Bitfinex - Conspiracy theories

Bitfinex Meltdown recap

August 2nd

Bitfinex Takes site offline

Announces 'some' bitcoin was breached from 'some' of their users accounts.

Announces close to 120,000 BTC was stolen from their Segregated Wallet system.

August 6th

Bitfinex announces their attention to resume operations and how to compensate client losses as a result of the incident.

Some information was leaked prior to this announcement that detailed a haircut of 36% plus a debt token issuance in the form of BFX Token. Whilst this was initially denied, it turns out the leak was actually true.

To be clear, what Bitfinex intends to do, is socailise the losses across all accounts and asset classes. This means whilst users who did not hold Bitcoin had no risk of their funds being breached, they are now in a position of liabiity. Whether a user holds fiat, ltc, eth/etc they are now susceptible to a generalised loss of 36%

BFX tokens are to function like a security where dividends will be paid out from site operation profits.

Supposedly this token will be tradable on the poloniex exchange.

DID THE HACK ACTUALLY HAPPEN?

We saw plenty of people point to the reduction in bitcoin stored in p2sh addresses in a very short time frame almost account for the exact amount of Bitcoin stolen, but the important questions remain regarding how this could have happened on a multi-signature setup that requires two independent party signatures for a transaction to happen.

BitGo was quick to announce that their servers were not breached, and that their responsibilities as co-signer were fulfilled with no tampering. The obvious question here is, if the site was implementing a multi-sig wallet system with 3 keys held by two independent parties, then surely BitGo's key would also have to be breached? Unless... Bitfinex's has access to BitGo API that allows them to effectively sign with BitGo's key on demand.

What is then the point of claiming to be secured by multi-sig if one party is able to effectively move all the funds ?

We can speculate that the CFTC's pressure on Bitfinex led them to implement poor security protocol. However, it still doesn't answer the question of how theft of such large scale could happen without tripping warning lights earlier on?

The question becomes quite compelling when we consider that Bitfinex has been at the centre of many unplanned outages resulting in large bitcoin price movements each time - 3 in the past 2 months alone.

We have evidence that executives with access to non-public information actively trade on their own exchange, so this is already something we no longer need to speculate over. However, is it possible that the scale of manipulation extends past just one person trading on insider information? Could it be possible that the exchange participages in aggressive manipulation of bitcoin price action, and does so with users funds?

This is a possibility that would explain some of the theories to come.

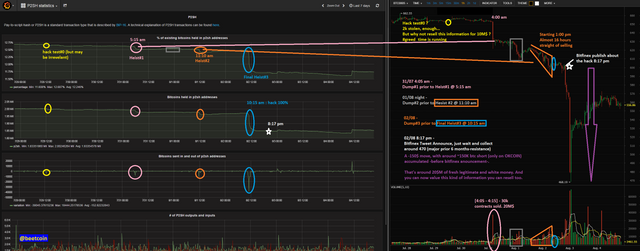

@beetcoin has some interesting remarks regarding price action around some significant events.

Whilst we can see that 120k btc did actually move, it doesn't mean that those bitcoins were not under the control of insiders to bitfinex. But why would they need to create such an elaborate story? What are their motives?

Naked Shorting

Thanks to r0achtheunsavory for his analysis on price action around the halving and brexit vote, it is suggested here that Bitfinex effectively sold bitcoin to bidders with bitcoin they did not really have and could not cover their shorts on unexpected brexit vote results.

This angle is still plausible as we haven't had a full audit of Bitfinex for proof of reserves. The scenario here would suggest that bfx indeed trades against their customers and furthermore does so with customer funds.

EXIT STRATEGY

Regardless of whether BFX traded against customers or not, it still remains a centralised service that relies largely on trust. Despite being touted as a western exchange, its operations are based in Asia. It is not a regulated exchange, it is only compliant to some requirements set forth by the CFTC. A possibility is that they simply hit their number and rather than stealing and pulling a gox, which would in turn harm the btc, they came up with the plan.

The plan allows them to steal north of 60m USD and a chance to stay in business. Then, over time, they can continue to unload 60 million worth of BTC on their own exchange.

SOCIALISED LOSSES

When an institution is unable to repay in full to its creditors, it is considered insolvent. Fractional reserve banking has given us both relative financial prosperity and also the bankruptcy of some of the highest profile financial instutions in the world. Bitfinex is no longer whole, and with their public announcement, regardless of what really happened, they are now plannning on giving every account a generalised loss of 36% across all asset classes. In traditional banks, having a hole in your accounts is very normal, infact, this liability can be sold on , over and over again, and it is effectively how money is created out of thin air. With something like Bitcoin, it is impossible to create bitcoin out of thin air to move the 'hole' along.

Their plan for making customers whole involves issuing a security that pays dividends on profits resulting from site operations. This 'BFX COIN' will carry the debt of what is owed to customers until redeemede in full by bitfinex or in exchange for shares of iFinex. Such debt instruments have been scorned upon by even altcoin exchanges such as Bittrex. For fear of getting into trouble with the SEC, any listing of a token that functions as a security is prohibited. How they plan on getting this coin listed on Poloniex is another matter, but it would be a risk to the continued operations of Poloniex.

Furthermore, what incentives does BFX give investors to buy their debt ? The exchange relies largely on reputation and trust for which it has largely lost. A resumption of operations would likely yield reduced operating profit, if profit at all, Those wishing to sell their BFX tokens may find they are unable to liquidate close to their issue value because of course, BFX would only be interested in buying back their debt at the lowest price possible.

MOVING FORWARD

It is certainly a legal mine field that lawyers now face, any class action lawsuit may not be in the best interest of its claimants as any funds recovered will likely be straight to the pockets of the lawyers. At this point, both BitGo and Bitfinex have already sought to protect themselves by first BFX assuming 10y0% responsibility for their inadequately secure implementation of multi-sig and noting Bitfinex's terms of service that feature a broad definition of loss and force majeur.

Implementation of Multi-Signature Segregated Wallets need to be put through a stringent litmus tests, and not rushed to implementation. Authorities need to be educated further on the consequences of technological implementions that are not yet mature, and liable to attack.

Exchanges need to be more open, not only on their security measures, but actively take a role on hiring the best security experts to interrogate their security implementation. After-all, when you are the sole custodian of tens of millions of dollars worth of customer funds, security is utmost importance.

Tansparency of security audits and proof of solvency should be conducted regardless of authorities regulations or requests to do so. Users should expect nothing less. Public ledgers have been touted as one of the major reasons people put faith in Bitcoin, seeing regular audits and proofs of solvency is not asking for sensitive informtion, it is asking for essential information.