Here's How The Second Richest Man Made 85 Billion Dollars

The most successful investor in the world, that has topped the Forbes list consecutively, is undoubtedly Warren Buffett. This man has gained massive wealth by simply investing. And what sets him apart from others is that he started with nothing and wanted to stay far away from Wall Street. Today, we will take a look at how Warren Buffett invests and how exactly he made over 85 billion dollars. But first, let's take a look at how Buffett got started. Warren Buffett came from a middle class family, so he quickly learned the value of money. At the age of 13, he started delivering newspapers, selling magazines and saved a substantial amount of money, which he then invested into 40 acres of farmland. He realized that if he wanted to accumulate more money, he needed to learn more about business. When he turned 15, he used his savings to buy pinball machines and placed them in barber shops.

Guidance from Benjamin Graham

Within a few months he owned 3 different machines and then sold the business for 1200 dollars or over 16 thousand dollars in today's money. After graduating high school, he applied to Harvard University but was rejected. He then applied to Columbia Business School, where he met his mentor, Benjamin Graham, a professor at the school. Graham’s classes taught him how you can succeed consistently in the stock market without speculative activities. He realized that the game Wall Street often plays only leads to disasters in the long run. His method was simple, find undervalued companies, that are priced lower than they’re actually worth. This creates the so called “margin of safety” and minimizes your risk considerably without having to hedge your investments. Buffett quickly realized the potential of this strategy. So he went to work with his mentor at his investment firm where he mastered this method. When Graham decided to retire, Buffett had already saved up around 150,000 dollars or 1.5 million in today’s dollars. So, he decided to start his own investment firm. He applied the same strategy. In the beginning of his career, he was mainly looking for small companies that are doing just good enough, but are still undervalued. One of his early investments was Dempster Mill, a windmill manufacturing company which was a struggling business at the time. It was trading at 18 dollars per share but Buffett believed the company’s assets to be worth 75 dollars per share. So even if the company goes bankrupt, assets could be sold and he would still make a profit. So over the next couple of years, he kept acquiring Dempster’s Mill shares until he became the majority shareholder.

Starting Berkshire Hathaway

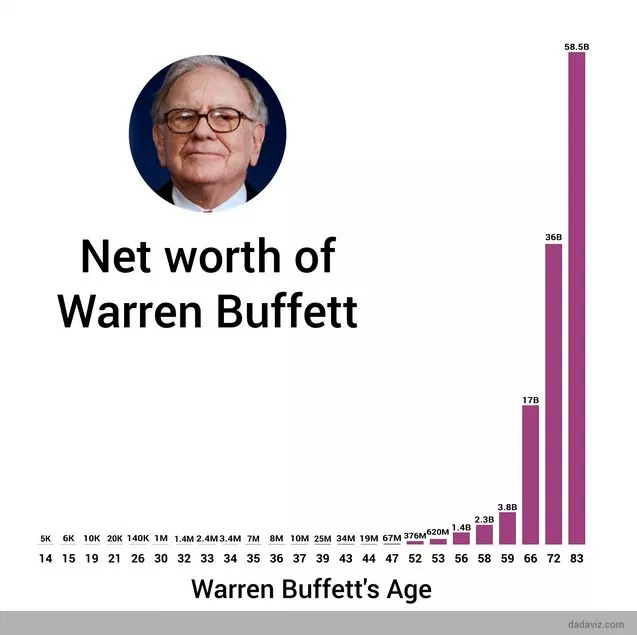

In order for the company to achieve its full potential, Buffett changed the management, improved the operations and was then able to sell the company for much more ($80 per share) than the amount he invested. Buffett made multiple similar investments where he made a substantial profit. And in less than 5 years of starting his business, the value of his investments grew to millions of dollars. In fact, his personal wealth reached a million dollars before the age of 30, which was a goal he had as a young boy. After acquiring Berkshire Hathaway, his approach to investing changed. Instead of focusing on small struggling companies. He started buying more successful companies that were undervalued, such as the American Express. The reason these companies were often undervalued was due to either lack of interest from institutional investors or a recession.

But, what actually made him the richest investor in history is the insurance business, which is a very lucrative field. Buffett realized that insurance companies work exactly like banks. You regularly pay your premium but only get your money back if you get into an accident. So insurance’s companies have a constant cash flow, which are technically considered liabilities. Exactly like the money you deposit into a bank. Suddenly, Warren Buffett found himself having access to enormous amounts of capital which he quickly started investing in the best companies and in the next few years, his personal net worth grew exponentially. He kept doubling his net worth every few years by investing in some of the most successful companies such as Coca-Cola, Bank of America, GM and so on. Until he became the richest man in the world in 2008. Buffett didn’t achieve that by simply speculating and hoping to win. But rather understood how the stock market worked and consistently used the same strategy.