Earn on average over 10% by investing in real estate short term loans (bridge loans)!!

Hi everyone,

I have written about my experience investing in short term bridge loans secured by real estate in prior posts with Groundfloor. Groundfloor allows all investors whether you are accredited or not to invest as little as $10 per loan and earn 10% plus annualized returns.

I have been investing with Groundfloor for almost two years now and have been very pleased with my returns. I have invested in a total of 424 loans to date and have only had 1 loan that where the borrower has failed to perform and Groundfloor is currently exercising their rights to foreclose on the property to recoup some of the investment.

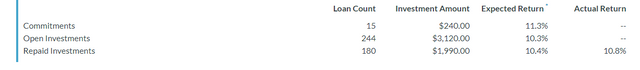

I currently have had 180 of my 424 loans repaid to date and those loans on average earned an annualized return of 10.8%. See below for a screenshot of my current holdings and returns:

As you can see these loans have historically performed very well and have typically been paid back prior to the 1 year maturity date. Bridge loans are definitely riskier than a savings account but since Groundfloor allows you to diversify by investing $10 per loan the risk is greatly minimized.

I have written in more detail about these loans in previous articles which is why I am not going into to much detail here. I just wanted to post an update and my referral link since Groundfloor is running a promotion for September where if you use my link below you will receive a $20 bonus once you deposit $10 into your account and invest it in one loan. I will also receive $20 as compensation to so it is a Win-Win for everyone! If you want to try out this asset class and basically get 2 free loans when you invest in one during September use my link below and give it a try. Groundfloor also allows you to invest in IRAs so that may be a good option also. See below for my referral link if you would like to earn $20!

https://www.groundfloor.us/new_referral/f11513

Once you sign up using my link you can get your own link and earn $20 for you and anyone you refer during September. (After September the referral bonus goes down to $10)

For someone who wants to diversify into a different assets class that historically is has had higher minimum investments and has not been available to non-accredited investors Groundfloor may be a good option for you.

If you have any questions about my experience with the platform feel free to reach out and I can provide more details.

This article is not investment advice and you should consult your own advisor before investing in anything mentioned in this article. I am not providing any legal, investment, tax or other consulting advice. This article is for informational purposes only.

Hmmmm, too good to be true, I literally haven't heard of this, but i'll carry out my own research before putting any money here.

I am a real estate investor and have even used bridge loans on deals before. There are many products like this popping up, which is all well and good while the market is still rising and interest rates are rock bottom.

The thing is, most of these loans are for people either flipping or getting their property or financials in a position to refi into a longer-term loan so there is risk in people not performing.

On the flipside atleast the lender has a lien on the property and can foreclose to recoup the loan amt, which is good collateral for a few here and there. But if there is any real downturn in the market things get ugly quick.

This isn't to say one should not invest in such products, but just be cognizant of what it is and the risk-reward. This would qualify as your "risky" portion of an overall portfolio in my opinion, and again. I am a real estate investor. I share a ton of real estate info on my steemit blog and on my website https://scaredycatguide.com/category/real-estate-investing

Totally agree with you and I understand the risks that come along with the large return. You wouldn’t get that return if there wasn’t risk and it definitely should not be a enormous part of your net worth. It only makes up a couple % out of my entire portfolio. I will definitely come check out your blog! These investments are definitely not for everyone but I figure $10 bucks for $20 just to try it out is worth it to me for a few minutes to open the account haha. Even if you did just that to see how these work you get a 200% return on one loan and you can get some feel with out risking much. I did it with my friend and the promotion does work so it has been confirmed.

Posted using Partiko iOS

Nice, gotta love those promo $$$. And yeah you are basically free rolling just to try. Love those scenarios!

Yes you definitely want to do your own research and make sure you read the agreements etc. Never want to invest in anything before doing that. It’s not to good to be true there are many hard money lending opportunities with similar returns. I have done similar deals but minimums have been much higher. It’s a good way to get into this type of investment for a low amount of money and try it out. It’s not for everyone as the risk is higher which is why you receive a larger return on your investment. By no means are these returns guaranteed like a bank savings account. I just like them due to the low barrier to entry with the ability to diversify your loans with not a lot of capital. You should take a look and assess fir your self. I have a high tolerance for risk but it doesn’t mean it is right for you unless you understand exactly what your risk is and what your investing in. Definitely do some due diligence before you commit to any investment.

Posted using Partiko iOS

Yeah, alot of these are popping up over the years. Fundrise is another one though they focus on several loan types.

Being I'm an investor I'm the guy that generally you are making the money off of, so long as I perform.

I have two projects right now that if I didn't have the cash to put up myself then I'd of pulled a bridge loan.

I like these products cus of the high yield, but also know that I am relying on people out there flipping houses and/or trying to refi into longer-term loans to perform on these.

I do alot of real estate meetups and have helped many real estate investors and now there is too many people that don't know what they are doing, the rising market and low interest rates have been a savior at time.

This product will probably perform well while the market/economy is still good and I may even jump into some loans myself, just be sure to pay attention to any market downturn. That is when you want to lighten up as more of these loans will start to go bad.

Couldn't agree more and I wouldn't everything you have into it either since they are higher risk loans. I have invested through Fundrise also for a few years and they have delivered decent returns as well also with a low barrier to entry if you want to get your feet wet without risking a ton of capital. I believe Fundrise has a minimum of $500 to start which is pretty low.

I am also in one small deal on SmallChange which was a new construction equity deal of a odd lot and that is set to perform fairly well as of now. This is also a very high risk deal but I only have $500 in it to test out the site.

great post buddy;

read here something about investment : Lаunсhing Yоur Real Estate Invеѕting Cаrееr — Steemit https://steemit.com/drcgcoin/@growingcryptos/drc-gold-miners-the-love-of-gold-a-bright-future

Your level lowered and you are now a Minnow!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.