Why I don't believe Dave Ramsey is good for the unconstrained

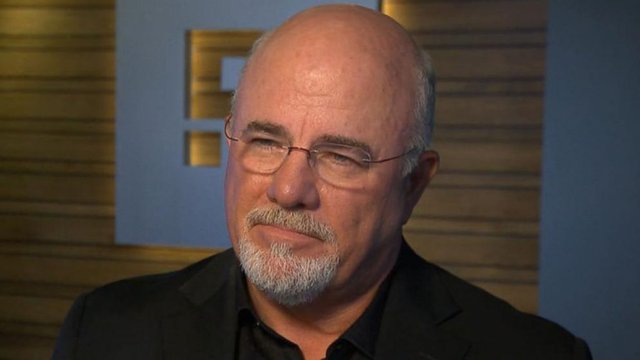

If you have been living in the dark for the last 10-20 years, you probably haven't heard of Dave Ramsey. He's a very successful radio talk show guru who has been able to garner a following of millions to his teachings.

His focus is to use a Christian infused set of teachings that parallels his own financial journey. It began in a quest to become an instant millionaire that failed, leaving his family in massive debt, and how he dug himself out of that to eventually find financial security. From there, he told the rest of the world his journey and turned it into a media empire.

Well done, Dave. You took lemons and made lemonade out of it. But I am going to go out on a limb and say that this is not the process that most of the unconstrained are on, and why taking the Dave Ramsey "fork in the road" may not help your long term financial position.

Dave Ramsey is good for those down on their luck

Most of the people who congregate to the Dave Ramsey message are those that probably congregate to watching 3AM Infomercials that tell them that they could be a real estate millionaire with no money down. Or that religiously watch QVC channel and pick up the phone to order crap they don't really want or need. Are subject to making rash decisions on the spur of the moment without critical thinking. You see no matter how good your strategy is, if you are not strategic, you can't benefit. You will forever be chasing the next shiny object down the rabbit hole.

For many of those people, Dave Ramsey is another shiny object.

So those that are emotionally sensitive to any thing or person that has the "answer" to their poverty, their enslavement, their lack of hope for the future, are going to gravitate to Dave Ramsey and spend $ to buy his teachings, his books, his videos... anything he and his multi-million dollar corporation is willing to sell. He will promote services that he has a kick back in, and the gullible will follow it like moths to a flame.

.jpeg)

The conversation gets degraded as to whether his teachings are the answer, rather than the conversation directing at understanding exactly what the problem is, so that a solution can have the greatest efficacy.

And for that reason, 99% of the followers of Dave Ramsey are no different to most of the population in that they will follow anyone that has a message of hope rather than actually looking critically at their situation, accepting their mistakes and learning not to repeat them over and over again. The very same people that fell into a debt hole by buying crap at the malls, on TV, on the Internet, etc. that they never really needed, but reacted in an emotional "shoot from the hip" fashion, find themselves in debt and then do exactly the same thing again to buy the antidote - which they have determined is Dave Ramsey. It is not.

No one has the antidote to your bad habits other than you

The problem is that we are programmed at a very young age as to our belief systems. And most of the programming is from those that are not experts in financial independence or life. They are our parents. Their failures will become our failures. Until you realize that you owe a debt of gratitude to your parents for ensuring that you didn't die as a child, but not necessarily that their life experiences should become yours, will you learn the art of critical thinking and how to see through a scam. Here's a really quick overview as to what really went on before you reached the ripe old age of 7 years old:

This is why most rich people come from rich families. They observed at the most programmable stage in life the habits of successful parents.

Those that became wealthy in spite of their families developed the art of critical thinking early, and realized that life has challenges and that maybe they were not well equipped for those challenges from their parents. That they had to seek knowledge and answers from other sources and many were lucky enough to awake the entrepreneur within early. But still, it is a life long struggle with changing habits that they had to overcome. And if you had parents that instilled the very opposite of strategic financial thinking into your brain at an early age, it is a monumental struggle to fight against that. Your entire belief system was pre-programmed and needs to be refactored into something that is more in tune with a strategy that will overcome life's challenges. And unfortunately the challenges that you face are probably 3x more difficult than your parents due to the advance of technologies and the scaling of influence that never existed pre-Internet.

