Profitable Investments In Commercial Real Estate -SqPay

According to JLL experts, the global investment transactions with commercial real estate will increase from $650 billion in 2016 to $700 billion in 2017, having recovered to the levels of 2014-2015.

According to JLL, the main investment real estate market in the world is the USA: it is in this country that 16 of the top 30 cities in terms of direct investments in the commercial real estate are located.

Investment activity in the World is supported by increased investment from institutional players attracted by the profitability of commercial real estate, as well as new sources of capital from countries such as China, India and Malaysia.

The share of cross-border transactions in the total volume of investment activity may exceed 50% by 2020 against the backdrop in interregional capital flows.

One of the brightest trends in commercial real estate is the strengthening of Chinese investors. According to the results of 2016, China has overtaken the US, becoming the world’s largest cross-border buyer of commercial real estate.

The difference between commercial real estate and other major classes of assets is liquidity.

Compared to stock exchange securities, such as stocks and government bonds, the real estate market is not as organized and efficient as other markets.

Investments in liquid assets are hampered by the location in geographic areas deprived of internal investment opportunities.

Moreover, an important factor is the threshold for entry into such projects for a private investor. Although many investors are looking for the opportunities of investing in overseas real estate, there are huge obstacles to transfer the capital from the legal point of view.

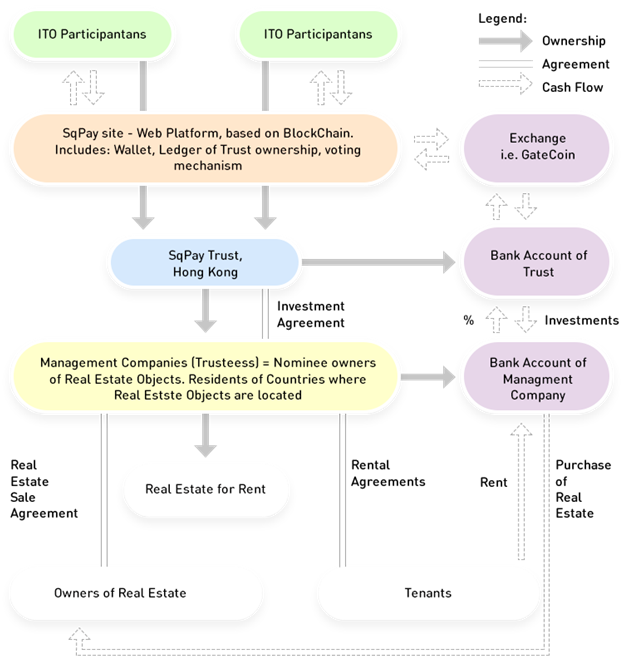

SqPay offers a model of profitable investments in commercial real estate and shifts the traditional investment model (with a high entry threshold and tax complexities) to the environment of using Blockchain technology and digital tokens (on their basis). SqPay tokens are backed up by real estate items.

Introduction of SqPay>>>>

The project essence: SqPay connects Blockchain technologies with the realm of commercial real estate.

This business model creates a new approach in corporate governance, where every participant can easily take part in management and influence dividends distribution.

Modern technologies provide tremendous opportunities for private investors from all over the world to become a part of an ecosystem with no restrictions on the movement of capital.

Despite economic uncertainty and geopolitical challenges, investors’ activity in the global real estate market remains high.

The concept>>>

Creation of a trust (DAT – Decentralized Autonomous Trust) and collection of cryptocurrencies to the wallet of a Trust. The trust will be registered in Hong Kong since the legislation of this city allows to protect the rights of the token holders (Hong Kong is one of the most advanced cities for projects using crypto-currencies).

Creation of the Blockchain Web-based Infosystem in the Trust, which will allow the holders of tokens to vote for:

- Distribution of profit;

- Selection of real estate objects;

- New investment directions proposed by the committee.Evaluation, audit and acquisition of commercial real estate object in street retail with the current anchor tenants.

Distribution of rental income to dividends and further business development as per voting results.

To officially launch the SqPay project, we need investments that are divided into two rounds:

PreITO – softCup 0.05 M $ hardCup 0.15 M $

ITO – softCup 10 M $ hardCup 90 M $

The funds collected at preITO are necessary for the Trust registration, legal structuring, software and project infrastructure development.

The funds raised at ITO will be used for the acquisition of commercial real estate objects, that will create a flow of profit to be distributed among the holders of the tokens.

Tokens allow for the distribution of dividends in proportion to the total amount.

Tokens bear the voting rights for the decisions proposed by the committee.

SQP tokens are divided, i.e. their number does not need to be an integer, since fractional partitioning will create the convenience for working with SQP.

The smallest fraction is 0.0001 SQP.

It should be noted that to obtain dividends and to vote, holders must have at least one full token. We will not be able to pay dividends if the token holder trades them on a third-party exchange, rather than inside our ecosystem.

The minimum number of tokens an investor can purchase is 1.

The total number of tokens is limited to 100,000,000.

In the ITO process, payments can be received in any crypto currency; this becomes possible when using the technology https://shapeshift.io

PreITO (2 weeks)

1 000 000 – 3 000 000 (1 – 3%) – $0.5 per 1 token, and the minimum purchase is 1 tokens.

ITO (4 weeks)

90 000 000 (90%) – $1 per token, and the minimum purchase is 1 token.

6 000 000 – 8 900 000 (6-8.9%) – will be distributed among the team

100 000 (0.1%) – Bounty campain

In the event of fewer tokens sale via ITO, the number of tokens for the team will be reduced to 9%, and the rest will be “burnt.”

The funds raised will be stored in a multi-signature wallet under the supervision of three members of the advisory committee. The management of the funds will be transparent and in line with the strategic plan.

Weblink :- https://sqpay.io/

BTT ANN link :-https://bitcointalk.org/index.php?topic=2117288.0

Great post thank you for the insight. I'm looking forward to this event great!!!