The Fractional Reserve Banking System / Zeitgeist Addendum

Society today is composed of a series of institutions…from political institutions, legal institutions, religious institutions… to institutions of social class, familial values

and occupational specialization. It is obvious the profound influence these traditionalized structures have in shaping our understandings and perspectives…

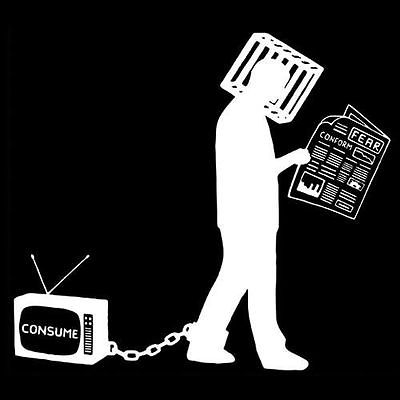

Yet, of all the social institutions we are born into, directed by and conditioned upon, there seems to be no system as taken for granted and misunderstood…as the monetary system. Taking on nearly religious proportions, the established monetary institution exists as one of the most unquestioned forms of faith there is. How money is created, the policies by which it is governed and how it truly affects society are unregistered interests of the great majority of the population.

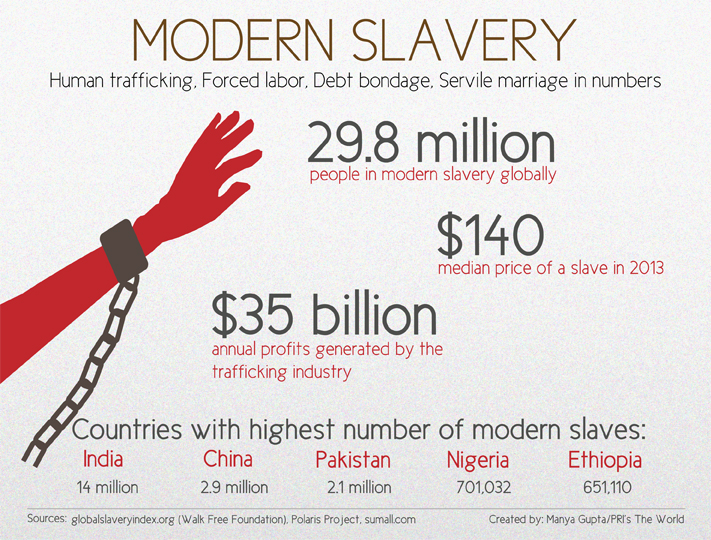

In a world where 1% of the population owns 40% of the planet’s wealth…in a world where 34,000 children die every single day from poverty and preventable diseases, and where 50% of the world’s population lives on less than 2 dollars a day… one thing is clear:

Something is very wrong.

And whether we are aware of it or not, the lifeblood of all of our established institutions and thus society itself, is money. Therefore understanding this institution of monetary policy is critical to understanding why our lives are the way they are.

Unfortunately, economics is often viewed with confusion and boredom. Endless streams of financial jargon coupled with intimidating mathematics quickly deter people from attempts at understanding it. However, the fact is, the complexity associated with the financial system is a mere mask, designed to conceal one of the most socially paralyzing structures humanity has ever endured.

[PART 1. “None are more hopelessly enslaved than those who falsely believe they are free.”-Johann Wolfgang von Goethe-1749-1832]

A number of years ago, the central bank of the United States, the Federal Reserve, produced a document entitled “Modern Money Mechanics”. This publication detailed the institutionalized practice of money creation, as utilized by the Federal Reserve and the web of global commercial banks it supports. On the opening page, the document states its objective: “The Purpose of this booklet is to describe the basic process of money creation in a fractional reserve banking system”. It then proceeds to describe this ‘fractional reserve process’ through various banking terminology. A translation of which goes something like this:

The United States Government decides it needs some money, so it calls up the Federal Reserve, and requests, say, 10 billion dollars”. The fed replies, saying ” sure… we’ll buy 10 billion in government bonds from you.”

