Will The Fed Finally Raise Interest Rates To a Reasonable Level ?

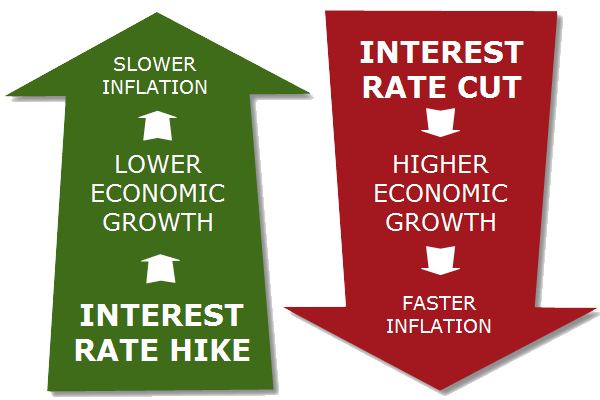

The Federal Reserve has had interest rates near 0 for a long time, but recently has started, albeit very slowly to raise them. There are many side effects of raising interest rates, both positive and negative, so it is something that you need to know about. Interest rates have a ripple effect throughout the entire economy not just simply on traditional fixed income securities like CDs and Bonds. So the real question is will the Federal Reserve continue to raise interest rates and how long can they do it for before we start seeing consequences.

The whole point of near 0 interest rates was in order to aid growth after the 2008 recession. With essentially 0% loans to banks, the idea was they would lend out to people and businesses at low rates, thus pushing the economy upwards. Overall I would say that their plan worked and pretty well, but the fear is what happens to growth when that low cost money is taken away? If businesses need to go to the actual market to get money, will they be able to grow in the same way?

The short answer is no they wont be able to grow as they can and in my opinion we will probably see a bearish stock market or at least a stagnant one for a few years. This is the largest fear from the Federal Reserve in the first place. If businesses cant adapt to the higher rates and the more expensive cost of money, they could have trouble even staying in business. They are trying to take an approach of raising rates very slowly, but even then, we dont know what will happen.

The ultimate goal is really to set interest rates so high that no one will even borrow from the Fed. Essentially banks will use savers money and pay them higher rates for just holding money in an account. This is the money they will use to lend out and give to businesses. Now because the money from the Fed is so cheap, banks hardly even want your money, which is is a bad thing overall. Not to mention banks are getting very rich on this influx of free liquidity.

I think that the longer the Fed holds off on raising rates, the worse the problem will become and at this point we need to just bite the bullet. If we prolong pushing rate hikes back for years, it will all hit us at once and we will feel the effects. Sure rate hikes are going to hurt the stock market, but the truth is the stock market is overvalued at the moment. Price to earnings ratios are out of control, companies arent worth what people are paying for them, but the only reason they are is because its the only option if you want good returns. Once bonds start to pay more as well as savings accounts, people are going to move money back into them. I cant tell the future, but I think the Fed is going to have to raise rates and they know it.

-Calaber24p

Nice post, although I believe that FED is stuck, because by raising rates yield curve will invert. Stock market is in La La Land whit all this financial engineering going on. Bond market is in bubble and when this pops all hell is going to break loose.

Interesting video:

Im trying to stay optimistic , but I agree something could happen.

How do you think this could affect crypto?

You're so nice for commenting on this post. For that, I gave you a vote!

I think they're doing so at somewhat a reasonable pace. However, there are signs that wage inflation is starting to finally happen. It remains to be seen if the current rate at which they are raising interest rates is fast enough to counter out inflation.

I think its hard to see the immediate effects, we might have to wait a bit before the picture becomes clearer. Were still in the short term in regards to when the raises were done.

thanks fopr the blog

and also thanks for the money news

Thats awesome info

Thanks for the info buddy

I always like your posts!

Hope you also like my post