USD/CAD Long Term Technical Analysis - Awesome break-out trade opportunity, don't miss the boat! :D

Hello Ladies and Gentlemen,

I hope all of you are well today. I have a good trade opportunity I would like to share with the Steemit community. Depending how well received this is, this may be the first of many analysis threads I will be submitting over the next year. I trade most markets so my analysis will be spread over many different stocks, commodities, and currencies (including bitcoin & altcoins).

First off, I am not a financial advisor. This is merely my opinion by which I chose to place my trades on. As with any advice received on the internet, do not act upon it until you have researched the subject to death. Trading is a risky endeavor, never risk more than you are willing to lose and never get involved with something you don't have a decent understanding of.

Now on to the fun stuff.

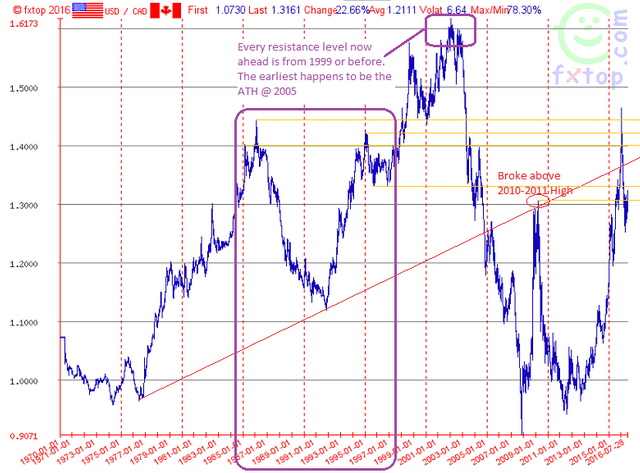

The USD/CAD pair has been on my radar ever since it started it's heavy correction about 3 months ago as I have anticipated a continuation of the long term uptrend. During the last extensive rally, price moved from 1.189 all the way until it reached 1.47, breaking through many important resistance levels of the past, a few not seen since the mid 1990's.

The graph below represents 1/1/1970 to present:

The graph below represents 1/1/1995 to present:

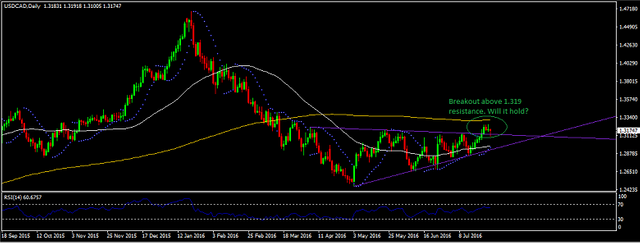

As you can see, USD/CAD has just recently broken through a very important resistance level. It is the level near 1.32 on the graph above. Now that trading is above this level we have now paved the way for 1.34, 1.4, and beyond.

The graph below represents 1/1/2013 to present:

The graph below details the same time-period as the graph above. Dated 11/4/2011 to present:

As you can see, these graphs illustrate the long term uptrend as well as the recent breakout above 1.319 very nicely. Trading formed a near perfect "rising triangle" pattern that was now broken just yesterday and is currently being retested now. I feel very confident about this trade if the 1.319 level continues to hold, especially since oil is also in a down trend.

Trade over the past two years has seen the USD/CAD pair fly from a low of 0.9613 to a high of 1.47, which is a difference of 0.5087 or +34.5%. This is a very respectable move for a currency pair so it is not surprising that it had such a violent correction. That being said, It has been higher in the past and since we are currently trading at levels not seen since the mid 1990's, it seems more than likely to head up than down. Also, when you add the fact that oil is falling and the vast majority of central banks around the world (including Canada) are looking to continue easing, this helps support the theory that we might see higher USD/CAD valuations in the near future.

The graph below represents 11/11/2015 to present:

The graph above illustrates the recent breakout of the USD/CAD pair. The pair traded in a "rising triangle" pattern for over a month until finally breaking out to the upside recently. Price has currently worked it's way down to the 1.319 support line.

The graph below represents to present:

The graph above illustrates the current break out and move back down to the 1.319 support line. Now that we have had a confirmed break out on the longer term charts, we can now look to the short term graph to "confirm" the break out. Typically price will break out and then move back to retest the support line.

