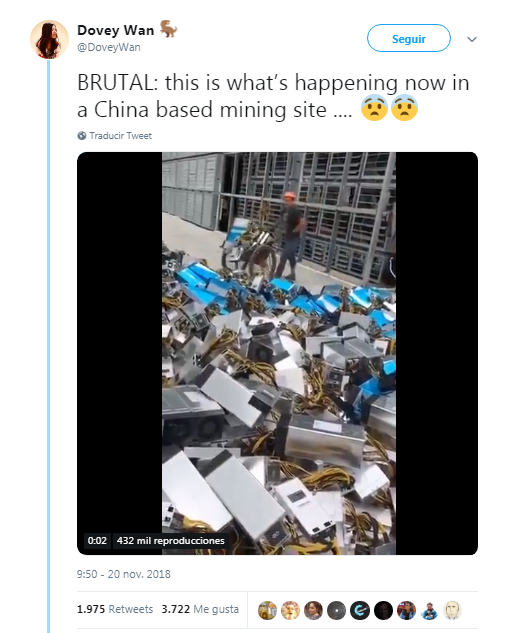

ASIC Miners Dumped In China After Bitcoin’s Price Crash

Chinese cryptocurrency miners are dumping their ASIC miners on the street after the market crash we experienced the last weeks. With Bitcoin’s current price level only the most efficient miners remain on the network. Most of the machines were sold as metal rather than as ASIC miners.

Unprofitable Chinese Miners Sell ASIC Hardware

In a recent video circulating on the internet, it is possible to see that there are crypto miners selling their ASIC devices. At current prices is more profitable for miners to turn off their ASIC hardware and wait for prices to go up once again. Moreover, by turning some miners off (the old ones) it is possible to reduce electricity costs.

However, this is not something exclusive to big miners. It also happens to smaller individuals and companies that have inefficient mining operations. The crypto mining market adjusts automatically depending on the competition that there is in the space.

According to Dovey Wan, Founding Partner at Primitive, F2Pool says that miners are sold by “pound.” F2Pool is one of the largest and most important miners in the crypto market.

She wrote on the matter:

“The current miner are sold by ‘pund,’ more of a parody. The fact is – say if you can’t mine with S9 with profit, someone with better unit economic will buy at a very low price to ‘recycle.”

She then explains that the ‘turn off price’ for Bitcoin miners is $3,800 dollars. The turn off price is the price level in which mining Bitcoin is no longer profitable for a miner. Those who have better installations and more efficient equipment will ultimately survive. Smaller miners become unprofitable and will stop mining.

It is possible to see that there was an important reduction in Bitcoin’s hash rate in the last months. Back in August, Bitcoin’s hash rate was 61 million TH/s. However, since that moment, the TH/s used by the Bitcoin network is down 44 percent.

According to Hu Jue of Si Hua Mining, miners are starting to turn off their operations. There are several investors that are dumping old generation devices such as the Antimner S7 or V9.

About it, he said:

“When ASIC rigs become obsolete it is common for large Chinese mining farms to sell them as scrap metal. Of course, old models are out of the game, as the picture shows. But that doesn’t represent the majority.”

At the time of writing, the hash rate of the Bitcoin network is 41 million TH/s. If the price does not improve, the hash rate could still fall in the next weeks. As Dovey Wan explains, there is an important factor to take into account as well, the electricity cost. Currently, China is facing a dry season. That means that some hydro-based mining farms could be paying higher prices for electricity, complicating things even more.