I'll give Dave Ramsey two pats on the back

If Dave Ramsey did one thing, it is to curb the downward spiral of the debt laden. By promoting a "STOP WHAT YOU ARE DOING RIGHT NOW!" approach to financial spending, at least you can halt the downward momentum. Cut up the credit cards, live a life on "rice & beans, beans & rice" as he says and halt the insanity. Sure, I get that. That is just part of changing course. But like an aircraft carrier in the ocean, heading in the wrong direction, cannot immediately turn 180 degrees around, your life probably can't as well. It has to be done incrementally.

But wouldn't it be better to have an idea where you are going and maybe then you could look critically at different ways to get there? The problem with most of the Dave Ramsey audience is that they are meandering along - no sense of direction and therefore anything along the way becomes the distraction that they sorely look for.

I'll give credit to Dave Ramsey for two things:

Stop the bankster infused notion that you can afford that XXXXX (insert house, car, TV, education, etc. here) because "you deserve it". You don't deserve it, until you can afford it. Period. Cut up the credit cards and direct bloodline to other people's money because you are not yet worthy of the risk. You have to learn to be worthy by regaining control in your own life first.

Build up an emergency savings fund that will cover you for 3-6 months of actual expenditures to remove the stress of being out of control, and to then allow you to regain composure and focus on where your ship should be heading.

Great. Now you have a bit more control. But what is to stop you from repeating the same life habits that got you in that mess to begin with? Sure, you now have someone loudly proclaiming that you should stop the insanity. But the insanity came incrementally. Little bit at a time. That dress in the store, that car in the window, that item on the menu at your favorite restaurant, etc. If we have a culture that rewards you in small steps for living "a good life" and yet never actually agrees what that life should be, you revert back to what your parents taught you prior to 7 years old of what a good life was (hopefully they were there to do that). After all, what else? The church? The government? The TV? Do you get your moral compass from institutions that don't have your best interest at heart?

And sorry, but Dave Ramsey also doesn't have your personal interest at heart. He has a macro-level interest in a marketplace that will direct money in his direction, rather than in their own. Sorry to burst your bubble here, but it is true. You can take from his teachings some parts of the answer, but it isn't the complete answer. Believing in faith that it is, is the very same bad habits you are doing that got you in the predicament that you are in. And chances are it is the same bad habits that your parents practiced and that you learned from. When they are old and grey, can you support them if you are following the same poor financial practices that stopped them from developing a retirement plan that is able to cover them when they can no longer work? If not, then you have some serious work to do.

So what is the answer?

First you have to realize that the answer is within you, but you have to undo the teachings and bad habits that you learned at your most vulnerable periods in your life. That means you have to be willing to look in the mirror. First, life is not a serious of short sprints joined together. There is no "easy money", no "quick buck", no gains without struggle. But that just struggling isn't the answer to give you gains. Struggle is a part of it, yes. But struggle has to be for a purpose and that purpose needs to be defined. Precisely and categorically.

With purpose, you can plan your road trip to it. Realize along the journey, you will be distracted. The media, the pre-programmed agendas you got as a child, your perception of your value as compared with your peers, etc. That the pre-determined path of spending 1/4 of your life in education, 1/2 of your life in work, and 1/4 of your life in retirement, is a failed methodology that doesn't work. That life is about experience and you need to find a way to be sustainable throughout it.

The key is to first stop being distracted, and focus on sustainability. You need to bring in as much money as you expend. It is that simple. But how you do that determines whether you can move forward from that effort. You will never be able to advance past sustainability with a job. Because the boss won't pay you more than the others (within reason) and that you don't want to work for the boss in the first place. Unless you can curb lifestyle inflation, just saving a massive percentage of your income alone will only allow you to amass money. It is what you do with that money that determines whether you can be sustainable without human effort. Once you have achieved that, you at least can find some peace.

From that point, what you do is entirely up to you. Maybe you want to scale up and make billions? Maybe you want to spend your time in the service of others. Maybe you want to devote your time to creation and invention? Maybe you just want to sit around playing video games all day? Who knows. That is your choice. But you can't do any of this until you have reached a point of financial sustainability, and Dave Ramsey offers no answer or direction in terms of achieving that other than to cut up the credit cards and pay off your debt.

