As some analysts project Bitcoin to be the 'new gold', the question to ask is does it replace paper or physical gold?

Are cryptocurrencies such as Bitcoin a replacement for sovereign currencies like the dollar, or are they more comparable to bonds, securities, or commodities such as gold? That is the question that many analysts on both sides of debate have been trying to wrap their heads around ever since cryptocurrencies exploded onto the markets late last year.

Perhaps the real answer lies in the fact that Bitcoin, Ethereum, Litecoin, etc... function in part as all of these vehicles while at the same time having intrinsic flaws that create conflict when they interact with the current monetary and financial systems. By this we mean that cryptocurrencies may have a specific definition of their nature and attributes according to their creators, but so far they have been treated as different types of assets by different investors.

Nearly 70% of all Bitcoin transactions take place in just three countries in the world... Japan, South Korea, and China. And in the majority of instances, these trades were focused on using the cryptocurrency as an arbitrage to help investors in these countries get out of their own sovereign currencies and into ones like the dollar or euro. Thus their use and intent for Bitcoin wasn't as a medium of exchange to buy goods and services but simply as an alternative Forex trade.

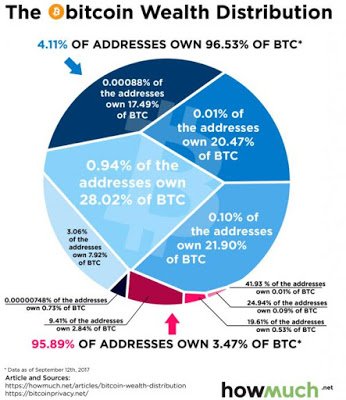

Likewise, a new study out using blockchain data shows that Bitcoin ownership is limited to just 4% of cryptocurrency wallets owning 96% of all the Bitcoin currently available. And this limited segregation of the cryptocurrency means that the price can be controlled or manipulated the same way a chip leader at a poker table can aggressively control the betting habits of the rest of the players.

And then there is the story Jamie Dimon of JP Morgan will sack any of his bankers who own them. (Hah.. we’ve heard them bragging in the pub about how much they’ve made from holding Bitcoin.) - Bill Blain, Mint Partners

Then there is the argument being made by Bitcoin evangelists that cryptocurrencies are the 'new gold', and are taking over the purpose that gold has had regarding wealth protection for the past 5000 years. But this premise is quickly refuted by the fact that Bitcoin's volatility is so great that one can gain or lose upwards of 20% of their wealth in a single day, which is no different that what citizens of Zimbabwe experienced in their stock markets two decades ago during their country's hyper-inflationary period.

Thus in reality if there is a comparison to make between cryptocurrencies (Bitcoin) and gold, it is in the paper markets only, and not in the physical markets. Ie... Bitcoin now has an ETF and of course gold has one as well (GLD).

Lastly Bitcoin has yet to make a serious dent into the consumer economy as while a few retail stores claim to accept Bitcoin for payment of goods and services, very few actually accept Bitcoin directly and instead accept third party conduits like eGifter which you first have to purchase to 'load' your Bitcoin into and then the card company will deliver the monetary conversions into dollars which then are processed in the retailer's Point of Sale (POS) system.

Thus why would you use your fiat currency to buy Bitcoin to then have to buy a third party debit card so you can pay for goods that could have been purchased without all the middlemen with your fiat currency?

Sovereign governments are now in the process of preparing for an end to dollar hegemony and the uni-polar reserve currency system. And those who are at the forefront of this are stockpiling physical gold, and forging new trade partnerships that will one day soon facilitate trade in a gold backed system. And while cryptocurrencies of some form and fashion will play a significant role in the future monetary layout because the Blockchain has been widely agreed upon to be an intrinsic part of that future, the likelihood of private de-centralized cryptos such as Bitcoin achieving the necessary critical mass to become fully mainstream appears unlikely, and will remain a speculative asset that will be traded more along the lines that paper gold is today, than as a replacement for the purposes and attributes that are intrinsic in physical gold.

BITCOIN IS A SCAM SET-UP BY PENTAGON – HC ON DIEGO GARCIA ISLAND!!

☼

https://busy.org/@motherlibertynow/bitcoin-is-a-scam-set-up-by-pentagon-hc-on-diego-garcia-island

It's Official! Did the NSA Create Bitcoin? That's Classified!

☼

LAST DAY OF BitCOiN! CrYpToS in FREEFALL!

☼

Congratulations @argonath! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Hello sir

Would you like to join this company program?

Company name is x-traders.

New lunching company program .

$20 SIGN UP BONUS.

7 level referrals commission.

LEVELS OF CAREER LEADER 11.

BIG MATCHING BONUS.

Life long time passive income.

Life changing program.

If you join this company then you can change your life. Trust me. If you want to more details then click link below.

Read more details and after that join this company program.

More details https://x-traders.com/?ref=12025064