So, the government then takes some piece of paper, paints some official looking designs on them, and calls them ‘Treasury Bonds’. Then, it puts a value on these Bonds to the sum of 10 billion dollars, and sends them over to the Fed. In turn, the people at the Fed draw up a bunch of impressive pieces of paper themselves, only this time calling them ‘Federal Reserve Notes’…also designating a value of 10 billion dollars to the set.

The Fed then takes these notes and trades them for the Bonds. Once this exchange is complete, the government then takes the 10 billion in Federal Reserve Notes and deposits it into a bank account…and upon this deposit, the paper notes officially become ‘legal tender’ money, adding 10 billion to the US money supply. And there it is… 10 billion in new money has been created. Of course, this example is a generalization, for, in reality, this transaction would occur electronically, with no paper used at all. In fact only 3% of the US money supply exists in physical currency. The other 97% essentially exists in computers alone.

Now, Government bonds are, by design, instruments of Debt and when the Fed purchases these bonds, with money it created essentially out of thin air, the government is actually promising to pay back that money to the Fed.

In other words… The money was created out of debt. This mind numbing paradox of how money, or value, can be created out of debt, or a liability, will become more clear as we further this exercise.

So, the exchange has been made and now 10 billion dollars sits in a commercial bank account. Here is where it gets really interesting, for as based on the Fractional Reserve practice, that 10 billion dollar deposit instantly becomes part of the bank’s Reserves, just as all deposits do. And regarding reserve requirements, as stated in Modern money mechanics:

A bank must maintain legally required reserves, equal to a prescribed percentage of its deposits. It then quantifies this by stating: under current regulations, the reserve requirement against most transaction accounts is 10%.”

This means that with a ten billion dollar deposit, 10% or 1 billion is held as the required reserve, while the other 9 billion is considered an excessive reserve and can be used as the basis for new loans.

Now, it is logical to assume that this 9 billion is literally coming out of the existing 10 billion dollars deposit. However, this is actually not the case. What really happens is that the 9 billion is simply created out of thin air, on top of the existing 10 billion dollar deposit. This is how the money supply is expanded. As stated in Modern Money Mechanics: ” of course, they (the banks) do not really pay out loans from the money they receive as deposits. If they did this, no additional money would be created. What they do when they make loans is to accept promissory notes (loan contracts) in exchange for credits (money) to the borrower’s transaction accounts.”

In other words, the 9 billion can be created out of nothing, simply because there is a demand for such a loan, and there is a 10 billion dollars deposit to satisfy the reserve requirements.

Now, let’s assume that somebody walks into this bank and borrows the available 9 billion dollars. They will then most likely take that money and deposit it into their own bank account.

The process then repeats, for that deposit becomes part of the banks reserves, 10% is isolated and in turn 90% of the 9 billion or 8.1 billion is now available as newly created money for more loans. And, of course, that 8.1 can be loaned out and redeposited creating an additional 7.2 billion…to 6.5 billion.. to 5.9 billion etc.

This deposit-money creation-loan cycle can technically go on to infinity… the average mathematical result is that about 90 billion dollars can be created on top of the original 10 billion. In other words, for every deposit that ever occurs in the banking system, about 9 times that amount can be created out of thin air.

[Bank of America commercial]

So that we understand how money is created by this fractional reserve banking system,

a logical, yet elusive question might come to mind:

What is actually giving this newly created money value?

The answer: The money that already exists.

The new money essentially steals value from the existing money supply… for the total pool of money is being increased, irrespective to demand for goods and services, and, as supply and demand finds equilibrium- prices rise, diminishing the purchasing power of each individual dollar. This is generally referred to as ‘inflation’ and inflation is essentially a hidden tax on the public.

