Want a 3-week Steem Power boost? Think twice

Currently I'm writing a series of posts that reveals some not that obvious facts about leasing steem power from @minnowbooster. In the last two posts we were talking about current average APR and SP/STEEM ratio for the deals registered in the last month. In this post I'm going to explain why I mostly talked about the 4 week lease market in my previous posts. The answer is very simple - liquidity.

High market liquidity means that you can execute the deal quickly without a significant compromise in price and with no noticeable restrictions on the deal's volume. Low liquidity means much longer wait times, smaller volumes and worse prices if you want to speed up the process.

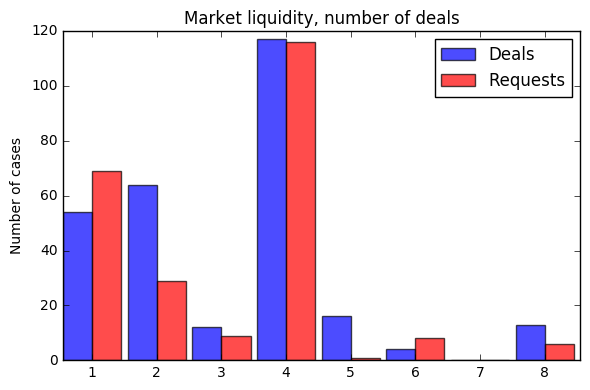

In this post I'm going to measure liquidity in two ways. First, as a plain number of deals in a market for particular duration of SP lease. And second, as a volume of deals and requests measured in SP. We will consider durations from 1 week to 8 weeks. The graph below shows the number of deals registered whiting last 7 days in these markets. It also shows the current snapshot of lease requests (hence request numbers are not accumulated within the last 7 days).

Few obvious conclusions to make are:

- 4-week SP lease market is the most liquid one. If you want to get a good price and strike a deal fast - you should go here. Second most liquid market is 1-week market with 2-week market following close by.

- 3, 5, 6, 7, 8 week markets are barely alive. The number of deals and open requests is pretty low.

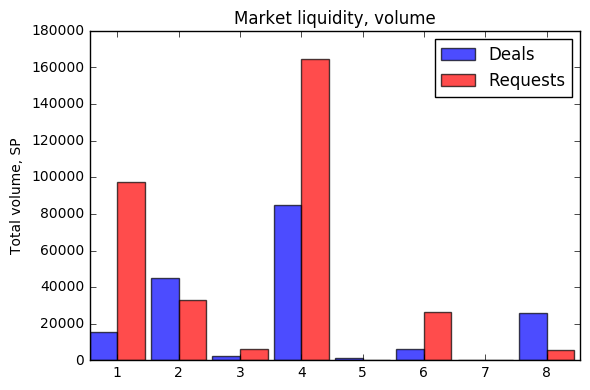

Next graph shows the volume of deals and requests measured in SP. The same selection rules apply as in the previous graph.

Again, we can see that 4-week market is the most liquid one, with 1 and 2 week markets sharing the second place. More interesting thing to notice is that 1-week market has an substantial demand for SP-lease that it not satisfied by the lenders. Probably borrowers do not factor in the 7-day cooling off period premium that is most pronounced in the 1-week market and misprice the requests.

2-week market looks promising for the borrowers since the volume of deals is slightly higher than the volume of requests. This effect is even more pronounced for the 8-week market which is much less liquid at the same time.

Disclamer: Please be aware that the information in this post may be incorrect. I have this blog to keep track of my notes (that might or might not be related to Steemit) as a learner. You should do your own research if you want to avoid mistakes that might be caused by this post.

Following you and thanks for teaching me!

To be honest I don't understand any of this can you explain this in dummy terms for someone who isnt econmic minded. Basically i'm a minnow and struggling, i really want to see some return for the effort i put in because i have no income and no savings therefore i have non f my own funds to put int steemit. I can see from being here after almost a month that steem power is vital to seeing any return. How do i borrow steem power? am i going to be able to afford the interest. Are ppl really going to vote me up more if i have that steem power, do i need to vote myself up, How much do i need to borrow?

Unfortunately there are no easy answers to your questions.

Steem power is vital for curation and it allows you to determine the flows of rewards on the platform. Yes, you can upvote yourself but it is not appreciated here. Discussion under my previous post has more info on how much you can make doing it.

To borrow stem power you need to find another user who is willing to lend it. A good way is to go to minnowbooster.net and borrow there. People are not going to vote you up just because you have SP.

This article answers a humble question which timeframe for a lease is more liquid. The answer is 4 weeks. For a newbie that means that it is easier to get a SP lease for 4 weeks in terms of wait and price given that you price your request correctly (at about 100 SP/Steem week now).

Thank u for thorough response, i think i get some of it. so they lease you the SP and take it back after 4 weeks plus u have to pay APR ontop of that, what happens when you dont have the funds to pay the APR or do we/they/i assume that by having the SP im going to earn enough to pay back the lease?

You pay the fee upfront. If you do not have enough steem you can not borrow.

Congratulations @umich! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP