The Origin Of Money

Another controversial topic perhaps… There are numerous theories and historical evidence for the origin of money, and it has caused rigorous debate among Economists, Archaeologists, Anthropologists and other Social Scientists… What is money, what constitutes a money, and where does it originate? And considering the importance of money to a functioning market economy beyond that of self-sufficient barter, isn’t this at its most fundamental an incredibly important question? I would argue that it is…

I hope to answer the question of the origin of money as a necessary truth using axiomatic logical deduction, based on Human Action… That is, Praxeology… And I hope to demonstrate this through a simple thought experiment, taken to its logical conclusion… No mathematics, or models, only logical deduction based on the Actions of Humans…

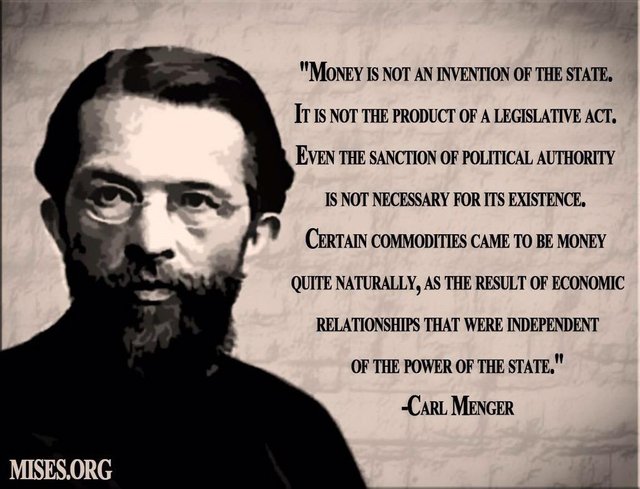

Carl Menger And His Theory of Money

First, we take our leave from the Founder of the Austrian School of Economics, the great Carl Menger (1840-1921)… His visionary insights into the economics of Human Action allowed him to formulate a theory of the origin of money even though he couldn’t explain it fully… He put it thus; “Money has not been generated by law. In its origin it is a social, and not a state institution. Sanction by the authority of the state is a notion alien to it…” So that would rule out Fiat Money and Debt Ledgers would it not? These other origins of money that Social Science has been so fervently debating this last Century? And please don’t think that I dismiss these theories, for there is ample historical and archaeological evidence for both Fiat commodity monies, paper monies however short lasting, and debt and credit ledgers… But to be clear these should be understood as derivatives, as Fiat Decree of the control of money, or control of the credit and debt ledgers, but not as the origin of money… To have control of something must mean that there was a time when there was no control over it, unless you are seriously considering that a Fiat Money or Debt System can invent itself spontaneously out of nothing overnight and everyone not only understand it but start using it from day one?! That is impossible… So now to prove it…

Self Sufficiency

The Thought Experiment… Imagine a life of self sufficiency… You have appropriated or settled land, have set your boundaries and proceeded with constructing a shelter from materials on your land for your family… You grow your own food, have a supply of fresh water, have your own source of heating and clothes… You are self reliant and are able to survive… In this world there is no need for money, because it has no utility… If it has no utility it has no value…

Human Needs and Wants

Even in self sufficient survival mode, ultimately, eventually, you must be wanting something that your own property and labour cannot provide; at some time you will want and need the property of other people… This is logical… There are only two ways to get the property of other people; one is by violence, the other by voluntary exchange… You are a peaceful soul so you will exchange property voluntarily… You know what you want; a pair of shoes… But first you need something for it to be exchanged for… You construct a chair which you hope will secure you the pair of shoes you require… You are ready to go to the market…

Barter

You reach the market and look for the shoemakers stall… You find him and request a pair of shoes, and offer your chair in exchange… Here we hit the inherent limitations of Direct Exchange, that is of Barter; the Double Co-incidence of Wants… If you want shoes, then you are reliant on the shoemaker wanting your chair in exchange… Even if the shoemaker were to desire the chair enough to exchange his shoes for, this would be the exception rather than the rule, for the co-incidence that both parties of an exchange desire exactly what the other is selling, when you think about it, is pretty slim… In this instance the shoemaker does not want your chair… The exchange cannot be made… At least not directly… You still desire the shoes and still have your chair so the next logical step is, you ask the shoemaker what he would be willing to exchange his shoes for… The shoemaker replies that he requires 10 bushels of wheat to exchange with the farmer for the leather for his shoes… You instruct the shoemaker to start making the shoes, while you go in search of exchanging your chair for at least 10 bushels of wheat…

