How to Create a Budget (and find money you didn't know you had)

Today's post is a follow-up to an article I wrote about Extreme Couponing. If you're trying to save money and you don't have a budget, you could be missing out on some serious money!! Through budgeting, my husband and I have managed to pay off almost $20,000 in student loan debt on a very modest income. So let's talk Budgeting 101.

To create a budget, there is one simple rule: EVERY DOLLAR HAS A NAME. How many of us impulse buy coffee, or spontaneously go out to eat, or grab a few extra items at the store? Doing this can add up to hundreds of dollars a month. You can still get your coffee and go out to eat, but it's important to budget for it.

Start with your income, so you know what you have to work with. Necessities (food, shelter, bills, etc.) come first. After you've factored those in, what do you have left? Name each dollar. We try and set aside money to put in our savings account each month, as well as a small coffee budget, a date budget, and a few other "fun" things. We used to set aside $100 each month for fun spending, but we learned that we preferred paying down student loan debt at a quicker rate. Once we have our student loans paid off (we're almost there!), we will have that extra money to spend each month. We understand that things come up, so we have a small "Misc." fund for gifts, events, or anything in life that might need cash!

Now that you have the basics on how it works, it's time to figure out the best way to keep track of your budget! We primarily use Mint.com and Excel spreadsheets. Mint is a great, FREE website that you can link up to your bank account and categorize your spending. You can see when you are over or under in your created categories. It's also an app, which is great when you want to check in on the go.

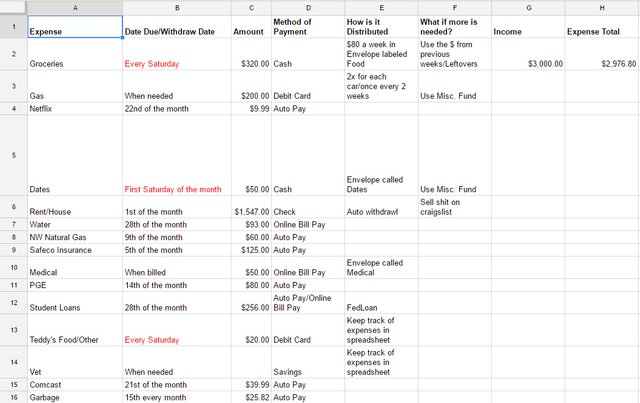

I personally prefer spreadsheets. It's a bit old school, but for me it makes the most sense when it's all laid out. We use Google Drive to create the spreadsheets, which is also free and available as an app. Here's a look at part of our actual budget.

If you don't like either of those options, pen and paper will work great!

So now that you have your budget, how to you ensure you will stick to it? The answer is simple: CASH .

When possible, use cash to pay for things! We have a grocery budget of $80 a week. We withdraw it in cash each Sunday, and put it in an envelope. Once it's gone, we're done buying groceries. It forces me to be really careful in choosing what we eat. By careful budgeting (and couponing), we still eat a lot of meat and fresh produce. When I drank coffee, I would put a certain amount on a gift card each month, and that was all I had to spend. Take cash out for as many things as you can! I keep it divided by using envelopes, or little makeup bags that come from a subscription service.

If you're just starting out, give yourself grace. It will take awhile to get the hang of it and to actually stick to your budget. But you absolutely can do it!! Please feel free to ask any questions or clarifications. Next time, I will share a post about how we paid down my $20k student loan debit!