONAL Financiers' perspective, the dollar emission should be kept such that consumers don’t default on their debt! In other words, without a CONSTANT dollar emission all the banking system has to recognise massive losses and the entire transnational financing system will collapse.

First group to understand that was obviously the Financiers. And they decided to outdo national elites and to correct the mistake that had been made in 1944…in the small city of Bretton Woods.

What exactly did financiers do and what chain of events did they trigger? I will speak about this in my next article.

Please feel free to leave your comments / questions and follow me if you liked this and want to read more: @conspi-theorist

About me:

In my Blog I write about Politics and Economics, analyse the News, and give advice on where to invest. I studied economics and finance in Russia, the UK and Italy and have worked in Banking, Consulting, and Investment firms. If you follow me I will be able to provide my view with lots of arguments and a very balanced view.

Very interesting post!

@team101 - thanks mate!

@conspi-theorist Upvoted and followed! This is a great post and was chosen to feature on the front page of today's 'Steem Talk' edition: https://steemit.com/news/@steemtalk/steem-talk-your-daily-best-of-steemit-digital-newspaper-wed-evening-edition-22

Thank you!

Good article. I am doing same writing on this topic. Here is my link on steemit https://steemit.com/intro/@greenman/part-4-trust-who-do-you-trust-do-you-trust-your-local-city-council-provincial-or-national-gov-t-do-you-trust-the-global-world

I hope you can give me pointers and please don't mind my run on sentences as that is my story telling style.

Great piece and thanks for sharing. Happy to upvote and share this on Twitter✔ for my followers to read. Cheers. Stephen

Thank you Stephen, appreciated!

Looking good over here @conspi-theorist!

@getonthetrain - thank you, man!

Great stuff @conspi-theorist - I sent you a message via chat, but in case you're not logged on there regularly, I would love to know if you could discuss these topics on my program http://www.AREA51.fm Roswell NM podcast. My email is [email protected] if you'd prefer responding there.

Best, Guy

Sorry, missed that, will reach out to you there..