Let’s put aside that to get the wheat you need to find a wheat seller that is willing to part with at least 10 bushels of wheat for your chair, further illustrating how inherently limited barter is for every exchange in an economy, let us just say that you are able to exchange your chair for the wheat…

From Direct Exchange To Indirect Exchange

You get back to the shoemaker stall breathless and highly annoyed, cursing this barbaric barter system… At least your shoes are ready… You exchange your wheat for the shoes you desire… And yet an important distinction has just occurred… This is no longer a direct exchange, but indirect exchange, using a medium of exchange… The solution of Human Action, the Market Economy, to the inherent limitations of direct exchange is exchanging indirectly… We have our first glimpse of the origin of money…

Common Mediums of Exchange

As the Market Economy develops and over an extended period of time, it should become clear that while you may have many common mediums of exchange it is beneficial for efficient market exchange that there are as few common mediums of exchange as possible… The reasons for this should be obvious… The less common mediums of exchange that exist within the Market Economy, the less indirect exchange between common mediums of exchange is required… Simply the market cutting out waste, the Invisible Hand… Wheat for example may be a common medium of exchange for shoemakers wanting to pay for their leather, but wheat couldn’t really be considered a very good medium of exchange… Why?

The Most Common Mediums Of Exchange

History has demonstrated that a select few goods have been used by Humans as money over thousands years, and so you can look at these various mediums and start to identify what properties and characteristics make them better common mediums of exchange than others… I will take my lead more or less from Aristotle of Thrace (384-322 BC) and the intrinsic utilities he identified for a successful and therefore common medium of exchange…

Four Main Characteristics

The first characteristic of a good medium of exchange is durability… This rules out wheat, eggs, and other perishable goods for obvious reasons… Perishable goods spoil and lose their utility as anything let alone as a reliable medium of exchange, whereas a base metal like copper say, would last several years or even indefinitely…You can deduce therefore that successful mediums of exchange tend to be durable materials within the Market Economy, so you are looking at typically metals…

The second characteristic is portability… It should be easy to transport or carry around and exchanged in the market… This would mostly rule out the base metals as transporting a ton of iron to market to buy ten cattle would be a logistical nightmare and frankly insanity… It would make far more sense that the market would pick a precious metal, like gold or silver… A gold coin could purchase the same ten cattle as could the ton of iron, but in a far more efficient and elegant manner…

The third characteristic is divisibility… The word pecuniary (which is a latin name for money) means cows, as herds of cattle were a common medium of exchange in Antiquity; but cattle don’t lend themselves easily to division at least unless you have killed them first… Again if we look at metals, they are relatively easily divisible… A mint can strike any weight of metal into a coin without affecting any of the utility of the remaining metal, while dividing a diamond or a cow would severely affect the utility of what would be left over… Again the intrinsic utility of metals as a medium of exchange comes to the fore…

The fourth characteristic I would ascribe is intrinsic scarcity… Aristotle referred to it as “intrinsic” value, but this has been refuted in my previous post, so I will call it intrinsic scarcity… Every common medium of exchange of the market (free of Fiat Decree) in Human History has this one characteristic in common… Nails, shells, feathers, cows, silver, gold, all of which have been money in history, are all intrinsically scarce, otherwise they would not have value… Think about it, how is an ounce of gold worth multiples of an ounce of copper? Because an ounce of gold is multiple times scarcer in the earth than copper… The historical average ratio between the supply of gold and silver into the Market Economy of fifteen, i.e fifteen ounces of silver supply for every ounce of gold supply, dictated the value of the gold silver ratio at fifteen to one; in other words you could exchange fifteen times more goods with an ounce of gold than an ounce of silver… The supply of precious metals into the Market Economy is steady and expensively mined and produced, which keeps the medium of exchange stable and scarce… If Human History is proof of one thing, it is that the Market Economy should be in control of the money supply…

