Are You An Underdog Investor?

Who doesn’t like an underdog story?

Literally, the best movies ever made are based on the underdog conquering the big evil force. Here are just some of the movies based on an underdog story:

- Star Wars

- Rocky

- Karate Kid

- 8 Mile

- Braveheart

- Slumdog Millionaire

And the list could go on and on… Even if you look at sports, you’ll often find that the biggest fan bases are around teams that are the underdog.

For example, the Chicago Cubs won the World Series last year… and it was their first time in 108 years! However, the Cubs have one of the most loyal fan bases in all of sports.

Even though they have won only a single World Series in the last century, they are in the top 20 most valuable sports franchises in the world, at nearly $2.5 billion. And that’s comparing them to ALL sports.

(The Dallas Cowboys and Real Madrid take the top two spots.)

Clearly, people like an underdog story.

And apparently, investors like an underdog story as well. As in, they view themselves as the underdog that can beat the market.

Schroders just released their 2017 Global Investor Study and this was one of their main findings:

"People have unrealistically high annual-return expectations."

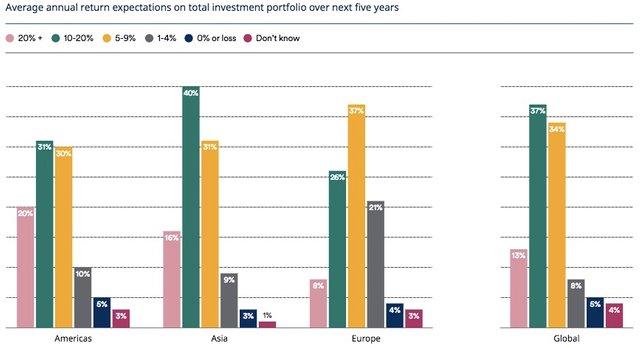

Source: Schroders

Here is what investors think their average return will be over the next five years:

"Millennials prove the most ambitious in their expectations, with an average return rate of 11.7% a year, while Generation X expects 9.9%, Baby Boomers 8.7% and those over the age of 70 expect 8.1%."

I usually don't like to pick on millennials, because, well, I am one.

But, HOLY CRAP MILLENNIALS... WHAT ARE YOU THINKING???

(Oh... and you Baby Boomers aren't off the hook either!)

Look, I'm all about going after big returns. I don't ever want to go into an investment with the goal of making small profits. In fact, that's why I purposefully go after investments that have higher than expected returns.

However, if average investors who are pursuing traditional investment strategies (stocks, bonds, mutual funds, etc.) think they are going to be getting over 11% returns, then they may be in for a rude awakening.

Because the 'expected return' from investors does not match up with the real data.

NOT EVEN CLOSE.

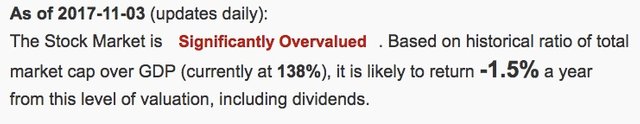

Source: GF

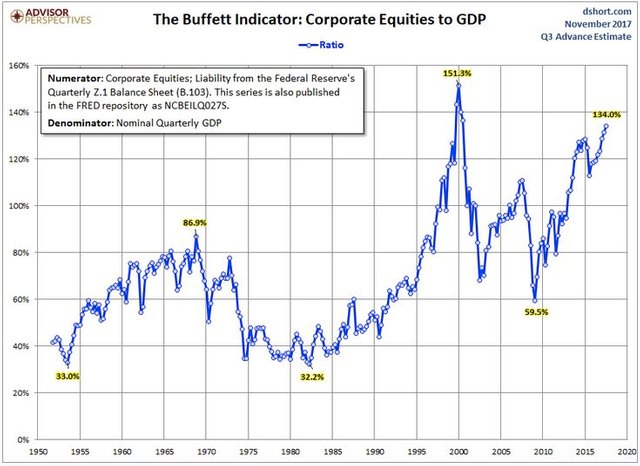

That is Warren Buffett's favorite market indicator.

It's the total market cap to US GDP ratio.

Essentially, this ratio is saying how much the market is valued in relation to what the market is producing.

Or said another way, this ratio shows us what investors are paying in respect to what the market is putting out.

Right now, the market is very expensive compared to what the market is actually producing. This suggests that investors are expecting significant upside in the production capabilities of the market.

But... that's what investors are expecting. When it comes to investing, expectations are often far from reality. There has only been one time in the past 60 years that this ratio has been higher - right at the peak of the dotcom bubble.

Source: AP

So who is right? Investor's expectations or historical market data?

Yes, the underdog story is great in Hollywood movies and professional sports.

But, if you think you are going to be the underdog investor over the next five years, you should either readjust your expectations or look to areas of the market that are valued much more favorably.