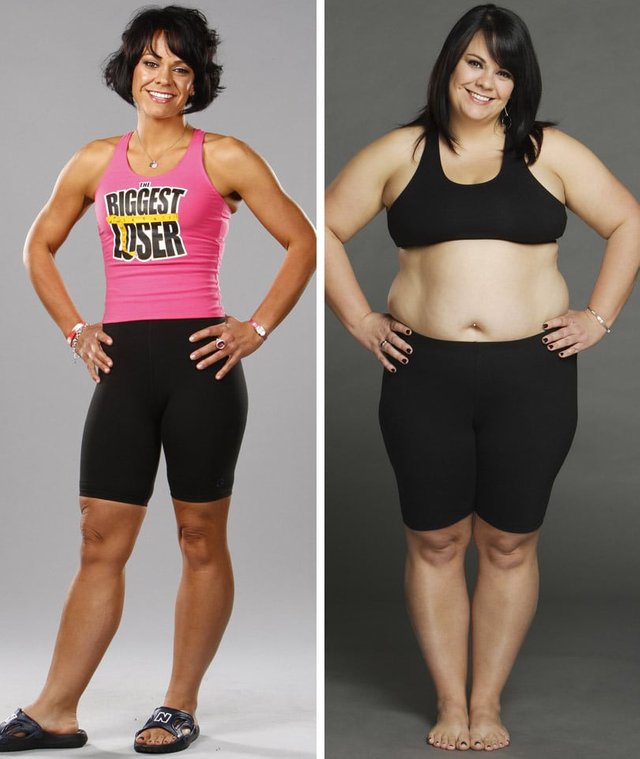

Dave Ramsey's teachings are like a diet plan

Like a diet, 85% of all people on it will gain back the weight after 2-3 years.

That doesn't mean that you shouldn't try to change your habits, but it is your habits that created the problem and most of those habits are due to distractions that you were pre-programmed to be vulnerable to. Once you start to realize that, apply critical thinking and rationality to your observations and decisions, and to get a real roadmap of where you want to be, can you ever do anything more than a small detour on the journey to enslavement and debt.

So I give Dave Ramsey props for trying to move people off that downward spiral. But well before Dave Ramsey came along, you were pre-determined to be on that road. What you have to realize is that you have a bit of work to do to reprogram your mind and habits to realize it isn't a road you want to be on. And maybe your parents subconsciously infused that into your brain before you reached the age of 7. If so, you have to do some hard work to undo that.

Remember, being Unconstrained is about critical thinking and being a contrarian. It takes courage and effort, and you will be criticized, questioned and challenged by all those that don't embrace those properties.

You got a 3.26% upvote from @booster courtesy of @beunconstrained!

NEW FEATURE:

You can earn a passive income from our service by delegating your stake in SteemPower to @booster. We'll be sharing 100% Liquid tokens automatically between all our delegators every time a wallet has accumulated 1K STEEM or SBD.

Quick Delegation: 1000| 2500 | 5000 | 10000 | 20000 | 50000

I don't think Dave Ramsey is a fake. But I do question most of his teachings as just peddling a fiction to the most vulnerable.

The main things with Ramsey is he preaches debt as basically the devil. For a long period of time (before I even knew who he was) I believed that myself.

I have since learned the difference between good debt and bad debt and have used reasonable leverage for my real estate investing business successfully.

All while probably still being to conservative with what I have done. Then again, I'm the scaredycatguide for a reason ;-)

If you manage the liabilities of money as a business would (per your real estate investing business), then you are no different to any other business. Very few businesses I know of funded their own inventory or their own capital equipment. Most use borrowed funds for this, but since there is a concept of leverage and they are trading on the cashflow, it works. When people think that their personal finances can be managed the same way, but have no business acumen, things go wrong.

Yeah, I can agree with that. I supposed I was lucky I had an interest in finance at a young age and understood both sides of the fence.

I upvoted your post.

Keep steeming for a better tomorrow.

@Acknowledgement - God Bless

Posted using https://Steeming.com condenser site.