Miners set a new annual profitability record

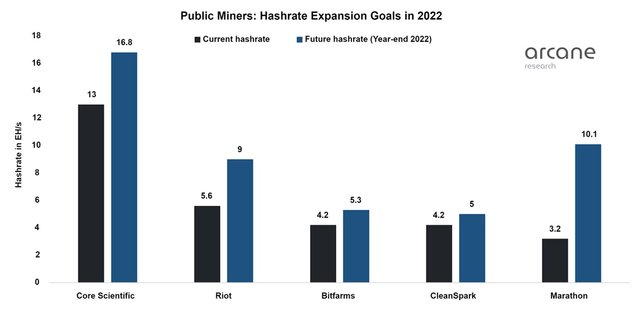

The last two years have been quite challenging for miners, and the drop in profitability has severely affected companies that borrowed money to expand. For example, Core Scientific, the biggest publicly traded miner as of late 2022, is undergoing Chapter 11 bankruptcy proceedings.

Cut to October 2022. Image source: arcane.no

The yield from a terahash of capacity dropped from $0.36 in November 2021 to $0.06 by the end of 2022.

Image source: hashrateindex.com

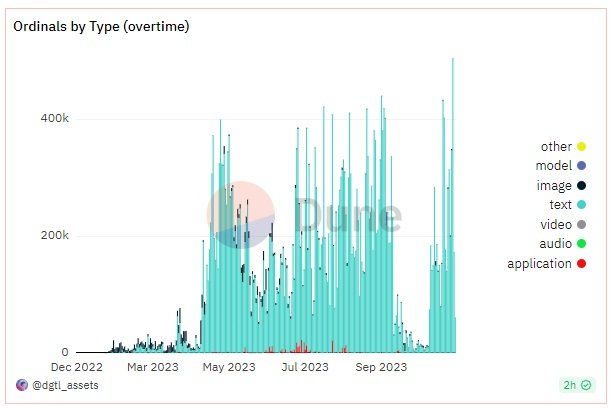

This year, however, miners were luckier with the new Ordinals protocol that makes it possible to mint quasi-tokens and transfer graphics and other digital objects in the Bitcoin network. The first surge of interest in the new coins came in May, and the second followed in mid-November.

Image source: dune.com

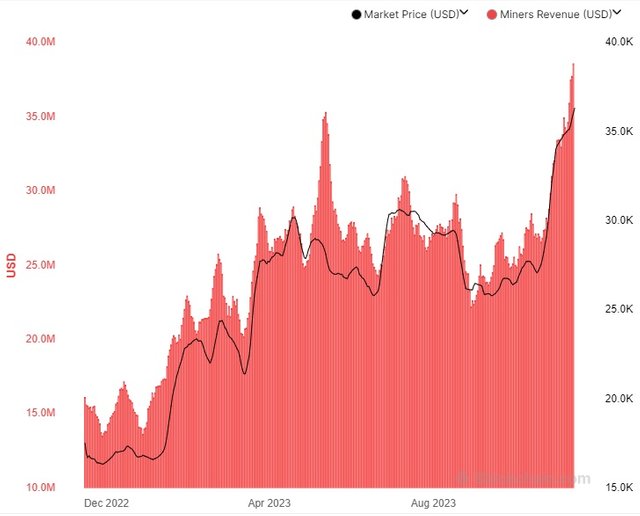

Due to the significant network load, users had to charge higher fees to speed up transaction processing. Miners set new annual profitability records in May and again in November thanks to the high fees.

Image source: blockchain.com

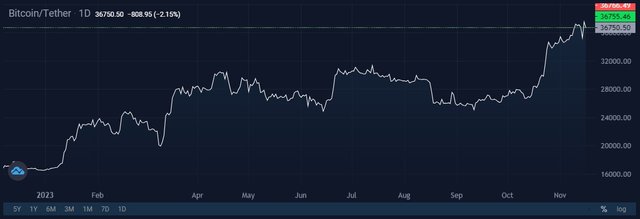

This year, Bitcoin's over twofold price increase has also played a positive role.

Image source: StormGain.com

Inspired by the coin's growth in price, public miners have returned to their 'buy and hold' strategy. Marathon Digital, one of the largest miners to date, left in its reserve 34% of mined BTC in Q3, taking its overall stash to 13,700 BTC. By the end of the year, the company plans to reach a speed of 26 EH/s.

The miners who survived 2022 are now actively increasing their capacity as they fight for market share. For example, Riot Platforms is trying to catch up with Marathon Digital. It is expected to receive 33,280 ASICs from MicroBT by early 2024. The new machines will take its computational speed to 20.1 EH/s.

This year, the Bitcoin network's hashrate has nearly doubled.

Image source: btc.com

Miners are increasing their ASIC pools despite the upcoming halving event in April 2024. Crypto miners hope history will repeat itself. After previous halving events, Bitcoin's price rose over four-fold within a year after the halving.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

good times