IT’S MINING JOINT VENTURE MANIA! New Deal to Invigorate the Industry

As an educator in the field of investing, I show people how to research companies and sectors in order to spot the next rainmaker – the one that’s most likely to bring the biggest returns in the shortest amount of time. I teach retail investors to look at balance sheets, SEC forms, things like that – and among the most important indicators is joint venture activity, which can make or break an entire market sector.

I’ve found that the vast majority of investors don’t pay enough attention to joint ventures, and that’s a huge and costly mistake. The best companies in any industry are the ones that partner with businesses that can bring value to the table: assets, capital, leadership, connections, and expansion opportunities, just to name a few.

You can see a textbook example of this in the American precious metals mining sector, which had a lackluster 2018 and needed a boost in order to get retail and institutional investors back into the fold. And let me tell you, the U.S. mining industry got a real shot in the arm with the announcement of the Newmont-Goldcorp and Barrick-Randgold deals:

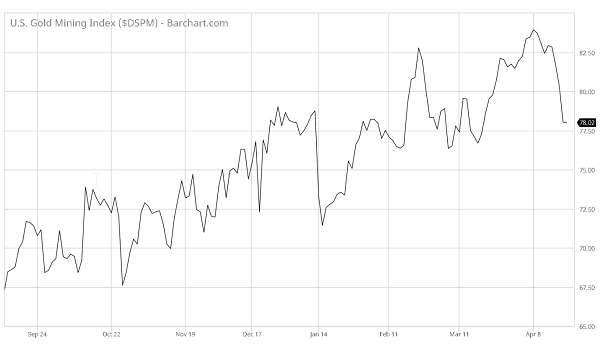

Courtesy: BarChart

The rising tide of joint venture activity lifted all boats, benefiting the mining sector as well as its newly invigorated shareholders. These partnerships and deals benefit all stakeholders because they empower mining companies to combine resources and reduce risk, allowing for more successful and profitable exploration and development projects.

Now, as you can see in the chart above, the momentum is clearly up and the mining sector is trading at the bottom of the channel – time to get in. I’m not going to try and play Newmont-Goldcorp or Barrick-Randgold now because those news items happened several months ago and are already priced into the shares.

That’s fine with me, because there’s a brand-new deal under way right now: American Pacific Mining Corp. (CSE:USGD, OTC:USGDF), an up-and-coming gold explorer focused on precious metal opportunities in the Western United States, just announced a joint venture with Oceana Gold – a mining company with numerous producing assets, including the largest producing gold mine in New Zealand.

The natural, economic, and human capital that Oceana Gold is bringing to the table are considerable, to say the least. Having operated sustainably since 1990 with a proven track record for environmental management and community and social engagement, Oceana Gold is a high-margin, multinational gold producer with assets located in the Philippines, New Zealand, and the United States.

Meanwhile, American Pacific fully owns multiple mineral-rich American projects, including their flagship Tuscarora Project: a high-grade vein system consisting of 91 claims spanning 1,818 acres north of Elko, Nevada in a prime gold district.

The Tuscarora region has already been successfully explored by Novo Resources and Newcrest Mining Ltd., warranting further exploration to uncover vein extensions with similar continuity and widths in the region. This region has a rich history and is one of the highest grade vein sets in all of Nevada.

With a market cap of $2.54 billion, Oceana is among the top 10 biggest gold players on the planet – a bona fide whale in the mining industry. And now, with Oceana Gold on their side, American Pacific can combine the resources, capital, and experience of the two companies, thus adding tremendous value to the Tuscarora Project and defining further drill targets across this large and historic land package.

American Pacific President Eric Saderholm is eager to combine the two company’s resources, noting that the joint venture “adds to the merit of this high-grade, epithermal gold project. Nevada is the top investor-friendly jurisdiction for mining, and I look forward to working alongside the Oceana Gold team as we move this gold discovery ahead at Tuscarora.”

Warwick Smith, the CEO of American Pacific, also appreciates the magnitude of the agreement: “This announcement adds excitement to the project and the company as we enter a new exploration season. Oceana Gold is the perfect partner in our eyes, especially with the success they have had at Waihi in New Zealand – a similar high-grade epithermal system. For a company of our size, this transaction is a big milestone.”

First there were Newmont-Goldcorp and Barrick-Randgold, and now there’s American Pacific-Oceana Gold. It’s a new dawn of venture mania and a spectacular boost for the industry as the superior-grade Tuscarora region becomes the focal point of today’s mining and tomorrow’s profits.

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. Wallace Hill Partners, a Canadian LTD, which is owned by the individuals that own Wealth Research Group, has entered three year marketing agreement with American Pacific Gold and has been compensated two hundred and fifty thousand dollars and has received two millions and eight hundred thousand shares directly by the company. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer

Original Article Available HERE

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #appeals channel in our discord.