- If the support line of 1.319 holds then this is a clear buy signal and I will go long USD/CAD.

- If price breaks below the 1.319, I will continue to watch the pair without opening a trade until price either rises back above the 1.319 level (in which case I will buy) or breaks below the 1.295 level (which will cancel the trade).

Now that we have a clear set of directions to follow for our entry, let me go ahead and show where I'd place my stop losses. The goal here is to know exactly when to enter, exit, and roughly where to take profits. In order to exit our position, we will be moving our stop losses up as price surpasses each new resistance level. This will make it so the price dictates when you get out instead of your emotions. Move your stop loss up to each support level as price moves past it until you are naturally stopped out of your trade. Here is the trade info now:

The graph below illustrates all Stop Loss, Entry, and Take Profit levels for this trade.

- Entry: 0.1319

- Aggressive Stop Loss #1: 1.26997 - 38.2% Fibonacci + Support level (-0.049 risk)

- Passive Stop Loss #2 (recommended): 1.2432 - Lowest level traded since 5/1/2016 (-0.076 risk)

- Take Profit (minimum)#1: 1.4 - 23.6% Fibonacci + Resistance level (+0.081 profit)

- Take Profit (medium)#2: 1.467 Previous High: 1/1/2016 (+0.148 profit)

- Fibonacci Extension #1: 1.532

- Take Profit (high)#3: 1.543 - Resistance level from 8/1/2002 (+0.224 profit)

- Take Profit (max)#4: 1.619 - Previous All Time High reached 1/1/2002 (+0.3 profit)

(Example of Risk/Reward ratio: For every $1 you risk, you stand to gain X dollars.)

Here is your Risk to Reward Ratios using the Aggressive Stop Loss (larger chance of failure):

- Take profit #1 = 1 Risk / 1.65 Profit

- Take profit #2 = 1 Risk / 3.02 Profit

- Take Profit #3 = 1 Risk / 4.55 Profit

- Take Profit #4 = 1 Risk / 6.12 Profit

Here is your Risk to Reward Ratios using the Passive Stop Loss (smaller chance of failure):

- Take profit #1 = 1 Risk / 1.06 Profit

- Take profit #1 = 1 Risk / 1.95 Profit

- Take profit #1 = 1 Risk / 2.95 Profit

- Take profit #1 = 1 Risk / 3.95 Profit

If you are wondering what instruments can be traded in order to capture this move, I have listed the 3 most popular down below.

- Forex Pair: USD/CAD - Long

- Future Contract: Canadian Dollar - Short (put)

- Forex ETF: Symbol=FXC Guggenheim CurrencyShares Canadian Dollar Trust ETF - Short

There you go ladies and gents! I hope you have enjoyed this write up, I have spent quite alot of time on it.

P.S: I have a great Stock pick to reveal next, one that I believe could turn 10k into half a million or more... so stay tuned, I am working on it as we speak!

Take care and happy trading! :)

Wow, very in depth. I was just happy I could use my Canadian money at the recreation weed stores in Washington state and get 20% vs the 24% exchange currently offered. Your thinking I should have waited then? lol

Well, Technically you did ok, The USD/CAD is actually the USD rising against the CAD. So, I'm calling for a Short Canadian dollar trade expecting it to go lower :). Feel proud! You got more than you would now buying weed at the shop :)

TBH, I went back to read that, I am unsure now what you meant. Does Washington state accept Canadian dollars now? D: D: If so that's friggin awesome man.

Damn, that is nerdy indeed. I'm not sure how useful it would be to people outside of North America who might have a harder time to acquire those currencies, but as a Canadian this is highly interesting, even if it's just for vacation purposes!

haha :D Thanks man. I take my nerdness to the next level. Regardless, If you are interested in trading these types of things you just need to find a Forex broker :) I used Oanda for many years and loved them. Alpari is another one that is big. Just figured I'd let ya know so you can have the same opportunities I do in the future :) Take care man, Best of luck with trading.

PS - Just thought of something. 1Broker and Simplefx!! You can use bitcoin to trade Forex and Stocks :) It's not very legitimate yet (I'm pretty sure they don't actually purchase anything and just follow the prices) but, they do pay out, i've used 1broker quite a bit back in the day

Super detailed post, I look forward to following your updates.