From Common Medium Of Exchange To Money

So let’s concentrate on the precious metals… History demonstrates that for most of it the precious metals have been the main forms of money… We have established that precious metals have the best characteristics of a good money, that of durability, portability, divisibility, and that the intrinsic scarcity of these precious metals is what gives them Marginal Utility as money… Over an extended period of time, these intrinsic characteristics will tend to edge out other common mediums of exchange, until the precious metals are near universally accepted… A producer only has to accept two mediums of exchange when selling his produce, and a consumer only has to carry two mediums of exchange when consuming the produce of others… So money could be defined as the most marketable good in the economy, the money…

The Implications of Money

When a medium of exchange becomes a money, the magic starts happening… I would define money as a medium of exchange, unit of account, and store of value… When precious metals emerge as the most efficient medium of exchange in the Market Economy, half of the exchange transactions within that economy will be in precious metals… It doesn’t matter if you are buying or selling, the exchange will be done in weights and measures of gold and silver… It will cease to have utility for anything other than money… If everyone is holding the same thing and that thing is already intrinsically scarce, then as the economy develops and more seek it as money, the thing becomes even scarcer… The Marginal Utility of holding precious metals is increased and the Marginal Utility of other goods in the economy decreases against them… Everything becomes cheaper as all of the economy benefits equally from lower prices… A perfect store of value…

But the most far reaching implications of money is as an unit of account… You’ve overcome the limitations of barter by adopting indirect exchange, which evolves into common mediums of exchange, which evolves into money, let’s say, precious metals… What does this mean? You are no longer valuing shoes in chairs, or shoes in wheat, or wheat in chairs… You are now able to value chairs and shoes and wheat, in precious metals… The implications are quite profound… Now the Market Economy has a mental tool for calculating and allocating resources… When all goods in society are exchanged and denominated in one (or two) money, then you have the birth of Price Discovery, which leads to Prices, Catallactics… Once you have prices, then the Market Economy can rationally start allocating resources based on those exchange ratios… Money is now complete; a medium of exchange a store of value and an unit of account…

Conclusion

Money cannot arise from a Decree by a King or a Ruler… It cannot be invented by very clever people and adopted instantly by the ignorant indolent masses… When you really think about it in terms of the Actions of Humans, then money can only originate in the market as the solution to the inherent limitations of Direct Exchange… Only after money has been invented and established in the Market Economy, can a King or Ruler take control of the money supply and use their “Higher” Power to impoverish the rest of us… If money were abolished tomorrow it would only be reinvented the day after tomorrow, because unless you live a life of self sufficient solitude then you need money to get paid for what you produce, and use that money to pay for what you need to consume… Money at its essence is the language that we all use to communicate value and allocate our private property and capital… It is not evil as so many ignorant people believe, but if monopoly issue of it can be controlled by the Ruling Elite, it can and has been used for great evil (One need only look at the madness of the Twentieth Century, the Century of War and Central Banking)…

Understand the critical distinction between money as an elegant beautiful invention of the market for freedom of exchange and trade, and money as a tool of enslavement and misery in the hands of Parasitic Ruling Elites; then you can start to see the solution to our current unsustainable Fiat Debt Slavery System, is in our own hands…

Well done, a great, short primer into the origins of money. A money whose supply is not centrally-controlled is one in which consumer sovereignty can be best expressed.

Looking over the white paper for STEEM it is obvious they thought of this in how it is created and avoids simple inflation via redistribution of new tokens as dividends throughout the system for those that bring the most value to it.

That impressed me the most, frankly. I was always slightly uncomfortable with bitcoin's generation system because it allocates new money at yesterday's prices in the same way that the Fed does. It's not as bad because of the Fed's whimsy, it happens at a predictable rate, but it still concentrates a value arbitrage as a point-source to, effectively, a small group of people.

STEEM's system is far more equitable as producers along with 'miners' are paid handsomely for their time and effort.