Review on Loki Network

What is Loki?

Loki is a hybrid Proof of Work / Proof of Service based blockchain that allows application development. A short crude way of putting this in my mind is to think of Monero (XMR) as the private version of Bitcoin (BTC), and Loki (LOK) as the private version of Ethereum (ETH). There is a need for private blockchains in my view. For people who do not want their assets on full public display, or individuals and groups persecuted for their identity there is a clear use case for private blockchains.

I've written down a few short bullets:

- Monero hard fork but with a web application layer

- Hybrid Proof-of-work and Proof-of-stake consensus

- The hybrid consensus nodes will allow for a service layer on top of it

- All of the applications built on top of the protocol will inherit the features of Monero:

- 120 second block time

- Cryptonote protocol (first used by Bytecoin then forked to create Monero)

- Ring signatures

- Stealth addresses

- Range proofs (Loki uses Bulletproofs) - verifies Service Nodes hold the required amount of Loki, proves the amount they send is valid (below supply count and non-negative)

- ASIC resistant

Token economics

| Loki supply | 150,000,000 |

|---|---|

| Loki difficulty target (blocktime) | 120 seconds |

| Emission speed factor | 21 (10 ^ (-21) plus 0.5% annual compound growth |

| Hashing algorithm | Modified CryptoNight (Bytecoin, Monero) |

| Elliptical curve | Curve25519 |

Differences between Monero and Loki

Loki expands on what Monero has created. It will include several dynamic features to its block rewards, governance funding, and updates to the CryptoNight hashing algorithm. The biggest change of all is enabling applications (called SNApps - detailed below) to be built on top of the Loki network.Reserve banks in most successful economies target annual inflation rates at 1-2% to stimulate spending and increase the velocity of money.One other key difference is Loki has 0.5% per year inflation rate. Monero's inflation rate is fixed.

People still run networks

Truth is most projects are designed and modified by the people behind the project. There have been a few experimental on-chain governance experiments (Decred, Dfinity) but the results are still waiting to come in. Projects are also susceptible to corruptible individuals. When Charlie Lee owned Litecoin, he could have been vulnerable to a sovereign player and threatened by a group. The trick is decentralize governance while also flexing on scalability and innovation. Loki network will be run by the Loki Autonomous Government (LAG). While I'm not a fan of the acronym "LAG" because it seems like Loki will move slowly, it's just an acronym people.LAG will have three components: Loki Foundation (think of Neo council), Loki Project Team (think City of Zion for Neo), and the Loki Funding System (mentioned below further down).

Yet another fork?

Hard forks unfairly connote negative sentiment among cryptocurrency enthusiasts. There are many reasons why forking occurs. Beneficial reasons vary such as implementing vertical use cases (Achain / ACT) to implementing upgrades (Monero / XMR scheduled hard forks). Potentially negative reasons align around block reward incentives. In the case of Bitcoin, 100% of the block reward is awarded to miners. While this secures the network through competition amongst miners, it also turns miners into profit seekers. When profits are there to chase, miners will increase hash rate and therefore secure the network. In Dash's case, the block reward is split between miners and other nodes that provide other network services (enforcing consensus rules and relaying transactions). When profitability is low for Dash, miners often vacate their hashing power in favor of other profitable ventures. This lower hash rate increases the network's vulnerability to 51% attacks.

Loki attempts to resolve this with an algorithm called the block reward equilibrium which will dynamically allocate block rewards between the different nodes operators (miners, transaction, consensus). When hashing rate is low and/or difficult the algorithm will incentivize miners with a higher percentage of rewards. Alternatively, when service nodes are in low supply the reward will shift in their favor.

Dynamic block rewards

Monero (XMR) funds its project by donation through the Forum Funding System (FFS). It's a sensible system in that it rewards projects that deliver on milestones. Essentially it's an escrow system. This filters out poor projects and rewards good ones. A longstanding criticism of FFS is that it underfunds the ecosystem and is at risk during a crypto recession. Other projects such as ZCash and Dash take in portions of the block reward (2.63% and 10% respectively) to build up their treasury to fund projects. A massive warchest enables these projects to endure tough times and invest for the long term.

