Want to boost your steem power fast? Consider higher APR

In the last post we talked about dynamics of SP/STEEM price and APR for steem power leases on @minnowbooster. In this post we are going decompose average prices into individual deals. To simplify the task we will concentrate only on the market for 4 week leases. Additionally, we will also look at new leases (proposed, but not completed deals).

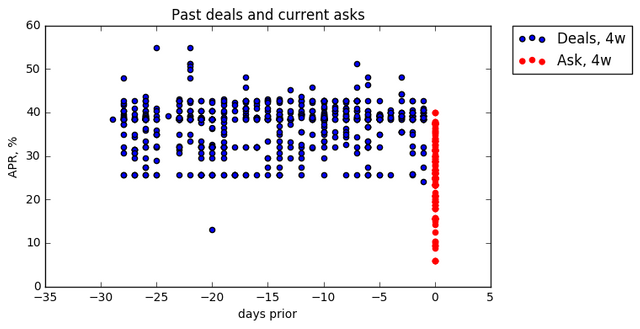

First graph shows the dynamics of APR for deals in the last 28 days (the window that is observable in the data for 4w leases).

Immediately we can see that the market frontier is consistently located at about 37 % APR. Most of the deals in the last month have closed above this value. Small portion of deals have closed below 37 % APR and almost no deals have APR below 25 %. The reasonable conclusion to make here is that it has no sense to submit a lease request with APR below 25 %. Yet we still see a significant tail of such requests in data.

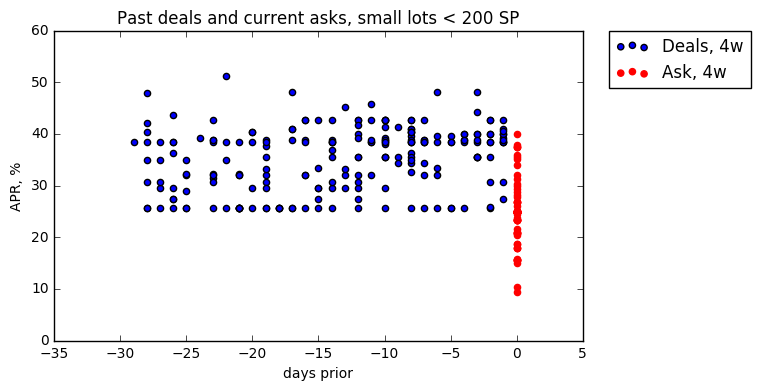

To refine our result even more I also created a graph for small lots of 200 SP or less. Similar frontier of 37 % APR holds here but the boundary is less evident. Notice also how the lowest reasonable APR forms a line of dots at the bottom of the graph. My guess that it comes from the default value of 150 SP/STEEM in the lease request form. More interesting fact is that these requests are getting filled from time to time.

To summarize what we've seen so far I can say that if you want your order to get filled quick you should consider APR 37 % or higher. If you have some time to spare and do not mind to send your order in several times after rejection - you can try to gamble and submit orders below 37 % APR at around 32 %. But you definitely should not go lower than 25 % as the probability of being filled drops effectively to zero.

Let me know if you want to see this data at another angle. Probably you have a better idea on what to look for than I do.

@umich Thanks so much for this incredibly new way of looking at the lease or delegation rates. I assume you are looking at the NET interest rates for the investor, after factoring in the 10% commission and extra 7 days an investor must wait to have his delegation returned?

If I am right, the cost to the delagatee must be more than 37%.

For example, if a delegator delegates 1000 steem at a net rate of 37% APR for 4 weeks, he is tying up his steempower for 5 weeks (due to the one week cool-down period. This means he has to receive 1000 X 37% X % / 52 = 35.58 steem after the 10% commission. Before the 10% commission, the amount to be paid by the delagatee is 35.58 *10/9 = 39.53. For the 4 weeks, this is equivalent to an annual rate of 51.39%.