(Ron Paul) : “…what is the advice that you generally get, and that is inflate the currency. They dont say debase the currency, they dont say devalue the currency, they dont say cheat the people with savings, they say lower the interest rates. The real deception is when we distort the value of money, when we create money out of thin air, we have no savings yet theres so called capitol…so my question boils down to this-how in the world can we expect to solve the problems of inflation–that is the increase in the supply of money– with more inflation? ”

Of course, it can’t. The Fractional Reserve System of monetary expansion is inherently

inflationary. For the act of expanding the money supply without there being a proportional expand of good and services in the economy, will always debase a currency..

In fact a quick glance at the historical values of the US dollars Vs the money supply,

Reflects this point definitively, for the inverse relationship is obvious.

In fact, One dollar in 1913 required 21.60 cents in 2007, to match value…that is a 96% devaluation since the Federal reserve has come into existence.

Now, if this realty of inherent and perpetual inflation seems absurd and economically

self-defeating… hold that thought, for absurdity is an understatement in regard to how our financial system really operates.

For in our financial system money is debt and debt is money. Here is a chart of the US money supply from 1950 to 2006. Here is a chart of the US national debt for the same period. How interesting it is that the trends are nearly identical… for the more money there is, the more debt there is… the more debt there is, the more money there is.

To put it a different way, every single dollar in your wallet is owed to somebody by somebody; for remember, the only way the money can come into existence is from loans. Therefore, if everyone in the country were able to pay off all debts, including the government, there would not be one dollar in circulation.

(If there were no debts in our money system, there wouldn`t be any money”

-Marriner Eccles-Governor of the Federal Reserve

September 30th, 1941 -House Committee Hearing on Banking and Currency )

In fact, the last time in American history the national debt was completely paid off was in 1835, after President Andrew Jackson shutdown the Central Bank that preceded the Federal Reserve. In fact Jackson’s entire political platform essentially revolved around his commitment to shut down the Central Bank, stating at one point: ” the bold efforts the present bank has made to control the government are but premonitions of the fate that awaits the American people should they be deluded into a perpetuation of this institution or the establishment of another like it.” Unfortunately his message was short lived, and the international bankers succeeded to install another central bank in 1913…The Federal Reserve. And as long as this institution exists, perpetual debt is guaranteed.

Now, so far we have discussed the reality that money is created out of debt, through loans.

These loans are based on a bank’s “Reserves” and Reserves are derived from deposits. Through this fractional reserve system, any one deposit can create 9 times its original value, in turn debasing the existing money supply, raising prices in society.

And since all this money is created out of debt and circulated randomly through commerce, people become detached from their original debt and a disequilibrium exists where people are forced to compete for labor, in order to pull enough money out of the money supply to cover their costs of living.

As dysfunctional and backwards as all of this might seem… there is still one thing we have omitted from this equation… and it is this element of the structure which reveals the truly fraudulent nature of the system itself.

-The application of Interest.

When the government borrows money from the Fed or when person borrows money from a bank, it almost always has to be paid back with accrued interest. In other words, almost every single dollar that exists must be eventually returned to a bank, with interest paid as well. But, if all money is borrowed from the central bank and is expanded by the commercial banks through loans, only what would be referred to as the ‘principle’ is being created in the money supply…. So then, where is the money to cover all of the interest that is charged?

Nowhere. It doesn’t exist. The ramifications of this are staggering, for the amount of money owed back to the banks will always exceed the amount of money that is available in circulation. This is why Inflation is a constant in the economy, for new money is always needed to help cover the perpetual deficit built into the system, caused by the

the need to pay the interest.

What this also means is that mathematically, defaults and bankruptcy are literally built into the system. And there will always be poor pockets of society that get the short end of the stick. An analogy would be a game of musical chairs, for once the music stops someone is left out to dry.

