China’s Gold Scheme To Back Energy

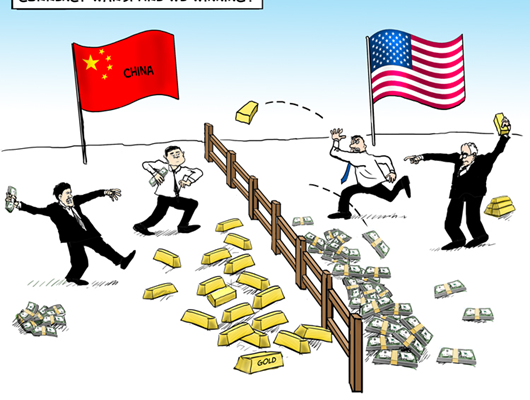

There has been quite a bit of speculation regarding China posturing for the energy market. News recently broke out that China was going to provide a crude oil futures contract that is priced in yuan. There seems to be some confusion regarding the validity, but analysis of the implications is warranted nonetheless. The scheme would change the entire fabric of the international monetary system and move power towards the East.

If China is able to bring this contract online, the mechanics would work in a clever but synchronous manner. Oil exporters to China will accept yuan as payment for oil, and as an incentive, the yuan will be exchangeable into gold. Oil exporters would exchange the yuan for gold with the bullion banks in London. Bullion banks, who are the main culprit of market-making, make the majority of their profits from futures contracts in dollars. Clearly, futures for dollars are not the same as dollars for gold. Speculators do not wish to take delivery of gold, but rather delivery of more dollars. The only issue with yuan for gold is that the bullion banks are most likely not willing to accept yuan for gold. How this will likely work is that the bullion banks will transact to take the yuan, but they will then transact with the People’s Bank of China to convert the yuan to dollars. China makes out perfectly by reducing dollar holdings and giving gold to the oil exporting nations from outside of China. Creating a dollar for gold scheme such as the one described above would deplete the bullion banks of the gold, but the bullion banks will get their dollars.

Additionally, China is the largest importer of oil in the world, at roughly 6 to 8 million barrels a day. If Saudi Arabia decided to take yuan and gold for oil, that would change the market completely. Saudi Arabia currently sells 1 million barrels per day to China, so with a little arithmetic, the math would work out something like this: $50 per barrel oil x 1 million barrels = $50 million per day. If you take $50 million divided by $1,300 gold, that would give you 38,462 oz. of gold. If you divide 38,462 oz. by a ton, that would be 1.20 tons per day. The per-annum rate would be 430+ tons of gold leaving the market per year. In this scenario, the oil exporters would deplete the gold stock, which would increase the dollar and yuan price of gold. In essence, the amount of gold for oil would marginally decrease, which would make the fiat price of gold move higher. This dynamic will cause oil exporters to sell their oil faster and faster, as they will receive less gold daily. To balance this amount of oil being imported, prices must go much higher. In a report from Reuters, Xinhua the Chinese state news agency, announced that China’s gold reserves were 12,100 tonnes at the end of 2016. A spokesman from the national gold association released the information last week. This is an extraordinary announcement if true and the internationalization of China is continuing.

Follow me @cbenn or read here: https://crushthestreet.com/articles/breaking-news/chinas-scheme-energy-colin-bennett

Cheers,

Colin Bennett