Loki will also take in a portion of the block reward into their Loki Funding System (LFS). This will enable them to invest for growth as well as stave off third party influences. Remember, in a network where there is a name-and-face to a project (i.e. Ethereum - Vitalik), the network may be decentralized but the governance and reputation may be completely dependent on that central figure. What would happen to Ethereum's valuation if something happened to Vitalik? There's an incredible amount of risk placed on a central point.

According to Loki's white paper the average split will be 50% for the miners, 45% for service nodes, and 5% to LFS.

As always, miners will receive network transactions fees for constructing valid blocks. Service nodes that actively stake and win will be awarded. Loki incentivizes service nodes to remain active by having mining nodes randomly select peer service nodes to check if the winning service node is online. The governance node run by the Loki Foundation will have its address published in every block header to allow for public audit.

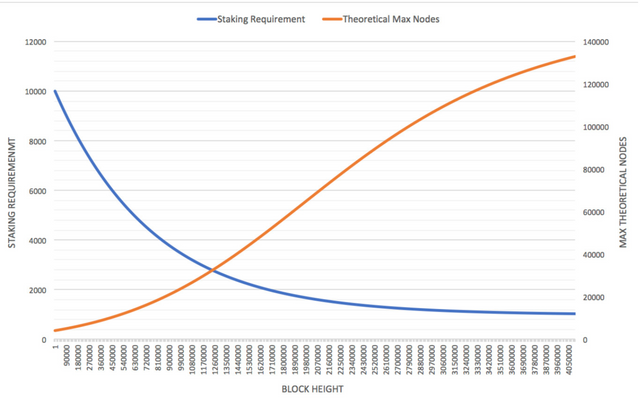

Dynamic masternode collateral

Dash's masternode system require 1,000 Dash. Go look at coinmarketcap and you'll see this is out of reach for many investors today. Those who got in early are able to maintain a higher entry barrier. Loki wants to avoid this. The masternode collateral requirement will decrease over time, thus reducing the entry barrier over time. A greater number of service nodes increases the network's decentralization, increases the network's security, speed, and anonymity. Clearly, they've innovated on Monero and Dash's playbooks.

Loki's staking requirements will be determined through an equation. It will take into account the circulating supply at the current block height.

Oh SNApp!

Game theory suggests that no player will intentionally sabotage a system that they directly benefit fromLoki will build Service Node Applications (SNApps) on its blockchain. The first SNApp will be the Loki messenger, a decentralized encrypted private messaging service. The difference between existing private messaging services is they run on a central server. That's a serious point of weakness. Remember when the government of India subpoenaed Blackberry for their messenger data?

To run SNApps, Loki's network will need to prevent attacks. One commonly referenced attack is a Sybil attack where a malicious player or set of players creates fake accounts and spams the network. Most blockchains deflect this by adding fee models. When applications run on top of the underlying Loki protocol, they too are subject to Sybil attacks. Does a double fee structure on both layers unfairly tax end users and the apps themselves? Workarounds for the application fee range from proof of work (using electricity and hashing power) to payments for service.

Application proof of work models are subject to players with enormous amounts of hashing power. This can be especially tricky when the application network itself has not matured. Payments for service models are effective Sybil deterrents but are naturally subject to pricing competition versus competitors (true marketplace). Loki proposes yet another hybrid system to prevent these attacks called Runes.

Runes is a hybrid PoW and payment for service model. Time will tell if this design works but I'm favorable to the numerous dynamic designs in Loki's architecture.

Loki looks promising

Standing on the shoulders of giants is Loki. It is innovating on other successful projects, Monero (funding), Ethereum (hybrid PoW and PoS), and Dash (master node). The team behind the project are all major hitters. My understanding is there may not be an ICO for this coin as they are wrapping up a private sale. This isn't financial advice but keep track of this project. I think it has the potential to be a game changer for individuals seeking to build decentralized applications with a focus on privacy.

Follow me on Twitter for more content.