Is it worth it?

That depends on the value of an upvote and the value of SBD. Let's take the above example. If you have 1000 steem each 100% vote is worth $0.27. With the current price of SBD at $5.30, that makes a vote worth $0.64 for the author and $0.211 for the curator. In total that's $0.851 per 100% vote. Assuming that you are a shill voter and effectively only voting for yourself you could keep all of that and vote 100% 10 times a day or every 2.4 hours.

So now you have borrowed the voting power of 1000 steem and you can vote yourself with $0.851 10 times a day for 28 days. That gives a total return of $0.851 X 10 X 28 = $238.28. Remember, you paid only 39.53 steem to receive the delegation. At the present steem price of $4.33 it means it cost you $171.16 to earn $238.28. That's a 39.2% profit in just 28 days! The annual equivalent profit is 39.2%*12 = 470% profit per annum.

Conclusion

The delegator makes around 37% but the delegated makes 470%. The conclusion is that it is well worth leasing steempower, providing you can put the votes to good use.

@swissclive, thank you for an elaborated comment!

You are right, I'm using "Effective price" (that accounts for the 10% commission) and I do include the cooling off period of 7 days to calculate APR for existing leases. For the requests I'm just using the posted APR. Hence, these are the NET APRs from the perspective of investor. For delegatee it is somewhat higher but since minnowbooster.net only publishes net APR I decided to leave it as is to keep things simple.

Taking into account the 10% commission it is much better for both delegator and delegatee to strike a direct deal instead. I think the value added comes from the 3rd party guarantee that the payments are going to be made to delegator and delegator is not going to revoke SP too early.

Given the selfvoting scheme you propose I wonder why such APRs are still available in the market. It sounds like a great arbitrage opportunity to rent all that SP (and selfupvote) until APR goes up and prohibits such kind of behavior.

Dear Swissclive friend, I am the winner of the contest developed by @Karlin "mascota divertida" and that counted on your wonderful contribution. Again I would like to thank you for that gesture.

Now, regarding your interesting analysis of this post, I have the following doubt. Why do you compare the 37% delegator gain to the 470% delegated gain? Isn't 37% of the delegator's profit supposed to be monthly and 470% of the delegated's profit is annual? Or is it that the monthly profit of the delegator is 3.08% per month so that when multiplied by 12 months (one year) it is 37%?

Forgive my ignorance, and I apologize for the used English, as I use the help of a translator to communicate with you. Thank you in advance for the clarification you can give me.

Greetings and a big hug.

Translated with www.DeepL.com/Translator

Hi @jamesbacon. The quoted rates are all annual. It’s 3.08% per month. The potential profit could vary greatly if you pay too much to lease steem, or if you are down-voted by a whale who does not like self-voting.

Ah ok now I understand perfectly! Thanks for clearing up, bro.

Congratulations @umich! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGood analasys of the @Minnowbooster "bank" and the APR for SP loans.

I have for the last three months had 1200 steem power delegated to minnowbooster. I undeligated just yesterday to see how things go with @therealwolf's new @smartsteem vote buyinh vote loaning system.

His is very neww but it owuld bne interesting to see if similar stats could be setup for all the "minnow boosting" systesm.

Well done.

Thanks for the info about smartsteem. I've not heard about it before.

It seems that they do not support renting SP from them.

Minnow Booster is abuot the only one I know of that actually offers a space for steemieans to apply for SP loans from the community. I am just looking at comparing the APR on loaning out your SP to some of the voting bots.

Trying to dtermine where you get the most bng for your deligted SP.

Thanks for voting and I am following! Thank you for teaching me something!

Thanks for good analysis!

Congratulations @umich! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPYou got a 50.00% upvote from @foxyd courtesy of @kyuubi!

Incredible work friend @umich, all your publications have a very high level, surely you will grow very fast! Thank you for providing us with such valuable information.

your posts are really interesting I am getting many information from your post love it