And that’s the point. It invariably transfers true wealth from the individual to the banks, for if you are unable to pay for your mortgage, they will take your property. This is particularly enraging when you realize that not only is such a default inevitable due to the fractional reserve practice, but also because of the fact that the money that the bank loaned to you didn’t even legally exist in the first place.

In the 1969, there was a Minnesota court case involving a man named Jerome Daly, who was challenging the foreclosure of his home by the bank, which provided the loan to purchase it. His argument was that the mortgage contract required both parties, being he and the bank, each put up a legitimate form of property for the exchange. In legal language, this is called “consideration”.

(Consideration: -a contract`s basis. A contract is founded on an exchange of one form of consideration for another.)

Mr. Daly explained that the money was, in fact, not the property of the bank, for it was created out of nothing as soon as the loan agreement was signed.

Remember what modern money mechanics stated about loans: “what they do when they make loans is to accept promissory notes in exchange for credits…Reserves are unchanged by the loan transactions. But deposit credits constitute new additions to the total deposits of the banking system.” In other words, the money doesn’t come out of any of their existing assets. The bank is simply inventing it, putting up nothing of its own except for a theoretical liability on paper.

As the court case progressed, the banks president, Mr. Morgan, took the stand, and in the judge’s personal memorandum, he recalled that “The Plaintiff (bank’s president) admitted that it, in combination with the Federal Reserve Bank…did create the…money and credit upon its books by bookkeeping entry…the money and credit first came into existence when they created it…Mr. Morgan admitted that no United States law or statute existed which gave him the right to do this…a lawful consideration must exist and be tendered to support the note.” “The jury found that there was no lawful consideration and I agree” He also poetically added, ” Only God can create something of value out of nothing”

And upon that revelation, the court rejected the bank’s claim for foreclosure and Daly kept his home. The implications of this court decision are immense, for every time you borrow money from a bank, whether it is a mortgage loan or a credit card charge, the money given to you is not only counterfeit, it is an illegitimate form of consideration and hence voids the contract to repay… for the bank never had the money as property to begin with. Unfortunately, such legal realizations are suppressed and ignored, and the game of perpetual wealth transfer and perpetual debt continues….

And this brings us to the ultimate question: why?

During the American civil war president Lincoln bypassed the high-interest loans offered by the European banks and decided to do what the founding fathers advocated, which was to create an independent and inherently debt-free currency. It was called the Greenback. Shortly after this measure was taken, an internal document circulated between private British and American banking interests stated:

“…slavery is but the owning of labor and carries with it the care of laborers, while the European plan…is that capital shall control labor by controlling wages. This can be done by controlling the money. It will not do to allow the greenback, as we cannot control that.”-The Hazard Circular, July, 1862

The fractional reserve policy perpetrated by the Federal Reserve, which has spread in practice to the great majority of banks in the world is, in fact, a system of modern slavery. Think about it… Money is created out of debt. And what do people do when in debt? They submit to employment to pay it off. But, if money can only be created out of loans, how can society ever be debt free? It can’t. And that’s the point.

And it is the fear of losing assets, coupled with the struggle to keep up with the perpetual debt and inflation inherent in the system, compounded by the inescapable scarcity within the money supply itself created by the interest that can never be repaid… that keeps the wage slave in line… running on the hamster wheel with the millions of others… in effect powering an Empire that truly benefits only the elite at the top of the pyramid… for at the end of day, who are you really working for? The banks. Money is created in a bank and invariably ends up in a bank. They are the true masters along with corporations and governments they support.

Physical slavery requires people to be housed and fed. Economic slavery requires the people to feed and house themselves

It is one of the most ingenious scams for social manipulation ever created, and at its core, it is an invisible war against the population. Debt is the weapon used to conquer and enslave societies and Interest is its prime ammunition.

And as the majority walks around oblivious to this reality, the banks, in collusion with governments and corporations, continue to perfect and expand their tactics of economic warfare…spawning new bases… such as the World Bank and International Monetary Fund…

Following you!